FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

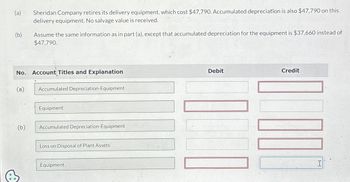

Transcribed Image Text:(a) Sheridan Company retires its delivery equipment, which cost $47,790. Accumulated depreciation is also $47,790 on this

delivery equipment. No salvage value is received.

(b)

Assume the same information as in part (a), except that accumulated depreciation for the equipment is $37,660 instead of

$47,790.

No. Account Titles and Explanation

(a)

Accumulated Depreciation-Equipment

Equipment

(b)

Accumulated Depreciation-Equipment

Loss on Disposal of Plant Assets

Equipment

Debit

Credit

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- saarrow_forward[The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Asset Computer equipment Furniture Commercial building Assuming DLW does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is DLW's year 1 cost recovery for each asset? Asset Date Acquired 2/26 2/26 12/20 Computer equipment Furniture Commercial building Total Year 1 Cost Recovery $ Cost Basis $ 19,500 $ 18,000 $ 341,000 3,900 2,572 9,050 15,522arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Case E Robert Sporting Goods Company has another piece of equipment (Q102) with the following cost and accumulated depreciation at its year ended December 31, 2020: Equipment (Q102) $9 000 000 Accumulated Depreciation 3 000 000 Due to obsolescence and physical damage, the equipment was found to be impaired. At the year-end Robert Sporting Goods Company had determined the following information: Fair value less cost of Disposal $4 500 000 Value in use or discounted net cash flows 4 000 000 Undiscounted net cash flows 5 500 000 Required: Assess equipment (Q102) for impairment and prepare the journal entry (if necessary) to report any impairment loss for the year. When selecting from dropdown lists, if a line item…arrow_forwardNonearrow_forwardFor each of the following depreciable assets, determine the missing amount. Abbreviations for depreciation methods are SL for straight-line and DDB for double-declining-balance. (Do not round intermediate calculations. Round your final answers to nearest whole dollar.) Asset A B C D E Cost 68,000 93,000 258,000 214,000 Residual Value $ 34,000 13,000 24,000 34,000 Service Life Depreciation (Years) Method 5 8 10 8 DDB SL SL DDB Depreciation (Year 2) $ 39,000 5,900 10,000 23,400arrow_forward

- A copy machine cost $39,000 when new and has accumulated depreciation of $25,000. Suppose Print Center sold the machine for $14,000. What is the result of this disposal transaction? OA. Gain of $14,000 OB. Loss of $25,000 OC. Loss of $14,000 D. No gain or lossarrow_forwardA company sells a long-lived asset that originally cost $200,000 for $50,000 on December 31, 2018. The accumulated depreciation account had a balance of $110,000 after the current year's depreciation of $45,000 had been recorded. The company should recognize a: Multiple Choice $100,000 loss on disposal. $40,000 loss on disposal. $40,000 gain on disposal. $25,000 loss on disposal.arrow_forwardNovak Corp., a small company that follows ASPE, owns machinery that cost $925,000 and has accumulated depreciation of $385,000. The undiscounted future net cash flows from the use of the asset are expected to be $513,000. The equipment's fair value is $440,000. Using the cost recovery impairment model, prepare the journal entry, if any, to record the impairment loss. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forward

- Rakesharrow_forwardOn December 31, 2021, after a slight mishap, Wreckless Transport Co. decides to evaluate its delivery truck for possible impairment. The company has the following information as of 12-31-2021: Equipment cost 65,000 Accumulated depreciation to date 20,000 Expected future net cash flows 10,000 Fair Value on 12-31-2021 8,000 Disposal costs 2,000 Fair value of equipment on 12-31-2022 15,000 Assume that the company will continue to use this asset in the future. As of December 31, 2021, the equipment has a remaining useful life of 4 years. INSTRUCTIONS: A Prepare the journal entry, if any, to record impairment at 12-31-2021 B Prepare the journal entry, if any, at December 31, 2022 to record the increase in fair value. C Prepare the journal entry on 12-31-2021 to record impairment assuming that the company intends to dispose of the truck rather than continue to use it. Show work to explain please.arrow_forwardSheffield Corporation purchased equipment on January 1, Year 1 for $105,000. Sheffield used the straight-line method of depreciation with a $22,000 salvage value and a useful life of 5 years. On January 1, Year 3 Sheffield sold this equipment for $77,000. Required: Calculate the gain or loss Sheffield should recognize from this sale. Gainarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education