FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

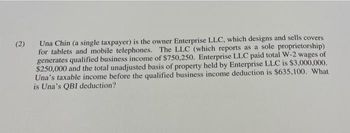

Transcribed Image Text:(2)

Una Chin (a single taxpayer) is the owner Enterprise LLC, which designs and sells covers

for tablets and mobile telephones. The LLC (which reports as a sole proprietorship)

generates qualified business income of $750,250. Enterprise LLC paid total W-2 wages of

$250,000 and the total unadjusted basis of property held by Enterprise LLC is $3,000,000.

Una's taxable income before the qualified business income deduction is $635,100. What

is Una's QBI deduction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- B Corporation, a calendar year-end, accrual-basis taxpayer, is owned 75 percent by Bonnie, a cash-basis taxpayer. On December 31, 2022, the corporation accrues interest of $4,000 on a loan from Bonnie and also accrues a $15,000 bonus to Bonnie. The bonus is paid to Bonnie on February 1, 2023; the interest is not paid until 2024. How much can B Corporation deduct on its 2023 tax return for these two expenses? a. $15,000 b. $19,000 c. $4,000 d. $0 e. $12,000arrow_forwardRachel, a single taxpayer, operates a construction business as a sole proprietor. This year, Rachel earned $225,000 of qualified business income after paying $40,000 of wages to her employees. The unadjusted basis of her business property totals $10,000. Rachel's taxable income before the deduction for qualified business income is $212,300. What is the amount of her QBI deduction? Group of answer choices $25,000 $15, 100 $29,900 $42,460 $45,000arrow_forwardEva received $60,000 in compensation payments from JAZZ Corp. during 2020. Eva incurred $5,000 in business expenses relating to her work for JAZZ Corp. JAZZ did not reimburse Eva for any of these expenses. Eva is single and she deducts a standard deduction of $12,400. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. (Leave no answer blank. Enter zero if applicable.) c. Assume that Eva is considered to be a self-employed contractor. What is her self-employment tax liability and additional Medicare tax liability for the yeararrow_forward

- Boots, Inc. is a "C" corporation engaged in the shoe manufacturing business. Boots is a calendar year, accrual method taxpayer with twong shareholders, Emil and Betty, who are unrelated cash method taxpayeal answering the questions below, assume for convenience that Emil and n each are taxable at a combined federal and state flat rate of 40% on ordinary income and a combined flat rate of 20% on qualified dividends and long capital gains. During the current year, Boots has the following income aa expense items: Income: $2,600,000 Gross profit-sale of inventory. Capital gains. $ 200,000 Expenses and Losses: $ 800,000 $ 800,000 $ 220,000 Operating Expenses. Equipment purchase (100% expensed) under § 168(k) Capital losses (a) Determine Boots, Inc.'s taxable income and its tax liability for the current year. (b) What result in (a), above, if Boots distributes its after-tax profits to Emil and Betty as qualified dividends? (c) What result in (a), above, if instead of paying dividends Boots…arrow_forwardCharlotte is a partner in, and sales manager for, CD Partners, a domestic business that is not a "specified services" business. During the tax year, she receives guaranteed payments of $177,400 from CD Partners for her services to the partnership as its sales manager. In addition, her distributive share of CD Partners' ordinary income (its only item of income or loss) was $106,440. What is Charlotte's qualified business income? $fill in the blank 1 ______?arrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $191,500 salary working full time for Angels Corporation. Angels Corporation reported $196,000 of taxable business income for the year (2023). Before considering his business income allocation form Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $191,500 (all salary from Angels Corporation). Mason claims $73,000 in itemized deductions. Assuming the business income allocated to Mason is income from a specified service trade or business, what is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forward

- The Blue Corporation, a C corporation, is owned 100% by Tim Morgan and had taxable income in 2019 of $535,000. Tim is also an employee of the corporation. In December 2019, the corporation has decided to distribute $450,000 to Tim and has asked you whether it would be better to distribute the money as a dividend or salary. Tim, a single taxpayer, is in the 37% marginal tax bracket. How would you respond to Blue Corporation? Consider only income taxes for this problem. (Tim's taxable income exceeds $434,550.) LOADING... Calculate the taxes for Blue and Tim under each option. (For the purpose of this analysis, we will only consider the marginal and capital gain rates for Tim. Ignore additional taxes imposed on high income taxpayers.) Distributed as dividend Distributed as salary Taxes for Blue Taxes for Tim Total tax liability Enter any number in the edit fields and then click Check Answer.…arrow_forwardThad, a single taxpayer, has taxable income before the QBI deduction of $189,500. Thad, a CPA, operates an accounting practice as a single member LLC (which he reports as a sole proprietorship). During 2021, his proprietorship generates qualified business income of $151,600, W–2 wages of $113,700, and $12,000 of qualified property. Assume the QBI amount is net of the self-employment tax deduction. If required, round any division to two decimal places and use that rounded amount in any future computations. Round your final answer to the nearest dollar. What is Thad's qualified business income deduction?arrow_forwardScott and Laura are married and will file a joint tax return. Laura has a sole proprietorship (not a "specified services" business) that generates qualified business income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted basis of $10,000. Scott is employed by a local school district. Their taxable income before the QBI deduction is $400,100 (this is also their modified taxable income). A. Determine Scott and Laura's QBI deduction, taxable income, and tax liability for 2022. B. After providing you the original information in the problem, scott finds out that he will be receiving a $6,000 bonus in December 2022 (increasing their taxable income before the QBI deduction by this amount). Redetermine Scott and Laura's QBI deduction taxable income, and tax liability for 2022.arrow_forward

- Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $191,500 salary working full time for Angels Corporation. Angels Corporation reported $446,000 of taxable business income for the year (2023). Before considering his business income allocation form Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $191,500 (all salary from Angels Corporation). Mason claims $73,000 in itemized deductions. Answer the following questions for Mason. Assume the same facts as question (b), except that Angels Corporation reported $196,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardThad, a single taxpayer, has taxable income before the QBI deduction of $191,000. Thad, a CPA, operates an accounting practice as a single member LLC (which he reports as a sole proprietorship). During 2022, his proprietorship generates qualified business income of $152,800, W–2 wages of $114,600, and $9,200 of qualified property. Assume the QBI amount is net of the self-employment tax deduction. If required, round any division to two decimal places and use that rounded amount in any future computations. Round your final answer to the nearest dollar. What is Thad's qualified business income deduction?arrow_forwardMs. Kona owns a 10 percent interest in Carlton LLC. This year, the LLC generated $66,400 ordinary income. Ms. Kona’s marginal tax rate is 32 percent, and she does not pay SE tax on her LLC income. Required: Compute the tax cost on Ms. Kona’s share of Carlton’s income assuming that she received a $29,000 cash distribution this year. Compute the tax cost on Ms. Kona’s share of Carlton’s income assuming that she received no cash distribution this year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education