FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you answer this general accounting question?

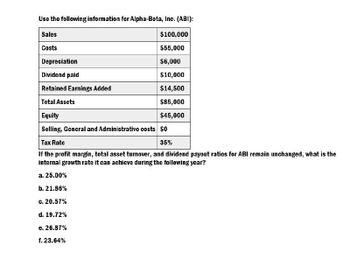

Transcribed Image Text:Use the following information for Alpha-Beta, Inc. (ABI):

Sales

$100,000

Costs

$55,000

Depreciation

$6,000

Dividend paid

$10,000

Retained Earnings Added

$14,500

Total Assets

$85,000

Equity

$45,000

Selling, General and Administrative costs $0

Tax Rate

35%

If the profit margin, total asset turnover, and dividend payout ratios for ABI remain unchanged, what is the

internal growth rate it can achieve during the following year?

a. 25.00%

b. 21.86%

c. 20.57%

d. 19.72%

e. 26.87%

f. 23.64%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the following information to answer the next question. Total Asset = $40 million Basic earning power (BEP) ratio is 20% Times-interest-earned (TIE) Principal payments = 4 million ratio is 6.55 $1.35 million; $0.37 million What is the company's EBIT? The company's interest expense? $3.33 million; $0.83 million $8.0 million; $0.62 million Depreciation = $1.0 million. $7.5 million; $0.75 million Lease payments = 0.6 million $8.0 million; $1.22 millionarrow_forwardUse this information for Mason Corporation to answer the question that follow. Mason Corporation had $1,058,000 in invested assets, sales of $1,229,000, income from operations amounting to $202,000, and a desired minimum return of 12%. Round the percentage to one decimal place. The profit margin for Mason Corporation is Oa. 19.1% Ob. 16.4% Oc. 86.1% IC. Od. 12.0%arrow_forwardUse this information for Mason Corporation to answer the question that follow. Mason Corporation had $1,030,000 in invested assets, sales of $1,275,000, income from operations amounting to $227,000, and a desired minimum return of 12%. Round the percentage to one decimal place. The profit margin for Mason Corporation is Oa. 22.0% Оb. 17.8% Oc. 12.0% Od. 80.8%arrow_forward

- INCOME STATEMENT XYZ Industries is forecasting the following income statement: Sales P8,000,000 Operating costs excl. depr. & amort. 4,400,000 EBITDA 3,600,000 Depreciation & amortization 800,000 EBIT 2,800,000 Interest 600,000 EBT 2,200,000 Taxes (40%) 880,000 Net income 1,320,000 The CEO would like to see higher sales and a forecasted net income of 2,500,000. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 10%. The tax rate, which is 40%, will remain the same. What level of sales would generate 2,500,000 in net income? *arrow_forwardPlease see the following Income Statement from Home Depot to answer the next two are all variable and their SGA + questions. Home Depot's Cost of Sales Depreciation/Amortization are their Fixed Costs. CONSOLIDATED STATEMENTS OF EARNINGS-USD ($) shares in Millions, $ in Millions Income Statement [Abstract] Net sales 12 Jan. 28, 2024 $ 152.669 101.709 50.960 I Cost of sales Gross profit Operating expenses: Selling, general and administrative 26.598 Depreciation and amortization 2.673 Total operating expenses 29.271 Operating income 21.689 15. What is Home Depot's cmr? 33.38% 16. How much revenue would have been needed for them to show operating income of $30,000 (profit before tax) in 2024? $177.564arrow_forwardComplete botharrow_forward

- XYZ Corporation had the following data in 2022 below: Total assets = P300,000Gross profit margin = 25%Quick ratio = 0.80 xBond payable = P60,000Days sales outstanding = 36 daysDebt ratio = 50%Retained earnings = P97,500Times interest earned= 6 xInventory turnover = 5 xTotal assets turnover = 1.5 xNo. of days in a year = 360 days Tax rate = 35%Compute the total liabilities.arrow_forwardXYZ Corporation had the following data in 2022 below: Total assets = P300,000Gross profit margin = 25%Quick ratio = 0.80 xBond payable = P60,000Days sales outstanding = 36 daysDebt ratio = 50%Retained earnings = P97,500Times interest earned= 6 xInventory turnover = 5 xTotal assets turnover = 1.5 xNo. of days in a year = 360 days Tax rate = 35%Compute the average merchandise inventory.arrow_forwardcalculate sales margin for this accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education