Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

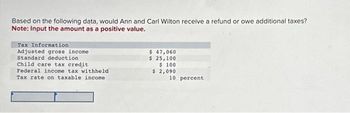

Transcribed Image Text:Based on the following data, would Ann and Carl Wilton receive a refund or owe additional taxes?

Note: Input the amount as a positive value.

Tax Information

Adjusted gross income

Standard deduction

Child care tax credit

Federal income tax withheld

Tax rate on taxable income.

$ 47,060

$ 25,100

$ 100

$ 2,090

10 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- rmn.3arrow_forwardDon't give answer in imagearrow_forwardDetermine the Income Taxes Responsibility for this taxpayers, remember to present procedure in any taxpayer. Taxpayer(s) Filing Status Income Itemized Deductions income Taxes LiabilityArturo Single $29,239 $2,000 ___________Belize HOH $53,129 $14,500 ___________Carmine Qualifying Widow 89,000 $12,490 ___________Family Rivas MFJ $139,000 $23,000 ___________arrow_forward

- A woman is in the 15% tax bucket and itemizes her deductions. How much will her tax bill be reduced if she makes a$200 tax deductible contribution to charity A. $30 B. $200 C. $0 D. $170arrow_forwardA woman is in the 15% tax bracket and itemizes her deductions. How much will her tax bill be reduced if she makes a $200 tax deduction contribution to charity? A. $30 B. $200 C. $ 0 D $ 170arrow_forwardWhat would be the marginal tax rate for a single person who has a taxable income of: a) $31,560 b) $58,150 c) $66,450 d) $100,580 DO NOT INCLUDE % SIGNarrow_forward

- 4. Based on the following data, would Beth and Roger Simmons receive a refund or owe additional taxes? (LO3.2) Adjusted gross income, $42,140 Credit for child and dependent care expenses, $400 Standard deduction, $24,800 Federal income tax withheld, $2,017 Tax rate on taxable income, 10 percentarrow_forwardWhat would be the marginal and average tax rates for a married couple with taxable income of $89,600? For an unmarried taxpayer with the same income? Use Table 3.7. (Do not round intermediate calculations. Enter the marginal tax rate as a percent rounded to 1 decimal place. Enter the average tax rate as a percent rounded to 1 decimal place.) a. What would be the marginal tax rate for a married couple with income of $89,600? Marginal tax rate for a married couple b. What would be the average tax rate for a married couple with income of $89,600? Average tax rate for a married couple % Marginal tax rate for an unmarried taxpayer c. What would be the marginal tax rate for an unmarried taxpayer with income of $89,600? % Average tax rate for an unmarried taxpayer % d. What would be the average tax rate for an unmarried taxpayer with income of $89,600? %arrow_forwardUse the tax table to determine each of the following values if your adjusted gross income is $20,000. Your tax liability if you are filing single using the standard deduction of $12,500 and have no adjustments, itemized deductions, or tax credits. Your tax liability if you are filing single using the standard deduction of $12,500, have a child tax credit of $500 and no other adjustments, deductions or credits.arrow_forward

- Use the following information Molly has collect to help her determine her taxable income for the year: Salary from her job 115,100 Interest earn from 1,280 savings Interest paid on student loans Your Answer: Answer 905 Standard deduction 12,950 Itemized deductions 842 Child tax credit 2000arrow_forwardQuestion2: Income tax The taxable income of Ahmed, Badriya and Sameer is $20,000, $45,000, $100,000 respectively. Use the following tax rates: 5% for income from 0 - $20,000 10% for income from $20,001 - $50,000 15% for income above $50,000 Calculate the tax payable by each person. Explain the type of taxation system applicable in this situation. Is this system of taxation fair? Explain why this system is being criticised?arrow_forwardAnswer all questionsDon't give answer in imagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education