Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

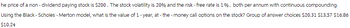

Transcribed Image Text:he price of a non- dividend paying stock is $200. The stock volatility is 20% and the risk - free rate is 1%, both per annum with continuous compounding.

Using the Black - Scholes - Merton model, what is the value of 1 - year, at-the-money call options on the stock? Group of answer choices $20.31 $13.57 $16.86

$10.24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 6. A stock price is currently at $20 and has a volatility of 20% p.a. The risk-free rate is 4% p.a. with continuous compounding. Use a three-step binomial tree model with step size 1 year to compute the arbitrage-free price of an American put option written on that stock with strike price K $20 and maturity T = 3 years.arrow_forwardThe current price of a non - dividend paying stock is $38.52. Use a two-step tree to value a European call option on the stock with a strike price $32.3 that expires in 12 months. The risk free rate is 9.9% per annum, and the volatility is 28.1%. What is the option price?arrow_forwardFor a stock, you are given that: i) The current stock price is 45 ii) The stock is going to pay a dividend of 1.2 after 3 months. This is the only dividend to be paid in the coming 6 months. iii) A 6-month 42-strike European put option on the stock has a premium of 0.36 iv) The continuosly compounded risk-free interest rate is 4% Consider a 6-month 42-strike American call option on the stock. Is it optimal to excerise that call option now? Possible Answers A Yes, because the sum of implicit put protection and interest on strike is greater than the present value of dividends B No, because the sum of implicit put protection and interest on strike is greater than the present value of dividends C Yes, because the sum of implicit put protection and interest on strike is smaller than the present value of dividends D No, because the sum of implicit put protection and interest on strike is smaller than the present value of dividends E Cannot be determinedarrow_forward

- Consider the following information for an individual stock Current share price is $30 Risk-free rate is 5% pa compounded continuously Volatility of the stock returns (σ) is 30% pa Strike price is $28 Time to maturity of the option is 12 months The firm is expected to pay no dividends over the next 1 year. Use the closed-form Black-Scholes model to price the European call option with the above characteristics 3.67 5.32 9.81 None of the abovearrow_forwardYou are given the following information about the stock of Company ABC: Share price $80 risk free rate of interest is 6%, time to expiration is 6 months, annualised standard deviationis 0.5 and exercise price is $85. Calculate the appropriate call value of the stock according to the Black-Scholes option pricing formula. (Show your workings in full) Calculate an appropriate put premium. (Show your workings in full)arrow_forwardYou buy a share of stock, write a 1-year call option with X = $55, and buy a 1-year put option with X = $55. Your net outlay to establish the entire portfolio is $54. The stock pays no dividends. a. What is the payoff of your portfolio? Payoff b. What must be the risk-free interest rate? (Round your answer to 2 decimal places.) Risk-free rate %arrow_forward

- 1. (20%) FIN307 stock has the following probability distribution of expected prices one year from now: State 1 2 3 Probability .25 .40 Price $50 $60 .35 $70 If you require a risk premium of 5% and Rf is 4%. What is the price you are willing to pay today for FIN307? Assuming the stock will pay a dividend of $4 per share.arrow_forwardYou are pricing options with the following characteristics: •Current stock price (St): $35.60 •Exercise price (X): $50 •Time to expiration (T-t): 9 months •Risk-free rate (rf): 3.25% •Volatility (0): 45% (a): What is the Black-Scholes value of call option? In your hand-written solution, provide the calculations of d1,d2, and the final call price. Use Excel or another spreadsheet program to compute the values of N(d1) and N(d2). See the notes for details. (b): Using put-call parity, what is the value of a put option? For this case, assume continuous compounding, which implies that PVt(X)=e-r(T-t).X.arrow_forwardHilltop stock has a current market price of $63 a share. The 1-year $60 call is priced at $8.75 while the 1-year $60 put is priced at $3.42. What is the risk - free rate of return? Group of answer choices 4.04% 3.61 % 4.62% 3.11%arrow_forward

- At time t=0 Mr. Anderson sets up a riskless portfolio by taking a position in an option and in the underlying asset. Explain what Mr. Anderson needs to do at time t=1 to keep his portfolio risk neutral and why. A stock price is currently $100 and at the end of four months it will be ST . A derivative written on this stock pays off expST1/3 in four months. Given that u = 1.15, d = 0.87, and that the risk-free interest rate is 10% p.a. (continuously compounded), answer the following questions using a one-period binomial model (show all the details of your calculations and display the results with four decimal places): Calculate the value of ∆ Calculate the current value of the derivative.arrow_forward16. Use the Black-Scholes formula to find the value of a call option on the following stock: Time to expiration = 6 months Standard deviation = 50% per year Exercise price - $50 Stock price = $50 Interest rate = 3% Dividend = 0 17. Find the Black-Scholes value of a put option on the stock in the previous problem with the same exercise price and expiration as the call option. 3. A stock index is currently trading at 50. Paul Tripp, CFA, wants to value two-year index options using the binomial model. In any year, the stock will either increase in value by 20% or fall in value by 20%. The annual risk-free interest rate is 6%. No dividends are paid on any of the underlying securities in the index. a. Construct a two-period binomial tree for the value of the stock index. b. Calculate the value of a European call option on the index with an exercise price of 60. c. Calculate the value of a European put option on the index with an exercise price of 60. d. Confirm that your solutions for…arrow_forwardSuppose that call options on XYZ stock with time to expiration 3 months and strike price $90 are selling at an implied volatility of 30% ExxonMobil stock price is $90 per share, and the risk free rate is 4%. Required: a1 If you believe the true volatility of the stock is 32%, would you want to buy or sell call options? a2-Now you want to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education