FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

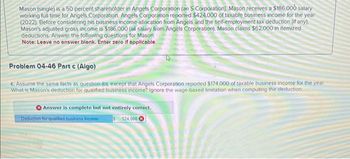

Transcribed Image Text:Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $186,000 salary

working full time for Angels Corporation. Angels Corporation reported $424,000 of taxable business income for the year

(2022). Before considering his business income allocation from Angels and the self-employment tax deduction (if any).

Mason's adjusted gross income is $186,000 (all salary from Angels Corporation). Mason claims $62,000 in itemized

deductions. Answer the following questions for Mason.

Note: Leave no answer blank. Enter zero if applicable.

Problem 04-46 Part c (Algo)

c. Assume the same facts as question (b), except that Angels Corporation reported $174,000 of taxable business income for the year

What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.

Answer is complete but not entirely correct.

Deduction for qualified business income

124.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- Compute for the tax due of the following individuals using the RA 10963 tax table. Show computations. 1. A business has net income before tax of P2,410,000.arrow_forwardFind the amounts that are missing from this summary of an income tax return: a. Gross income $42,685 b. Adjustments to income $3,670 c. Adjusted gross income d. Deductions $8,978 e. Adjusted gross income less deductions f. Exemptions (4 $3,100) $12,400 g. Taxable income Vince Bottolito's adjusted gross income on his federal tax return was $53.748. He claimed the standard deduction of $4,850, and one exemption at $3,100. What was Vince's taxable income? The Valek's gross income last vear was $64.890. They had adjustments to income totaling S3.829. Their deductions totaled $12.502. and they had four exemptions at S3.100 each. Find their taxable income.arrow_forwardPatriot Corporation reports the following results for the current year: View the current year results. Read the requirements. Requirement a. What are Patriot's taxable income and income tax liability for the current year? Begin by computing Patriot's taxable income. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Gross income Minus: Taxable income Requirements a. What are Patriot's taxable income and income tax liability for the current year? b. How would your answers to Part a change if Patriot's short-term capital loss is $12,000 instead of $2,000? Print Done - X Current Year Results Gross profits on sales Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss Operating expenses Print $ 159,000 7,000 8,000 9,000 2,000 70,000 Done Xarrow_forward

- Franklin Stewart arrived at the following tax information: Gross salary Interest earnings Eligible dividend income Basic personal amount Union dues Moving expense (50 km for employment) $49,100 870 110 39744.5 3,650 7,880 1,860 What amount will Franklin report as taxable income? (Round your answer to the nearest dollar amount. Omit the "$" sign in your response.) Taxable incomearrow_forwardGoose Corporation, a C corporation, incurs a net capital loss of $23,900 for 2021. It also has ordinary income of $19,120 in 2021. Goose had net capital gains of $4,780 in 2017 and $9,560 in 2020. If an amount is zero, enter "0". a. Determine the amount, if any, of the net capital loss of $23,900 that is deductible in 2021.$fill in the blank 1 _______ ? b. Determine the amount, if any, of the net capital loss of $23,900 that is carried forward to 2022.$fill in the blank 1 ______?arrow_forwardWhat is the income tax imposed on the corporate income earned by Bulldog and the income tax on the bonus paid to Rojas? (No plagiarism)arrow_forward

- f2. Subject:- Accountingarrow_forwardFranklin Stewart arrived at the following tax information: Gross salary Interest earnings Eligible dividend income Basic personal amount Union dues Moving expense (50 km for employment) $ 47,780 225 100 12,069 3,890 1,150 What amount will Franklin report as taxable income? (Round your answer your response.) Taxable income $arrow_forwardCompute for the tax due of the following individuals using the RA 10963 tax table. Show computations. 1. A business has net income before tax of P310,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education