Concept explainers

Uneven Cash Flow Stream

-

Find the

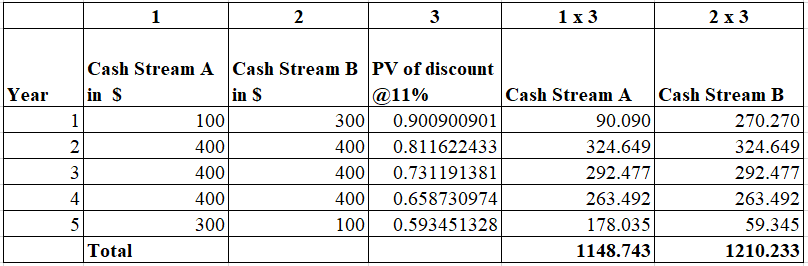

present values of the following cash flow streams. The appropriate interest rate is 11%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent.Year Cash Stream A Cash Stream B 1 $100 $300 2 400 400 3 400 400 4 400 400 5 300 100 Stream A: $

Stream B: $

-

What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar.

Stream A $

Stream B $

Answer 1)

At 11%

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- Find the present values of the following cash flow streams. The appropriate interest rate is 9%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $200 2 400 400 3 400 400 4 400 400 5 200 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream A $ Stream B $arrow_forwardUneven Cash Flow Stream Find the present values of the following cash flow streams. The appropriate interest rate is 12%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $250 2 400 400 3 400 400 4 400 400 5 250 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream…arrow_forwardPLEASE HELP ASAP!!! a) calculate the equivalent amount P at the present time. b) calculate the single-payment equivalent to F at n=5 c) Calculate the equivalent equal-payment swries cash flow A that runs from n=1 to n=5 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Find the present values of the following cash flow streams. The appropriate interest rate is 6%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $250 2 400 400 3 400 400 4 400 400 5 250 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream A $ Stream B $arrow_forward1. In a spiderplot, the most sensitive factor is the one with: a. the highest Y-intercept value b. the highest X-intercept value c. the most positive slope value. d. the highest absolute slope value 2. Equivalence of cash flows is NOT affected by: a. Timing of the cash flow b. Magnitude of the cash flow c. Interest rate. d. Point of view used 3. A Php 1,000,000 loan has a nominal interest rate of 10% per year compounded. quarterly. If this amount is to be paid oft quarterly over 5 years, how much will be the monthly amount due? a. 1,000,000 (A/P, 10%, 5) b. 1,000,000 (A/P, 2.5%, 20) c. 1,000,000 (A/P, 3.33%, 20) d. 1,000,000 (A/P, 5%, 20) 4. A bank advertises mortgages at an interest rate of 2% per month. What is the effective annual interest rate? Select the closest value. a. 1% b. 13% c. 24% d. 27% 5. Which of the following is the most useful if we want to measure the effect of uncertainty in parameter estimates? a. Sensitivity Analysis b. Basic Economic Study Methods c. Payback…arrow_forward(Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year 1 2 3 4 5 6 $ 780 A $ 19,000 19,000 19,000 19,000 19,000 B $19,000 19,000 19,000 19,000 19.000 C $19,000 95,000 a. What is the present value of investment A at an annual discount rate of 23 percent? $ 53265.99 (Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 23 percent? (Round to the nearest cent.) ..arrow_forward

- Suppose that the First United Bank of America has two loans. Each is due to be repaid one period hence and has independent and identically distributed cash flows. Each loan will repay $300 with a probability of 0.8 and $150 with a probability of 0.2. However, while the bank knows this, the investors cannot distinguish this loan from that of the Third TransAmerica Bank, which has the same number of loans, but will pay $300 with a probability of 0.5 and $150 with a probability of 0.5. There is a prior belief of 0.5 that the First United Bank of America has the higher-valued portfolio. Suppose that the First United wished to securitize these loans, and if it does so without a credit enhancement, the cost of communicating the true value is 7.5% of the true value. Assume that the discount rate is zero and that everybody is risk-neutral. Consider the following securitization scenario. The First United can create two classes of bondholders in a senior- subordinated structure or junior-senior…arrow_forwardAnswer it correctly please. I will rate accordingly with multiple votes. This is my last attempt. Please do it correctly. Typed answer please.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- 1. Kindly break down how you got terminal cashflow at the end of the project. 2. Explain how you arrived at Net Present Value. What is the formula used?arrow_forwardYou have just assessed a project involving an immediate cash outflow followed by a series of cash inflows over the next seven years by calculating the NPV and the IRR. You now discover that you have underestimated the discount rate. Using the correct, higher discount rate will have the following effects, relative your original NPV and IRR results:arrow_forwardUrgently need please solve by hand instead of using excel. thank you!arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education