FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Determine the following:

a. The cost of the units transferred to the Finishing Department.

b. The cost of the work-in-process inventory in the Forming Department

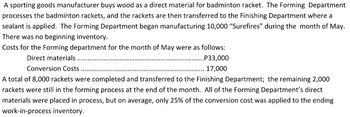

Transcribed Image Text:A sporting goods manufacturer buys wood as a direct material for badminton racket. The Forming Department

processes the badminton rackets, and the rackets are then transferred to the Finishing Department where a

sealant is applied. The Forming Department began manufacturing 10,000 "Surefires" during the month of May.

There was no beginning inventory.

Costs for the Forming department for the month of May were as follows:

Direct materials..

..P33,000

17,000

Conversion Costs.

A total of 8,000 rackets were completed and transferred to the Finishing Department; the remaining 2,000

rackets were still in the forming process at the end of the month. All of the Forming Department's direct

materials were placed in process, but on average, only 25% of the conversion cost was applied to the ending

work-in-process inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is a characteristic of a process cost accounting system? A. Material, Labor, and Overheads are accumulated by orders. B. Companies use this system if they process custom orders. C. Only Closing stock of work in process is restated in terms of completed units. D. Opening and Closing stock of work in process are related in terms of completed units.arrow_forwardProvide a description of how the job order costing and process costing methods are applied to determine accurate cost data.arrow_forwardExplain the flow of manufacturing costs through the inventories and into cost of goods sold.arrow_forward

- How is activity-based cost allocation useful to management for control and evaluation of the performance of a department? List three points only and briefly discuss them. Why is it necessary for the cost accountant to determine the percentage of completion in the ending work in process inventory at the end of the period? Briefly explain.arrow_forwardDuring production, how are the costs in process costing accumulated?A. to cost of goods soldB. to each individual productC. to manufacturing overheadD. to each individual departmentarrow_forwardIn a process costing system, the purpose of a production cost report is to allocate production costs incurred in a process to which of the following? Group of answer choices To finished goods inventory To the units completed and transferred to the next process and incomplete units left in the ending work-in-process inventory account To direct costs and indirect costs To individual jobs completed during a periodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education