Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

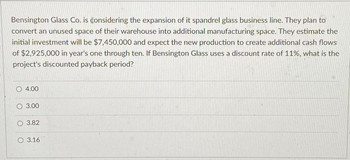

Transcribed Image Text:Bensington Glass Co. is considering the expansion of it spandrel glass business line. They plan to

convert an unused space of their warehouse into additional manufacturing space. They estimate the

initial investment will be $7,450,000 and expect the new production to create additional cash flows

of $2,925,000 in year's one through ten. If Bensington Glass uses a discount rate of 11%, what is the

project's discounted payback period?

4.00

O 3.00

O 3.82

3.16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sons Inc. management is considering purchasing a new machine at a cost of $4,390,000. They expect this equipment to produce cash flows of $845,890, $819,250, $917,830, $1,103,400, $1,093,260, and $1,306,800 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is $arrow_forwardManagement of Carla Vista Mints, a confectioner, is considering purchasing a new jelly bean-making machine at a cost of $312,50O. They project that the cash flows from this investment will be $ 90,000 for the next seven years. If the appropriate discount rate is 14 percent, what is the NPV for the project? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) NPV %24arrow_forwardMelton Manufacturing Ltd is considering two alternative investment projects. The first project calls for amajor renovation of the company’s manufacturing facility. The second involves replacing just a fewobsolete pieces of equipment in the facility. The company will choose one project or the other this year,but it will not do both. The cash flows associated with each project appear below and the firm discountsproject cash flows at 10%.Year Renovate Replace0 –$4,000,000 –$1,300,0001 2,000,000 1,000,0002 2,000,000 700,0003 2,000,000 300,0004 2,000,000 150,0005 2,000,000 150,000 Calculate the profitability index (PI) of each project and based on this criterion, indicate whichproject you would recommend for acceptance.arrow_forward

- Melton Manufacturing Ltd is considering two alternative investment projects. The first project calls for amajor renovation of the company’s manufacturing facility. The second involves replacing just a fewobsolete pieces of equipment in the facility. The company will choose one project or the other this year,but it will not do both. The cash flows associated with each project appear below and the firm discountsproject cash flows at 10%.Year Renovate Replace0 –$4,000,000 –$1,300,0001 2,000,000 1,000,0002 2,000,000 700,0003 2,000,000 300,0004 2,000,000 150,0005 2,000,000 150,000 Discuss the important elements to consider when deciding between these two projects.arrow_forwardABC Corp is considering a new project: the project requires an initial cost of $375,000, and will not produce any cash flows for the first two years. Starting in year 3, the project will generate cash inflows of $528,000 a year for three years. This project has higher risk compared to other projects the firm has, so it is assigned with a discount rate of 18%. What is the project's net present value? $773,016.1 $218,693.6 $449,487.3 $824,487.3 Oa b. C₂ d.arrow_forwardShelton Tax Services is considering investing in new software for their corporate tax business. The investment will require an outlay of $350,000 initially, and is expected to generate the following after-tax cash flows: Year 1, $60,000; Year 2, $80,000; Year 3, $105,000; Year 4, $120,000; Year 5, $145,000. Shelton uses a discount rate of 10%. What is the net present value of the proposed investment? Should this investment be accepted or rejected? Must show your computation steps. Use the appropriate tables in Appendix A to obtain the relevant present value factor and round up your final answer to the nearest dollar.arrow_forward

- Wildhorse Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. Should management go ahead with the project? Year 0 1 2 3 4 5 Cash Flow -$3,485,400 871,710 896,700 1,104,400 1,340,360 1,450,600 What is the NPV of this project? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to O decimal places, e.g. 1,525.) The NPV is $arrow_forwardFossa Road Paving Corporation is considering an investment in a curb-forming machine. The machine will cost $240,000, will last 10 years, and will have a $40,000 salvage value at the end of 10 years. The machine is expected to generate net cash inflows of $60,000 per year in each of the 10 years. Fossa's discount rate is 18%. The net present value of the proposed investment is closest to (Ignore income taxes.): Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $69,640 $37,280 $(48,780) $5,840arrow_forwardGreen & Company is considering investing in a robotics manufacturing line. Installation of the line will cost an estimated $15.7 million. This amount must be paid immediately even though construction will take three years to complete (years 0, 1, and 2). Year 3 will be spent testing the production line and, hence, it will not yield any positive cash flows. If the operation is very successful, the company can expect after-tax cash savings of $10.7 million per year in each of years 4 through 7. After reviewing the use of these systems with the management of other companies, Green's controller has concluded that the operation will most probably result in annual savings of $7.9 million per year for each of years 4 through 7. However, it is entirely possible that the savings could be as low as $3.7 million per year for each of years 4 through 7. The company uses a 12 percent discount rate. Use Exhibit A.8. Required: Compute the NPV under the three scenarios. Note: Round PV factor to 3…arrow_forward

- The Dallas Development Corporation is considering the purchase of an apartment project for $100,000. They estimate that they will receive $15,000 at the end of each year for the next 10 years. At the end of the 10th year, the apartment project will be worth nothing. If Dallas purchases the project, what will be its internal rate of return, compounded annually? If the company insists on an 8 percent return compounded annually on its investment, is this a good investment?arrow_forwardIvanhoe Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. Should management go ahead with the project? Year Cash Flow 0 -$3,046,900 1 803,710 2 889,200 3 1,247,600 4 1,285,160 5 1,576,500 What is the NPV of this project? - NPV $?arrow_forwardHardevarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education