FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

narubhai

Transcribed Image Text:Required:

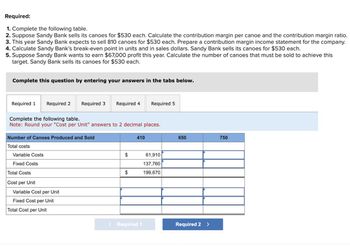

1. Complete the following table.

2. Suppose Sandy Bank sells its canoes for $530 each. Calculate the contribution margin per canoe and the contribution margin ratio.

3. This year Sandy Bank expects to sell 810 canoes for $530 each. Prepare a contribution margin income statement for the company.

4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $530 each.

5. Suppose Sandy Bank wants to earn $67,000 profit this year. Calculate the number of canoes that must be sold to achieve this

target. Sandy Bank sells its canoes for $530 each.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Number of Canoes Produced and Sold

Total costs

Complete the following table.

Note: Round your "Cost per Unit" answers to 2 decimal places.

Variable Costs

Fixed Costs

Total Costs

Cost per Unit

Variable Cost per Unit

Fixed Cost per Unit

Required 4

Total Cost per Unit

$

$

410

Required 5

< Required 1

61,910

137,760

199,670

650

Required 2 >

750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Explanation of break even point

VIEW Step 2: Computation of the amounts for the table.

VIEW Step 3: 2) Calculation of contribution margin per unit and contribution margin ratio.

VIEW Step 4: 3) Computation of contribution margin income statement.

VIEW Step 5: 4) Calculation of break even point in units and dollars.

VIEW Step 6: 5) Computation of target sales.

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Im having an issue with this problem. Thank you!arrow_forwardWhat is the meaning of Intestate?arrow_forward2. Within the framework of the Rokeach value survey, what are terminal values? a.goals that individuals would like to achieve during their lifetime b.principles that guide behavior and inform us whether actions are right or wrong c. preferable ways of behaving d. convictions or beliefs that guide our decisions and evaluations of how to behave e. fixed or predetermined policies or modes of actionarrow_forward

- Look at Ex.5 and ask questions as the examples: Does Henry have good friends?- Yes , he does.arrow_forwardThe owner of a bicycle repair shop forecasts revenues of $220,000 a year. Variable costs will be $65,000, and rental costs for the shop are $45,000 a year. Depreciation on the repair tools will be $25,000. a. Prepare an income statement for the shop based on these estimates. The tax rate is 20%. Depreciation Pretax profit INCOME STATEMENT 0 $ 0 b. Calculate the operating cash flow for the repair shop using the three methods given below. i. Dollars in minus dollars out. ii. Adjusted accounting profits. iii. Add back depreciation tax shield. Methods of Calculation i. Dollars in Minus Dollars Out ii. Adjusted Accounting profits iii. Add back depreciation tax shield Operating Cash Flowarrow_forwardAm I doing it correct?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education