Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

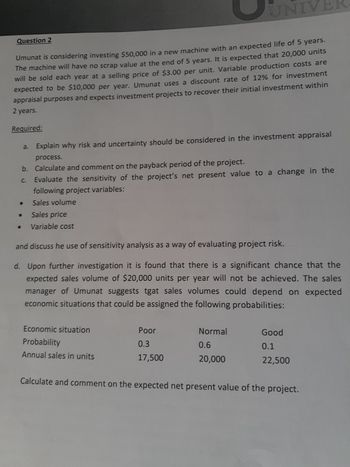

Transcribed Image Text:Question 2

Umunat is considering investing $50,000 in a new machine with an expected life of 5 years.

The machine will have no scrap value at the end of 5 years. It is expected that 20,000 units

will be sold each year at a selling price of $3.00 per unit. Variable production costs are

expected to be $10,000 per year. Umunat uses a discount rate of 12% for investment

appraisal purposes and expects investment projects to recover their initial investment within

2 years.

Required:

●

a.

b.

C.

Explain why risk and uncertainty should be considered in the investment appraisal

process.

Calculate and comment on the payback period of the project.

Evaluate the sensitivity of the project's net present value to a change in the

following project variables:

Sales volume

Sales price

Variable cost

UNIVE

and discuss he use of sensitivity analysis as a way of evaluating project risk.

d. Upon further investigation it is found that there is a significant chance that the

expected sales volume of $20,000 units per year will not be achieved. The sales

manager of Umunat suggests tgat sales volumes could depend on expected

economic situations that could be assigned the following probabilities:

Economic situation

Probability

Annual sales in units

Poor

0.3

17,500

Normal

0.6

20,000

Good

0.1

22,500

Calculate and comment on the expected net present value of the project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define- Capital Budgeting:

VIEW Step 2: a. Explanation:

VIEW Step 3: b. Calculate Payback Period:

VIEW Step 4: c. Sensitivity Analysis of NPV due to change in Sales Volume:

VIEW Step 5: c. Sensitivity Analysis of NPV due to change in Sales Price:

VIEW Step 6: c. Sensitivity Analysis of NPV due to change in Variable Cost:

VIEW Step 7: d. Calculate NPV:

VIEW Solution

VIEW Step by stepSolved in 8 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Halloween, Incorporated, is considering a new product launch. The firm expects to have an annual operating cash flow of $9.2 million for the next 8 years. The discount rate for this project is 13 percent for new product launches. The initial investment is $39.2 million. Assume that the project has no salvage value at the end of its economic life. a. What is the NPV of the new product? (Do not round intermediate calculations and After the first year, the project can be dismantled and sold for $26.2 million. If the estimates of remaining cash flows are revised based on the first year’s experience, at what level of expected cash flows does it make sense to abandon the project?arrow_forwardJasmine Manufacturing is considering a project that will require an initial investment of $49,400 and is expected to generate future cash flows of $9,500 for years 1 through 3, $7,600 for years 4 and 5, and $1,900 for years 6 through 10. What is the payback period for this project? fill in the blank yearsarrow_forwardJoanette, Incorporated, is considering the purchase of a machine that would cost $620,000 and would last for 10 years, at the end of which, the machine would have a salvage value of $62,000. The machine would reduce labor and other costs by $122,000 per year. Additional working capital of $8,000 would be needed immediately, all of which would be recovered at the end of 10 years. The company requires a minimum pretax return of 16% on all investment projects. (Ignore income taxes.) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Required: Determine the net present value of the project. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar amount.) Net present valuearrow_forward

- Bensington Glass Co. is considering the expansion of it spandrel glass business line. They plan to convert an unused space of their warehouse into additional manufacturing space. They estimate the initial investment will be $7,450,000 and expect the new production to create additional cash flows of $2,925,000 in year's one through ten. If Bensington Glass uses a discount rate of 11%, what is the project's discounted payback period? 4.00 O 3.00 O 3.82 3.16arrow_forwardCourses/88945/quizzes/289708/take Van Nuys Company Year Cash Flow Cost of Capital 12% %24 (7,370) 24 1 4,000 (2,000) 24 24 4,000 (2,000) 24 4,000 24 (2,000) $4 4,000 24 (2,000) 5 $4 4,000 (2,000) 24 24 6. 4,000 24 (2,000)arrow_forwardThe X Company is considering the acquisition of a new processor that has an estimated installed cost of $57,000. The processor has an expected life of 5 years and will be depreciated over a 5 year ACRS life to a zero salvage value. However, it is expected that the processor can be sold at that time for $6,000. If purchased, the entire $57,000 would be borrowed at an interest rate of 9%. A capital budgeting analysis results in a positive NPV for the project. An alternative to purchase is to lease the asset for an annual lease payment of $13,500. The lease includes maintenance services estimated to cost Company C $3,000 per year if they were not included in the lease payment. Company C's cost of capital is 11% and its marginal tax rate is 34%. Evaluate the purchase and lease options and make a recommendation of which is preferred.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education