Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please help me with this, i can understand

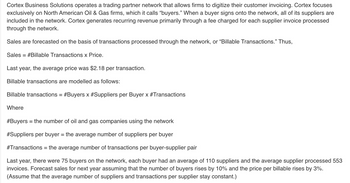

Transcribed Image Text:Cortex Business Solutions operates a trading partner network that allows firms to digitize their customer invoicing. Cortex focuses

exclusively on North American Oil & Gas firms, which it calls “buyers." When a buyer signs onto the network, all of its suppliers are

included in the network. Cortex generates recurring revenue primarily through a fee charged for each supplier invoice processed

through the network.

Sales are forecasted on the basis of transactions processed through the network, or "Billable Transactions." Thus,

Sales #Billable Transactions x Price.

=

Last year, the average price was $2.18 per transaction.

Billable transactions are modelled as follows:

Billable transactions = #Buyers x #Suppliers per Buyer x #Transactions

Where

#Buyers = the number of oil and gas companies using the network

#Suppliers per buyer = the average number of suppliers per buyer

#Transactions = the average number of transactions per buyer-supplier pair

Last year, there were 75 buyers on the network, each buyer had an average of 110 suppliers and the average supplier processed 553

invoices. Forecast sales for next year assuming that the number of buyers rises by 10% and the price per billable rises by 3%.

(Assume that the average number of suppliers and transactions per supplier stay constant.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hepworth Credit Corporation is a wholly owned subsidiary of a large manufacturer of computers. Hepworth is in the business of financing computers, software, and other services that the parent corporation sells. Hepworth has two departments that are involved in financing services: the Credit Department and the Business Practices Department. The Credit Department receives requests for financing from field sales representatives, records customer information on a preprinted form, and then enters the information into the computer system to check the creditworthiness of the customer. (Other actions may be taken if the customer is not in the database.) Once creditworthiness information is known, a printout is produced with this information plus other customer-specific information. The completed form is transferred to the Business Practices Department. The Business Practices Department modifies the standard loan covenant as needed (in response to customer request or customer risk profile). When this activity is completed, the loan is priced. This is done by keying information from the partially processed form into a personal computer spreadsheet program. The program provides a recommended interest rate for the loan. Finally, a form specifying the loan terms is attached to the transferred-in document. A copy of the loan-term form is sent to the sales representative and serves as the quote letter. The following cost and service activity data for the Business Practices Department are provided for the month of May: All materials and supplies are used at the end of the process Required: 1. How would you define the output of the Business Practices Department? 2. Using the FIFO method, prepare the following for the Business Practices Department: a. A physical flow schedule b. An equivalent units schedule c. Calculation of unit costs d. Cost of ending work in process and cost of units transferred out e. A cost reconciliationarrow_forwardAarrow_forwardLamar LLC is in the process of updating its revenues and receivables systems with the implementation of new accounting software. James Loden, Inc. is an independent information technology consultant who is assisting Tamar with the project. James has developed the following checklist containing internal control points that the company should consider in this new implementation: Will customer orders be received via the Internet? Are all collections from customers received in the form of checks? Are product quantities monitored regularly?arrow_forward

- In the evaluation of sales transaction processing and control design in the following information:(a)identify two or three potential weaknesses. breifly explain the potential mistatement, recommended correction and possible weakness of all two or three potential weaknesses identified. Marco uses the PC network to manage inventory, sales requisitions, and sales orders. Salesclerks who can read the perpetual inventory records via their PCs take customer orders. Most orders originate from phone requests, but a few arrive on a walk-in basis and some occasionally come in the mail. Usually, building contractors or their representatives call to get current price quotes and find out if specific appliances are in stock. When goods are available and the price is satisfactory, a salesclerk originates a sales requisition and the process of approving and filling it begins if customers plan to pick up their order the same day. Orders received after 4:00 PM cannot be delivered the same day; buyers…arrow_forwardPrecision Industries, Inc., is a manufacturer of electronic components. When a purchase order is received from a customer, a sales clerk prepares a serially numbered sales order and sends copies to the shipping and accounting departments. When the merchandise is shipped to the customer, the shipping department prepares a serially numbered shipping advice and sends a copy to the accounting department. Upon receipt of the appropriate documents, the accounting department records the sale in the accounting records. All shipments are FOB shipping point. Assume that all shipments for the first five days of the following year were recorded as occurring in the current year. If not corrected, what effect will this cutoff error have upon the financial statements for the current year?arrow_forwardThe birth of the Internet in the 1990s led to the creation of a new industry of online retailers such as Amazon, Overstock.com, and PCM, Inc. Many of these companies often act as intermediaries between the manufacturer and the customer without ever taking possession of the merchandise sold. Revenue recognition for this type of transaction has been controversial. Assume that Overstock.com sold you a product for $200 that cost $150. The company's profit on the transaction clearly is $50. Should Overstock recognize $200 in revenue and $150 in cost of goods sold (the gross method), or should it recognize only the $50 in gross profit (the net method) as commission revenue? 4. Do you agree with Alphabet's reasoning with respect to choosing whether it reports revenue gross versus net with respect to these advertising services? Indicate "yes" or "no," and explain.arrow_forward

- The following is a description of manufacturing com-pany’s purchasing procedures. All computers in the com-pany are networked to a centralized accounting system sothat each terminal has full access to a common database.The inventory control clerk periodically checks in-ventory levels from a computer terminal to identifyitems that need to be ordered. Once the clerk feels in-ventory is too low, he chooses a supplier and creates apurchase order from the terminal by adding a record tothe purchase order file. The clerk prints a hard copy ofthe purchase order and mails it to the vendor. An elec-tronic notification is also sent to accounts payable andreceiving, giving the clerks of each department accessto the purchase order from their respective terminals.When the raw materials arrive at the unloading dock,a receiving clerk prints a copy of the purchase orderfrom his terminal and reconciles it to the packing slip.The clerk then creates a receiving report on a computersystem. An electronic…arrow_forwardThe following is a description of manufacturing com-pany’s purchasing procedures. All computers in the com-pany are networked to a centralized accounting system sothat each terminal has full access to a common database.The inventory control clerk periodically checks in-ventory levels from a computer terminal to identifyitems that need to be ordered. Once the clerk feels in-ventory is too low, he chooses a supplier and creates apurchase order from the terminal by adding a record tothe purchase order file. The clerk prints a hard copy ofthe purchase order and mails it to the vendor. An elec-tronic notification is also sent to accounts payable andreceiving, giving the clerks of each department accessto the purchase order from their respective terminals.When the raw materials arrive at the unloading dock,a receiving clerk prints a copy of the purchase orderfrom his terminal and reconciles it to the packing slip.The clerk then creates a receiving report on a computersystem. An electronic…arrow_forwardA company is trying to set up proper internal controls for their accounts payable/inventory purchasing system. Currently the purchase order is generated by the same person who receives the inventory. Together the purchase order and the receiving ticket are sent to accounts payable for payment. What changes would you make to improve the internal control structure? Group of answer choices 1.The person in accounts payable should generate the purchase order. 2.The person in accounts payable should generate the receiving ticket once the invoice from the supplier is received. 3.No changes would be made since the person paying the bills is different from the person ordering the inventory. 4.The responsibilities of generating the purchase order and receiving the inventory should be separated among two different people.arrow_forward

- Precision Industries, Inc., is a manufacturer of electronic components. When a purchase order is received from a customer, a sales clerk prepares a serially numbered sales order and sends copies to the shipping and accounting departments. When the merchandise is shipped to the customer, the shipping department prepares a serially numbered shipping advice and sends a copy to the accounting department. Upon receipt of the appropriate documents, the accounting department records the sale in the accounting records. All shipments are FOB shipping point. How can the auditors determine whether Precision Industries, Inc., has made a proper year-end cutoff of sales transactions?arrow_forwardStone Holidays is an independent travel agency. It does not operate holidays itself. It takes commission on holidays sold to customers through its chain of high street shops. Staff are partly paid on a commission basis. Well-established tour operators run the holidays that Stone Holidays sells. The networked reservations system through which holidays are booked and the computerized accounting system are both well-established systems used by many independent travel agencies. Payments by customers, including deposits, are accepted in cash and by debit and credit card. Stone Holidays is legally required to pay an amount of money (based on its total sales for the year) into a central fund maintained to compensate customers if the agency should cease operations. Describe the nature of the risks to which Stone Holidays is subject arising from fraud and error.arrow_forwardConsider the following short case as you respond to the question:SPC Corporation sells computer security software. They maintain their AIS using general ledger software; data files are backed up twice a day. Sales staff can access the customer database, inventory files and general ledger, as well as sales-related documents such as invoices and sales orders. Newly hired sales staff members at SPC receive the company procedures manual which explains the process used to complete the steps in the sales/collection process. To minimize costs, SPC designates up to five sales staff members each month who can do credit checks for all new customers in addition to processing sales. SPC bills its clients monthly and uses the balance forward method of accounting for receivables; all cash receipts from clients are processed using a lockbox procedure. The lockbox firm's fee is 3% of all collections. SPC's accounting department estimates bad debts at the end of each fiscal year; they are normally…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:CENGAGE L

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning