FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

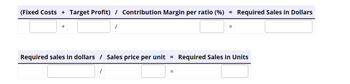

Summer Company sells a product with a contribution margin ratio of 54%. Fixed costs per month are $630. What amount of sales (in dollars) must Summer Company have to earn an operating of $6,400? If each unit sells for $25.00, how many units must be sold to achieve the desired operating income?

(Round your answers to two decimal places when needed and use rounded answers for all future calculations and write unit answers in whole units when needed.)

Transcribed Image Text:(Fixed Costs + Target Profit) / Contribution Margin per ratio (%) = Required Sales in Dollars

Required sales in dollars / Sales price per unit = Required Sales in Units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Gladstorm Enterprises sells a product for $46 per unit. The variable cost is $34 per unit, while fixed costs are $9,300. Determine the: Round to the nearest whole number of units. a. Break-even point in sales units b. Determine the break-even point in sales units if the selling price increased to $59 per unit unitsarrow_forwardHawk Homes, Ic., makes one type of birdhouse that it sells for $30.00 each. Its variable cost is $13.50 per house, and its fixed costs total $14,239.50 per year. Hawk currently has the capacity to produce up to 2,800 birdhouses per year, so its relevant range is 0 to 2,800 houses. Required: 1. Prepare a contribution margin income statement for Hawk assuming it sells 1,110 birdhouses this year. 2. Without ancaleuletione, detonmine llawks total contribution morgin if the company breake 3. Сн 4. Calculate Hawk's break-even point in number of units and in sales revenue. 5. Suppose Hawk wants to earn $21,000 this year. Determine how many birdhouses it must sell to generate this amount of profit. O margm per umt Omarginatio. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement for Hawk assuming it sells 1,110 birdhouses this year. (Enter your answers…arrow_forwardYou have recently hired an equipment operator for $30.00 per hour. To determine his/her billing rate you simply multiply $30.00 by 1.20 to ensure you get a 20% profit margin. Is this process correct?arrow_forward

- Gladstorm Enterprises sells a product for $52 per unit. The variable cost is $37 per unit, while fixed costs are $13,770. Determine the: Round to the nearest whole number of units. a. Break-even point in sales units _ b. Determine the break-even point in sales units if the selling price increased to $64 per unit _ unitsarrow_forwardFranklin Company incurs annual fixed costs of $133,500. Variable costs for Franklin's product are $29.70 per unit, and the sales price is $45.00 per unit. Franklin desires to earn an annual profit of $45,000. Required Use the contribution margin ratio approach to determine the sales volume in dollars and units required to earn the desired profit. Note: Do not round intermediate calculations. Round your final answers to the nearest whole number. Sales in dollars Sales volume in unitsarrow_forwardsarrow_forward

- Mia Enterprises sells a product for $90 per unit. The variable cost is $40 per unit, while fixed costs are $75,000. Determine the:a. Break-even point in sales units fill in the blank 1 of 2 unitsb. Determine the break-even point in sales units if the selling price increased to $100 per unit $ per unit fill in the blank 2 of 2 unitsarrow_forwardRakoarrow_forwardMaple Enterprises sells a single product with a selling price of $87 and variable costs per unit of $26. The company's monthly fixed expenses are $15,356. What dollar sales will Maple need in order to reach a target profit of $26,540? Round to the nearest whole dollar, no decimals.arrow_forward

- Gladstorm Enterprises sells a product for $50 per unit. The variable cost is $32 per unit, while fixed costs are $16,200. Determine the following: Round your answers to the nearest whole number. a. Break-even point in sales units fill in the blank 1 units b. Break-even point in sales units if the selling price increased to $62 per unit fill in the blank 2 unitsarrow_forwardFinley Corporation has monthly fixed costs of $67,000. It sells two products for which it has provided the following information. Contribution Sales Price Product 1 Product 2 $15 20 Margin $9 4 a. What total monthly sales revenue is required to break even if the relative sales mix is 30 percent for Product 1 and 70 percent Product 2? (Hint: Determine the contribution margin ratio for each product.) (Round your answer to the nearest dollar amount.) b. What total monthly sales revenue is required to earn a monthly operating income of $16,000 if the relative sales mix is 20 perce for Product 1 and 80 percent for Product 2? (Round your answer to the nearest dollar amount.) Answer is complete but not entirely correct. a. Break even sales revenue $ 190,625 b. Target sales revenue $275,000 Barrow_forwardRequired: Laguna Print makes advertising hangers that are placed on doorknobs. It charges $0.18 and estimates its variable cost to be $0.16 per hanger. Laguna's total fixed cost is $2,260 per month, which consists primarily of printer depreciation and rent. Calculate the number of advertising hangers that Laguna must sell in order to break even. Note: Round your intermediate calculation to 2 decimal places and final answer to the nearest whole number. Break-even Hangersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education