Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Consider a stock in two periods (two years). The stock price goes up by 30% or down by 10%

in each period. Current stock price is $100. There is a European put option on the stock with

exercise price $110 and time to maturity of two years. The interest rate in each period is 6%. In

the template, Date 0 denotes today, Date 1 denotes the end of year 1 and Date 2 denotes the end

of year 2. Use the two-period binomial tree model and discrete discounting to find the put option

price on Date 0.

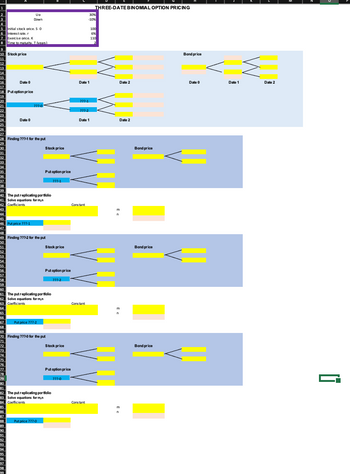

Transcribed Image Text:# Three-Date Binomial Option Pricing

## Parameters:

- **Up (U):** 30%

- **Down (D):** -10%

- **Initial stock price (S₀):** 100

- **Interest rate (r):** 6%

- **Exercise price (K):** 110

- **Time to maturity (T in years):** 3

## Structure:

### 1. Stock Price and Bond Price

- **Stock Price Tree (Dates 0, 1, 2):**

- Date 0 to Date 1: Stock price can move up or down.

- Date 1 to Date 2: Each branch can again move up or down, creating multiple possible future prices.

- **Bond Price Tree (Dates 0, 1, 2):**

- Represents possible bond prices at different dates, calculated based on risk-free interest rate.

### 2. Put Option Price

- **Put Option Price Tree:**

- Follows the same branching as the stock price, indicating potential option values on each date.

### 3. Finding ??? for the Put

- **Stock and Bond Price Trees at each stage:**

- Stocks and bonds are recalculated to find the value of the put option.

### 4. Put Replicating Portfolio

- **Solving equations for coefficients (m, n):**

- Determine the amounts in bonds and stocks needed to replicate the option’s payoff using coefficients (m for stocks, n for bonds).

- **Coefficient Calculation:**

- Separate equation sets for each date to calculate m and n at various stages.

### 5. Sequential Stages:

- **Date 0 to Date 1 (Finding ??? for the put):**

- Calculate initial put option price given stock and bond values.

- **Date 1 to Date 2:**

- Update calculations reflecting adjustments in stock and bond scenarios.

### Diagram Explanation:

- **Tree Diagrams:**

- Vertical columns represent different dates.

- Horizontal lines depict potential up/down movements of stock prices or changes in bond prices.

- Colored boxes indicate respective prices for stocks, bonds, and put options at each node.

This structured approach allows for a comprehensive understanding of how binomial option pricing evolves over multiple dates, incorporating factors such as stock movements, interest rates, and exercise price.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A stock is currently $100. Over each of the next two six month periods it is annim with continuous compounding. What is the value of a one year European call option with a strike price of $90arrow_forwardThe stock price is currently $130. Over each of the next two 2-month periods, it is expected to go up by 3% or down by 4%. The risk - free interest rate is 1.5% per annum with continuous compounding. What is the value of a 4- month European put option with a strike price of $120? Use a binomial tree model, and round the result to three decimal places. 1. $1.019 2. $2.602 3. S 0.029 4. $0.0 5. $6.645arrow_forwardYou observe the price of a European put option that expires in nine months and has a strike price of$45 is $3. The underlying stock price is $49.50. The term structure is flat, with all risk-free interestrates being 8%.a. What is the price of a European call option that expires in nine months and has a strike priceof $45? b. You observe next that the price of the call option (in part (a)) in the market is $9.59. Statewhy an arbitrage opportunity exists and explain how you would take advantage of thisopportunity. (Hint: answer should include an outline general strategy, net cost ofstrategy at initiation and net profit at expiration using the numbers in the question)arrow_forward

- A stock price is currently $52. At the end of 9 months, it will be either $60 or $44. The risk-free interest rate is 6%. Use the no-arbitrage binomial method to calculate the value of a 9-month European call option on the stock with strike price $52. Calculate the same option value using the risk-neutral methodarrow_forwardA stock which is sold at its face value of $3,000 is expected to pay a dividend of $120 for the next three years. It is expected that the price of this stock will increase by 7% of its initial face value each year. The nominal interest rate is 4% per year. What is the risk premium payable on this stock to induce investors to hold the stock for another two years? Risk premium (x) · = (Round your answer to two decimal places.)arrow_forwardA stock is currently priced at $42 and will move up by a factor of 1.23 or down by a factor of .91 each period over each of the next two periods. The risk-free rate of interest is 3 percent. What is the value of a put option with a strike price of $49? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Value of a put optionarrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.424 6.183 Maturity Month/Year May 32 May 35 May 41 Bid 103.4664 104.5004 ?? Asked Change 103.5392 +.3067 104.6461 ?? +.4341 +.5457 Ask Yield 6.079 ?? 4.111 In the above table, find the Treasury bond that matures In May 2035. What is your yield to maturity if you buy this bond? Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity 96arrow_forwardRefer to the following table: (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) 1 2 3 4 5 Zero- coupon YTM 4.00% 5.50% 5.50% 5.00% 4.50% What is the forward rate for year 2 the forward rate quoted today for an investment that begins in one year and matures in two years)? Note: Use at least four decimal places in all intermediate calculations. Question content area bottom Part 1 The forward rate for year 2 is enter your response here %. (Round to two decimal places.)arrow_forwardAn American call option expiring in 3 - years has an exercise price of E1,500.00 on the Eswatini stockmarket and currently trades at E1,940.00. It is anticipated that the stock will rise by a factor of 1.10 andfell by a factor of 0.80. If the interest rate is 6%; find the upward prices of the option until its expiry andthe pay - offs a binomial tree.arrow_forward

- The current price of a stock is $18. In 1 year, the price will be either $28 or $15. The annual risk-free rate is 3%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Find the price of a call option on the stock that has a strike price is of $23 and that expires in 1 year. (Hint: Use daily compounding.) Assume 365-day year. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardA call option is currently selling for $5.00. It has a strike price of $85 and ten months to maturity. A put option with the same strike price sells for $8.10. The risk-free rate is 4.6 percent and the stock will pay a dividend of $2.60 in three months. What is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardA call option currently sells for $7.00. It has a strike price of $40 and five months to maturity. A put with the same strike and expiration date sells for $5.00. If the risk-free interest rate is 5 percent, what is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education