FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Debit

$ 3,580

31,400

1,715

Credit

Cash

Merchandise inventory

Store supplies

Office supplies

Prepaid insurance

Store equipment

Accumulated depreciation, store equipment

Office equipment

Accumulated depreciation, office equipment

Accounts payable

Zen Woodstock, capital

Zen Woodstock, withdrawals

Rental revenue

645

3,960

57,615

$ 6,750

13,100

6,550

4, 000

52, 000

31, 500

14,600

501,520

Sales

Sales returns and allowances

2,915

5,190

331, 315

Sales discounts

Purchases

2,140

4,725

Purchase returns and allowances

Purchase discounts

Transportation-in

Sales salaries expense

Rent expense, selling space

Advertising expense

Store supplies expense

Depreciation expense, store equipment

Office salaries expense

Rent expense, office space

Office supplies expense

Insurance expense

Depreciation expense, office equipment

3,690

34,710

24,080

6,400

27,630

13,000

Totals

$592, 285 $592, 285

a. The balance on January 1, 2020, in the Store Supplies account was $480. During the year, $1,235 of store supplies were purchased

and debited to the Store Supplies account. A physical count on December 31, 2020. shows an ending balance of $180.

b. The balance on January 1, 2020, in the Office Supplies account was $50. Office supplies of $595 were purchased in 2020 and

added to the Office Supplies account. An examination of the office supplies at year-end revealed that $590 had been used.

c. The balance in the Prepaid Insurance account represents a policy purchased on September 1. 2020; it was valid for 12 months from

that date.

d. The store equipment was originally estimated to have a useful life of 12 years and a residual value of $3615.

e. When the office equipment was purchased, it was estimated that it would last four years and have no residual value.

1. Ending merchandise inventory, $29.000.

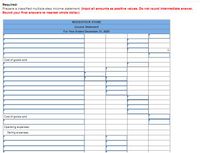

Transcribed Image Text:Requlred:

Prepare a classified multiple-step income statement. (Input all amounts es positive values. Do not round Intermedlate answer.

Round your final answers to nearest whole dollar.)

WOODSTOCK STORE

Income Statement

For Year Ended December 31, 2020

Cost of goods sold:

Cost of goods sold

Operating expenses:

Selling expenses:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1)Calculate the cost of goods available for sale and the number of units of ending inventory. 2)Assume blossom use FIFO periodic.Calculate the cost of ending inventory, cost of the goods sold,and gross profit. 3)prepared journal entries to record the July 10 purchase and the July 11 sales using FIFO periodic and FIFO perpetual. Assume both the sales and purchase were for casharrow_forwardHi Please help with question attached, thanks so much.arrow_forwardCalculate the missing amounts. (Loss amounts should be Indicated with a minus sign and input all other amounts as positive velues. Do not round Intermedlate calculations. Round "Gross profit ratio" to 2 decimal places.) Company A Company B 2020 2019 2020 2019 Sales 263,000 187,000 48,500 Sales discounts 2,630 1,200 570 Sales returns and allowances Net sales 16,700 6,200 168,950 45,500 Cost of goods sold 157,100 57,700 Gross profit from sales 51,700 49,100 22,100 Selling expenses 18,620 19,700 25,700 Administrative expenses 26,300 30,400 9,700 Total operating expenses 47,400 Profit (loss) 15,100 2,700 Gross profit ratio % %arrow_forward

- Susie Q Company shipped goods to a customer fob shipping point on January 30, 2004. Its year-end is January 31st. Susie Q Company should include this inventory on its balance sheet as of January 31, 2024. A True B Falsearrow_forwardAyayai Company has the following account balances: Sales Revenue $245,600, Sales Discounts $3,610, Cost of Goods Sold $103,600, and Inventory $41,800. Prepare the entries to record the closing of these items to Income Summary under the perpetual inventory system. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To close accounts with credit balances) (To close accounts with debit balances) Debit Creditarrow_forwardAssume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Estimating sales returns On December 31, Jack Photography Supplies estimated that approximately 2% of merchandise sold will be returned. Sales Revenue for the year was $80,000 with a cost of $48,000. Journalize the adjusting entries needed to account for the estimated returns.arrow_forward

- Complete the Adjustments column of the work sheet represented below. Ending merchandise inventory is $92,000. If an amount box does not require an entry, leave it blank. Work Sheet (partial) Trial Balance Adjustments Account Title Debit Credit Debit Credit Merchandise Inventory 81,000 92,000 81,000 Income Summary 81,000 92,000 V Purchases 273,000 273,000 x Purchases Returns and Allowances 12,100 12,100 x. Purchases Discounts 21,000 21,000 x Freight-In 5,300 5,300 x Feedback Check My Work Partially correctarrow_forwardPlease provide answer in text (Without image)arrow_forwardApply mathematical skills around cost structures and appropriate equations to answer the following, inclusive of all associated workings to maximise marks: The inventory value for the financial statements of Zyon for the year ended 31st Oct 2022 was based on an inventory count on 3rd Nov 2022, which gave a total inventory value of $836,200.Between 31st Oct and 3rd Nov, the following transactions took place:Purchases of goods $8,600. Sales of goods (profit margin 35% on sales $14,000). Goods returned by Zyon to supplier $878. What adjusted figure should be included in the financial statements for inventories at 31st Oct 2022 to nearest hundred?arrow_forward

- Calculate necessary data where you have a ? in the tablearrow_forwardOnly 8B question. Thanks!arrow_forwardJournalize the following merchandise transactions: (If an amount box does not require an entry, leave it blank.) a. Sold merchandise on account, $12,900, with terms 2/10, net 30. The cost of the merchandise sold was $8,385. Sale Cost b. Received payment within the discount period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education