Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELP ASAP!!!

a) calculate the equivalent amount P at the present time.

b) calculate the single-payment equivalent to F at n=5

c) Calculate the equivalent equal-payment swries cash flow A that runs from n=1 to n=5

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

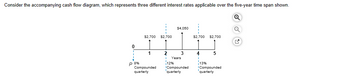

Transcribed Image Text:Consider the accompanying cash flow diagram, which represents three different interest rates applicable over the five-year time span shown.

0

p 8%

$2,700

1

Compounded

quarterly

$2,700

2

$4,050

3

Years

12%

Compounded

quarterly

$2,700 $2,700

4

5

I

13%

Compounded

quarterly

Q

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Time value of money calculations can be solved using a mathematical equation, a financial calculator, or a spreadsheet. Which of the following equations can be used to solve for the future value of an annuity due? PMT x {[(1 + r)ª − 1]/r} x (1 + r) O FV/(1 + r)¹ PMT x {[(1 + r)" - 1]/r} O PMT x ({1 - [1/(1 + r)"]}/r) x (1 + r)arrow_forwardWhich of the following equation will allow you to solve for the ROR for the following cash flow? If the file failed to load, click https://www.dropbox.com/s/nuxqnt15nak2kdc/ROR-FE1.jpg Year 0 1 2 3 4 5 Cash Flow $15,000 0 $2,500 $5,000 $7,500 $10,000 O 15,000 2500(P/A, i*, 5) + 2500 (P/G, i*, 5) O 0= 15,000 + 2500(P/A, i*, 5) + 2500 (P/G, i*, 5) O 15,000 = 2500(P/G, i*, 5) O 0 15000 + 2500(P/G, i*, 5) O 15,000 2500(P/A, i*, 4) + 2500 (P/G, i*, 4) O 0 = 15,000 + 2500(P/A, i*, 4) + 2500 (P/G, i*, 4)arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- 1/1 CengageNOWv2 | Online teachin X ow.com/ilrn/takeAssignment/takeAssignmentMan.uo?invoker=&takeAssignmentSessionLocator=&inprogress=false The IRR method assumes that cash flows are reinvested at OA. an average of the internal rate of return and the discount rate O B. the internal rate of return OC. the lower of the company's discount rate or internal rate of return OD. the company's discount ratearrow_forwardProvide detailed reasoning for the correct option, along with an explanation - Why the remaining options are incorrectarrow_forwardPlease solve step by step and quickarrow_forward

- Solve the below problem. (DONOT use CHATGPT else will report to cheggs) You are the CFO at Infosys Itd which is considering the following two mutually exclusive projects. All amounts are in INT Year Cashflow (Project A) Cashflow (Project B) -50,00,000 -42,00,000 0 1 21,00,000 18,00,000 2 18,00,000 8,00,000 3 15,00,000 6,00,000 4 10,00,000 13,00,000 5 7,50,000 21,00,000 Whichever project we choose, we require a 16 percent return on our investment. a. If we apply the payback criterion, which investment is to be chosen? b. If we apply the discounted payback criterion, which investment is to be chosen? why? c. If we apply the NPV criterion, which investment will be chosen? why? d. Based on the answers in (a) through (c) which project will be finally chosen? why?arrow_forwardKindly don't try to provide the answer from Chegg as they are incorrect (thoroughly checked). If it is possible to be solved in excel, then please do that.arrow_forwardFind the following values, using the equations, and then work the problems using a financial calculator to check your answers. Disregard rounding differences. (Hint: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in parts b and d, and in many other situations, to see how changes in input variables affect the output variable.) Do not round intermediate calculations. Round your answers to the nearest cent. An initial $800 compounded for 1 year at 5.5%. $ An initial $800 compounded for 2 years at 5.5%. $ The present value of $800 due in 1 year at a discount rate of 5.5%. $ The present value of $800 due in 2 years at a discount rate of 5.5%. $arrow_forward

- Select all the correct statements. The internal rate of return (IRR) generated by a positive cash flow stream of n payments a. is always given by the solution of a quadratic equation b. is always bigger or equal than -1 c. can be -2 for a suitable cashflow d. can be 17 for a suitable cashflow e. is always smaller or equal than +1arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardFind the present value of the following ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press PV, and find the PV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $400 per year for 10 years at 6%. $ $200 per year for 5 years at 3%. $ $400 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made at the beginning of each year; that is, they are annuities due. Present value of $400 per…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education