Concept explainers

Preparing production cost report, second department with beginning WIP; decision making

Ocean Worthy uses three processes to manufacture lifts for personal watercraft: forming a lift’s parts from galvanized steel, assembling the lift, and testing the completed lift. The lifts are transferred to Finished Goods Inventory before shipment to marinas across the country.

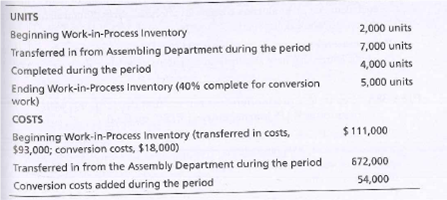

Ocean Worthy’s Testing Department requires no direct materials. Conversion costs are incurred evenly throughout the testing process. Other information follows for the month of August:

The cost transferred into Finished Goods Inventory is the cost of the lifts transferred out of the Testing Department. Ocean Worthy uses Weighted-average

Requirements

- Prepare a production cost report for the Testing Department.

- What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost?

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education