ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

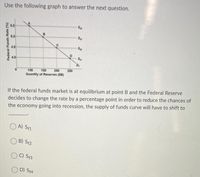

Transcribed Image Text:Use the following graph to answer the next question.

8 6.5

Su

5.0

Sp

Sa

4.5

4.0

D,

250

Quantity of Reserves (SB)

100

150

200

If the federal funds market is at equilibrium at point B and the Federal Reserve

decides to change the rate by a percentage point in order to reduce the chances of

the economy going into recession, the supply of funds curve will have to shift to

A) S1

B) St2

C) St3

D) Sf4

Federal Funds Rate (%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume that the Federal Reserve (Fed) sets the federal funds rate target at 4% and conducts open market operations to hit the 4% target. Shift the appropriate curve to show the Fed meeting its target. Federal funds rate 10 9 8 7 6 5 3 2 1 0 10 20 Supply of reserves Federal funds rate (target) Federal funds rate (current) 30 40 50 60 Reserves at the Fed 70 80 The Federal Reserve 90 100 raised the discount rate. lowered the discount rate. O sold U.S. Treasury securities. bought U.S. Treasury securities. Demand for reservesarrow_forwardAssume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $100. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 25 10 A lower reserve requirement is associated with a money supply. Suppose the Federal Reserve wants to increase the money supply by $100. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to worth of U.S. government bonds. Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions.…arrow_forwardI need help on D through H! Please! Suppose the reserve requirement is 8% and a new deposit of $900 billion is made into the banking system. Create T accounts to analyze the following questions. a) Initially, reserves would increase by? $900 Billion b) Required reserves would increase by? $72 billion c) Excess reserves would increase by? $828 billion d) The first round of loans would amount to? e) The second round of loans would amount to approximately? f) For the entire macroeconomy, after the infinite rounds of loans were taken into account, money supply would increase by? g) If the Federal Reserve bought bonds worth $600 billion, money supply would increase by? h) If the Federal Reserve sold bonds worth $600 billion, money supply would decrease by?arrow_forward

- 5. Changes in the money supply The following graph represents the money market in a hypothetical economy. As in the United States, this economy has a central bank called the Fed, but unlike in the United States, the economy is closed (that is, the economy does not interact with other economies in the world). The money market is currently in equilibrium at an interest rate of 6% and a quantity of money equal to $0.4 trillion, as indicated by the grey star. INTEREST RATE (Percent) 8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 0 Money Demand + 0.1 Money Supply 0.2 0.3 0.4 0.5 MONEY (Trillions of dollars) 0.6 0.7 0.8 New MS Curve New Equilibrium ?arrow_forward51) What is the impact on interest rates when the Federal Reserve decreases the money supply by selling bonds to the public? 52) Use demand and supply analysis to explain why an expectation of Fed rate hikes would cause Treasury prices to fall. 5.4 Supply and Demand in the Market for Money: The Liquidity Preference Framework 1) In Keynes's liquidity preference framework, individuals are assumed to hold their wealth intwo forms: A) real assets and financial assets. B) stocks and bonds. C) money and bonds. D) money and gold. 2) In Keynes's liquidity preference framework, A) the demand for bonds must equal the supply of money. B) the demand for money must equal the supply of bonds. C) an excess demand of bonds implies an excess demand for money. D) an excess supply of bonds implies an excess demand for money. 3) In Keynes's liquidity preference framework, if there is excess demand for money, there is…arrow_forwardThe following graph shows the money market in equilibrium at an interest rate of 7.5% and a quantity of money equal to $60 billion. Show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves on the following graph. 15.0 Money Supply Money Demand 0 Money Supply 12.5 10.0 INTEREST RATE 5 5.0 25 0 0 20 Money Demand 40 60 80 100 MONEY (Billions of dollars) 120arrow_forward

- Question 3 In the market for reserves, suppose that the federal funds rate and discount rate are both at 7%. If the Federal Reserve Bank sells securities in the open market, then the equilibrium rate for reserves will and the amount of borrowed reserves will O not change; decrease O not change; increase O rise; increase O rise; decrease Question 4 When the Federal Reserve Bank lowers the reserve requirements for commercial banks in the economy, this causes the curve for reserves to decrease and so the curve shifts to the ----- O demand; right O demand: left O supply; right O supply; leftarrow_forward8. Consider a hypothetical economy with a nominal GDP of $1.2 trillion, real GDP of $600 billion, and money supply of $60 billion. Suppose commercial banks are required to maintain a reserve requirement of 10% of deposits. Assume that banks do not hold excess reserves. a) Calculate the money multiplier for this economy. If the central bank buys $1 billion of government bonds, what is the effect on money supply? Show your work. b) Using the quantity theory of money, calculate the price level and the velocity of money for this economy prior to central bank action. Show your work. c) Assume that velocity is constant and real GDP increases by 2% each year. What will happen to nominal GDP and the price level next year if money supply does not change? Show your work. d) In (c), what money supply should the central bank set next year to keep the price level unchanged? Show your work. e) In (c), what money supply should the central bank set next year if it wants inflation of 5%? Show your…arrow_forwardB4B5arrow_forward

- As a result of the Fed's sale of $3,000 worth of government securities to First Main Street Bank, the bank becomes reserve deficient. Suppose that Nick, a First Main Street Bank's customer, re-pays back the $3,000 loan he took out a few months ago. STEP: 2 of 3 Which of the following most accurately describes First Main Street Bank's actions? The bank keeps the $3,000 as reserves. The bank creates a $42,000 loan. The bank keeps the $450 as reserves. The bank creates a $3,000 loan. The money supply in the economy is $arrow_forwardIn the situation depicted above, an increase in the money supply from $100 billion to $150 billion will cause the equilibrium rate of interest to: Group of answer choices a)Decrease from 4 percent to 2 percent. b)Increase from 2 percent to 4 percent. c)Decrease from 6 percent to 2 percent. d)Increase from 4 percent to 6 percent. e)Decrease from 6 percent to 4 percent.arrow_forwardThe following graph shows a hypothetical demand function for federal funds . Currently , the total amount of reserves in the banking system is $ 50 billion , the discount rate is 3.5 percent , and interest on reserves equals IOR = 1 percent . If the Fed reduces the discount rate to 3.00 percent , the equilibrium federal funds rate ( FFR ) will equal : O a . FFR 3.00% O b . FFR = 2.50% O c . FFR = 2.00% O d . FFR 1.50% O e . None of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education