Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

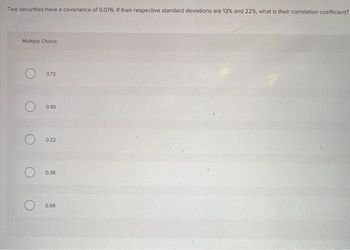

Transcribed Image Text:Two securities have a covariance of 0.076. If their respective standard deviations are 13% and 22%, what is their correlation coefficient?

Multiple Choice

O

0.72

0.95

0.22

0.38

0.58

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A stock's retum has a correlation of 0.67 with the market. The stock's standard deviation is 43% and the market's standard deviation is 22%. The stock's beta is closest to ?arrow_forwardIf the correlation between two stocks is .49 and the standard deviation of both stocks are 39% and 12% respectively, what is the covariance (in percent) between the two stocks?arrow_forwardThe Lost in Space corporation is trying to finally build a space ship that won't end up stranding everyone on it in some random part of the galaxy. To do so they are considering a new three-year project that will require an initial investment of $400 million. These initial assets will be depreciated straight-line to zero over their three-year tax life. The firm will be able to sell these assets at the end of the project for $45,250,000. The project is estimated to generate the following revenues during it's three year life: $315,485,369 in year one, $325,690,023 in year two, and $344,555,000 in year three. The firm expects that their costs will be equal to 47.75% of the projects same year revenues. They expect that project net working capital (in the form of inventory required) will be equal to 10.25% of the next year's revenue. The firms tax-rate is 21%. What are the project's cash flows from assets for years 0-3? What is the IRR on this project? Use available Excel template and…arrow_forward

- Asset A has a standard deviation of 0.17, and asset B has a standard deviation of 0.52. Assets A and B have a correlation coefficient of 0.44. What is the standard deviation of a portfolio consisting with a weight of 0.40 in asset A, a weight of 0.24 in asset B, and the remainder invested in a risk-free asset? Give your answer to four decimal places.arrow_forwardGiven the following probability distribution, what are the expected return and the standard deviation of returns for Security J? State Pi ri 1 0.5 11% 2 0.3 8% 3 0.2 5% O 9.40%; 2.04% O 8.90%; 2.34% O 7.40%; 2.94% O 8.40%; 2.64% O 7.90%; 1.74%arrow_forwardThe variances of stocks A and B are 1 percentage square and 4 percentage square, respectively. If the covariance between the two stocks is 0.6 percentage square, what is the correlation? Dontarrow_forward

- Stock A has a correlation with the market of 0.53. Assuming that the standard deviation of returns for Stock A is 24.0% and that the standard deviation of returns for the market is 10.0%, what is beta for stock A? A 1.31 B. 1.27 C. 0.17 D. 0.22arrow_forwardStock Y has a beta of 0.9 and an expected return of 9.46 percent. Stock Z has a beta of 2.1 and an expected return of 15.59 percent. What would the risk-free rate (in percent) have to be for the two stocks to be correctly priced relative to each other? Answer to two decimals.arrow_forwardYou are given the following possible returns for Security J. Given this information, determine the coefficient of variation for Security J State Probability G 1 30% 10% 25% 18% 14% 24% 27% 2 3 4 O 0.3907 O 0.3847 O 0.3721 O 0.4040 00.3597 31%arrow_forward

- What is the beta of IsoTech, given that the covariance between IsoTech and the market is 0.1 and the standard deviation of market returns is 51%?arrow_forward1. Using the following returns, calculate the average returns, the variance, standard deviations, and coefficient of variation for X and Y. Which stock is the least risky? Yr 1 2 3 Rx 12.20 9.65 0.00 6.50 Ry 4 8.00 -2.00 12.50 9.57arrow_forwardGiven the following probability distribution, what is the expected return and the standard deviation of returns for Security J? The answer choice lists expected return and standard deviation in the respective order. State 1 2 3 Pri 0.2 O 12%; 5.18% O 15%; 3.16% O 15%; 6.50% 0.6 0.2 O 20%; 5.00% 15%; 10.00% rj 10% 15 20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education