Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

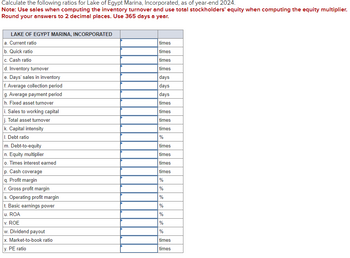

Transcribed Image Text:Calculate the following ratios for Lake of Egypt Marina, Incorporated, as of year-end 2024.

Note: Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier.

Round your answers to 2 decimal places. Use 365 days a year.

LAKE OF EGYPT MARINA, INCORPORATED

a. Current ratio

b. Quick ratio

c. Cash ratio

d. Inventory turnover

e. Days' sales in inventory

f. Average collection period

g. Average payment period

h. Fixed asset turnover

i. Sales to working capital

j. Total asset turnover

k. Capital intensity

I. Debt ratio

m. Debt-to-equity

n. Equity multiplier

times

times

times

times

days

days

days

times

times

times

times

%

times

times

times

times

%

%

o. Times interest earned

p. Cash coverage

q. Profit margin

r. Gross profit margin

s. Operating profit margin

t. Basic earnings power

%

%

u. ROA

%

v. ROE

%

w. Dividend payout

%

x. Market-to-book ratio

times

y. PE ratio

times

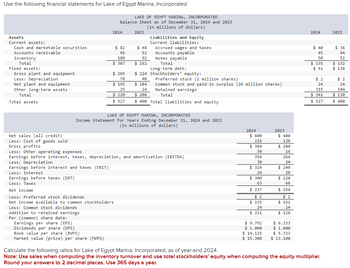

Transcribed Image Text:Use the following financial statements for Lake of Egypt Marina, Incorporated

LAKE OF EGYPT MARINA, INCORPORATED

Balance Sheet as of December 31, 2024 and 2023

(in millions of dollars)

2024

2023

Assets

Liabilities and Equity

Current assets:

Current liabilities:

Cash and marketable securities

Accounts receivable

Inventory

$ 82

45

180

$ 48

Accrued wages and taxes

52

Accounts payable

92

Notes payable

Total

Fixed assets:

$ 307

$ 192

Total

Long-term debt:

Gross plant and equipment

$ 265

Less: Depreciation

70

40

Net plant and equipment

Other long-term assets

Total

$ 195

25

$ 184

24

$ 220

$ 208

Total

Total assets

$ 527

$ 224 Stockholders' equity:

Preferred stock (2 million shares)

Common stock and paid-in surplus (24 million shares)

Retained earnings

$ 400 Total liabilities and equity

Net sales (all credit)

Less: Cost of goods sold

Gross profits

LAKE OF EGYPT MARINA, INCORPORATED

Income Statement for Years Ending December 31, 2024 and 2023

(in millions of dollars)

2024

$ 600

216

$ 384

30

354

Less: Other operating expenses

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

Less: Depreciation

Earnings before interest and taxes (EBIT)

Less: Interest

Earnings before taxes (EBT)

Less: Taxes

Net income

Less: Preferred stock dividends

Net income available to common stockholders

Less: Common stock dividends

Addition to retained earnings

Per (common) share data:

Earnings per share (EPS)

Dividends per share (DPS)

Book value per share (BVPS)

Market value (price) per share (MVPS)

2023

$ 400

120

$ 280

16

264

30

24

$ 240

24

20

$ 324

$ 300

$ 220

63

66

$ 154

$ 237

$ 2

$ 235

24

$ 211

$ 2

$ 152

24

$ 128

$ 9.792

$ 6.333

$ 1.000

$ 1.000

$ 14.125

$ 5.333

$ 15.300

$ 13.100

Calculate the following ratios for Lake of Egypt Marina, Incorporated, as of year-end 2024.

2024

2023

$ 40

$ 36

45

44

50

52

$ 135

$ 132

$ 51

$ 138

$ 2

$ 2

24

24

315

104

$ 341

$ 130

$ 527

$ 400

Note: Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier.

Round your answers to 2 decimal places. Use 365 days a year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Similar questions

- Use the following financial statements for Lake of Egypt Marina, Inc. LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 2020 2021 2020 Assets Liabilities and Equity Current assets: Current liabilities: Cash and marketable securities $ 91 $ 28 Accrued wages and taxes $ 40 $ 32 Accounts receivable 50 36 Accounts payable 50 40 Inventory 140 132 Notes payable 50 32 Total $ 281 $ 196 Total $ 140 $ 104 Fixed assets: Long-term debt: $ 11 $ 124 Gross plant and equipment $ 300 $ 220 Stockholders’ equity: Less: Depreciation 75 40 Preferred stock (8 million shares) $ 8 $ 8 Net plant and equipment $ 225 $ 180 Common stock and paid-in surplus 60 60 (60 million shares) Other long-term assets…arrow_forwardAssets Current assets Net fixed assets INCOME STATEMENT, 2022 (Figures in $ millions) Revenue Cost of goods sold Depreciation Interest expense 2021 $ 101 2022 $ 195 910 1,010 $ 2,005 1,085 405 251 Req A and B Req C and D BALANCE SHEET AT END OF YEAR (Figures in $ millions) Liabilities and Shareholders' Equity Current liabilities Long-term debt Req E Complete this question by entering your answers in the tabs below. a&b. What is shareholders' equity in 2021 and 2022? c&d. What is net working capital in 2021 and 2022? e. What are taxes paid in 2022? Assume the firm pays taxes equal to 21% of taxable income. f. What is cash provided by operations during 2022? g.Net fixed assets increased from $910 million to $1,010 million during 2022. What must have been South Sea's gross investment in fixed assets during 2022? Answer is complete but not entirely correct. h. If South Sea reduced its outstanding accounts payable by $46 million during the year, what must have happened to its other current…arrow_forwardPlease provide correct answer this question general accountingarrow_forward

- Please answer complete question otherwise skip it please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) The Sharjah Corporation reported the following balance sheet data for 2020 and 2019: 2020 2019 Cash $ 77,375 $ 22,955 Available-for-sale securities (not cash equivalents) 15,500 85,000 Accounts receivable 80,000 68,250 Inventory 165,000 145,000 Prepaid insurance 1,500 2,000 Land, buildings, and equipment 1,250,000 1,125,000 Accumulated depreciation (610,000) (572,000) Total assets $ 979,375 $ 876,205 Accounts payable $ 76,340 $ 148,670 Salaries payable 20,000 24,500 Notes payable (current) 25,000 75,000 Bonds payable 200,000 0 Common stock 300,000 300,000 Retained earnings 358,035 328,035 Total liabilities and…arrow_forwardPlease help prepare Financial position and comprehensive income statementarrow_forwardWhat is the debit to asset ratio?arrow_forward

- Balance Sheet You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $391,000, Accounts receivable = $191,000, Inventory = $91,000, Accrued wages and taxes = $10,900, Accounts payable = $309,000, and Notes payable = $609,000. What is Campus's net working capital? Multiple Choice $1,601,900 О $673,000 О -$255,900 $928,900arrow_forwardPLEASE HELP MEarrow_forwardSelected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation Wayne EnterprisesCurrent assets:Cash and cash equivalents $ 2,494 $ 541Current investments 125Net receivables 1,395 217Inventory 10,710 8,600Other current assets 773 301Total current assets $15,372 $9,784Current liabilitiesCurrent debt $ 1,321 $ 47Accounts payable 8,871 5,327Other current liabilities 1,270 2,334Total current…arrow_forward

- Please provide answer this following requirements on these general accounting questionarrow_forwardUse the common-size financial statements found here: ommon-Size Balance Sheet 2016Cash and marketable securities $ 480 1.5 %Accounts receivable 6,030 18.2Inventory 9,540 28.8Total current assets $ 16,050 48.5 %Net property, plant, and equipment 17,020 51.5Total assets $33,070 100.0 %Accounts payable $ 7,150 21.6 %Short-term notes 6,850 20.7Total current liabilities $ 14,000 42.3 %Long-term liabilities 7,010 21.2Total liabilities $ 21,010 63.5 %Total common shareholders’ equity 12,060 36.5Total liabilities and shareholders’ equity $33,070 100.0 %Common-Size Income Statement 2016Revenues $ 30,000 100.0 %Cost of goods sold (20,050) 66.8Gross profit $ 9,950 33.2 %Operating expenses (7,960) 26.5Net operating income $ 1,990 6.6 %Interest expense (940) 3.1Earnings before taxes $ 1,050 3.5 %Income taxes (382) 1.3Net income $668 2.2 % Specifically, write up a brief narrative that responds to the following questions: a. How much cash does Patterson have on hand relative to its total…arrow_forwardQuick answer of this accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning