FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

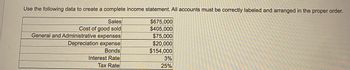

Transcribed Image Text:Use the following data to create a complete income statement. All accounts must be correctly labeled and arranged in the proper order.

- Sales: $675,000

- Cost of goods sold: $405,000

- General and Administrative expenses: $75,000

- Depreciation expense: $20,000

- Bonds: $154,000

- Interest Rate: 3%

- Tax Rate: 25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is given to you relating to the operations of PrincehallCorporation: The income tax rate is 40%. Net sales $11,862 Cost of sales 8,321 Gross margin ? Selling, general, and administrative expenses $ 2,743 Depreciation, amortization, and asset write-offs 278 Total operating expenses: ? Income from operations : ? Interest expense 91 Interest and other income 11 Earnings before income taxes: ? Income taxes ? Net earnings: ? Determine the earnings before taxes:arrow_forwardI need help with thisarrow_forwardPlease help me with show all calculation thankuarrow_forward

- Use the following to answer questions 34 – 39 ST reports the following income statement results: $700,000 221,575 Sales Operating expense Net income 48,800 Sales returns & allowances 25,000 Gross profit 282,825 Interest expense 250 34. $ Calculate Net sales: 35. Calculate Cost of Goods Sold Calculate operating 36. income 37. $ Calculate Income before Income tax (IBT) %. Calculate the gross profit 38. margin (one decimal place) %. Calculate the net profit margin (one 39. decimal place)arrow_forwardQuestion: Use the information given below. Accounts Payable $125,000 Accounts Receivable $175,000 Accrued Expenses $80,000 Cash $50,000 Common Stock $20,000 Cost of Goods Sold $400,000 Depreciation Expense $30,000 Gross PPE $700,000 Inventory $250,000 Long Term Debt $150,000 Net PPE $250,000 Note Payable $30,000 Operating Expenses $200,000 Sales Tax Expense Total Equity $950,000 $25,000 $340,000 What is the value of total assets?arrow_forwardprepare a balance sheet and income statement from the following information: Cash $625.00 Revenue $21,000.00 Note Payable $5,000.00 Retained Earnings $10,600.00 Expenses $7,000.00 Issued Capital Stock $500.00 Accounts Receivable $2,500.00 Inventory $6,900.00 Accounts Payable $1,000.00 Cost of Goods Sold $10,500.00 Accrued Sales Tax $1,425.00 Prepaid Insurance $12,000.00 Plz answer fast without plagiarism i give up votearrow_forward

- Given the following information: $8 million $10 million $7 million $3 million Average Inventory: $6 million Average A/R: Average Fixed Assets: Accounts Payables:$4 million Revenues: $2 million Liabilities: Total Expenses: Cost of Goods Sold: $10 million Assume no other assets or liabilities exist beyond what is articulated above. a. Compute Net Profit Margin b. Compute Total Asset Turnover c. Compute Return on Equity (ROE) d. Compute Inventory Turnover e. How much equity would have to be swapped out for debt to increase ROE by 1% assuming that nothing else changes? f. What is the firm's sustainable growth rate if dividends are equal to $0.5 million?arrow_forwardPortions of the financial statements for Peach Computer are provided below. Net sales Expenses: PEACH COMPUTER Income Statement For the year ended December 31, 2024 Cost of goods sold Operating expenses Depreciation expense Income tax expense Total expenses Net income Cash Accounts receivable Inventory Prepaid rent Accounts payable Income tax payable PEACH COMPUTER Selected Balance Sheet Data December 31 2024 $106,000 45,400 79,000 3,400 $1,090,000 600,000 54,000 44,000 49,000 5,400 2023 $87,000 51,000 57,000 5,800 39,000 12,000 $1,900,000 1,788,000 $112,000 Increase (I) or Decrease (D) $19,000 (I) 5,600 (D) 22,000 (I) 2,400 (D) 10,000 (I) 6,600 (D) Required: Prepare the operating activities section of the statement of cash flows for Peach Computer using the direct method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardThe Lancaster Corporation's income statement is given below. Sales Cost of goods sold Gross profit Fixed charges (other than interest) Income before interest and taxes Interest Income before taxes Taxes (35%) Income after taxes LANCASTER CORPORATION a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times interest earned Fixed charge coverage times b. What would be the fixed-charge-coverage ratio? Note: Round your answer to 2 decimal places. times $ 223,000 155,000 $ 68,000 33,100 $ 34,900 13,400 $ 21,500 7,525 $ 13,975arrow_forward

- You are given the following income statement and balance sheet: Income Statement Sales EBT Taxes (40%) Net Income Cash A/R Inventories Total CA Fixed Assets Total Assets $15,000 $800 $320 $480 Balance Sheet $100 $2,000 $4.000 Accounts Payable Debt Common Stock Retained Eamings $6,100 $1,900 $8,000 Total Claims $1,000 $4,000 $2,000 $1,000 $8,000 Now make the following forecast and assumptions for the upcoming year: Sales are expected to increase by $5.400 over the coming year. All assets and accounts payable can be expressed as a percentage of sales. The firm's profit margin will remain at 3.2 percent. The firm has a dividend payout rate of 75 percent. Using the equation method, determine the additional funds needed for the coming yeaarrow_forwardPlease provide correct answerarrow_forwardNeed help about this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education