Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

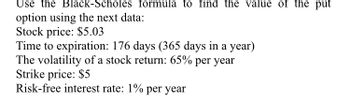

Transcribed Image Text:Use the Black-Scholes formula to find the value of the put

option using the next data:

Stock price: $5.03

Time to expiration: 176 days (365 days in a year)

The volatility of a stock return: 65% per year

Strike price: $5

Risk-free interest rate: 1% per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The stock price is currently $30. Each month for the next two months it is expected to increase by 8% or reduce by 10%. The risk-free interest rate is 5%. Use a two-step tree to calculate the value of a derivative that pays off [max(30 — St; 0)]2, where St is the stock price in two months? If the derivative is American-style, should it be exercised early?arrow_forwardD4) Finance Calculate the price of a 3-month American put option on a non-dividend-paying stock when the stock price is $50, the strike price is $50, the risk-free interest rate is 5% per annum, and the volatility is 25% per annum. Use a binomial tree with a time interval of 1 month.arrow_forwardThe current stock price is $20, the risk - free interest rate is 5% per annum (consecutive compounding), and the volatility is 15% per annum. Calculate the price of a European call option with a maturity of 3 months and an exercise price of $21. However, this stock is assumed to be non - dividend.arrow_forward

- Consider a stock in two periods (two years). The stock price goes up by 30% or down by 10%in each period. Current stock price is $100. There is a European put option on the stock withexercise price $110 and time to maturity of two years. The interest rate in each period is 6%. Inthe template, Date 0 denotes today, Date 1 denotes the end of year 1 and Date 2 denotes the endof year 2. Use the two-period binomial tree model and discrete discounting to find the put optionprice on Date 0.arrow_forwardA stock price is currently $52. Its volatility is 35% p.a. . The risk-free interest rate is 8% p.a. with continuous compounding. What is the value of a 2-year European call option with a strike price of $55, using a 2-step binomial tree? Without doing any calculations, explain what would happen to the value of the option if the stock volatility decreasesarrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Year Stock Market Return (%) T-Bill Return (%) 2016 13.0 0.2 2017 21.0 0.8 2018 -6.2 1.8 2019 29.8 2.1 2020 20.6 0.4 Required: What was the risk premium on common stock in each year? What was the average risk premium? What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)-- expressed in % (NOTE: 11.31% is incorrect)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education