ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

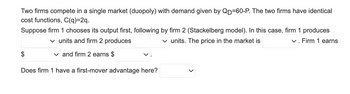

Transcribed Image Text:**Duopoly Competition and the Stackelberg Model**

In this scenario, two firms compete in a single market, known as a duopoly, with demand given by the equation \( Q_D = 60 - P \). Both firms have identical cost functions, represented by \( C(q) = 2q \).

### Stackelberg Model Dynamics

The Stackelberg model involves one firm (Firm 1) choosing its output first, followed by the second firm (Firm 2) making its decision. The interaction is sequential:

- **Output:**

- Firm 1 produces a certain number of units.

- Firm 2 subsequently produces its output based on Firm 1's decision.

- **Market Price:**

- The price in the market is determined after both firms have chosen their outputs.

- **Profits:**

- Firm 1 earns a specified amount in profits.

- Firm 2 earns its own profit based on the residual demand and its cost structure.

### First-Mover Advantage

Evaluating whether Firm 1 has a first-mover advantage is crucial:

- This examines if committing to an output level before Firm 2 provides Firm 1 with a strategic advantage, potentially leading to higher profits or more favorable market positioning compared to Firm 2.

Understanding the interplay between the firms in this model sheds light on strategic decision-making and competitive behaviors in oligopolistic markets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose two firms, A and B, have a cost function of ?(??) = 30??, for ? = ?, ?. The inverse demand for the market is given by ? = 120 − ?, where Q represents the total quantity in the market, ? = ?? + ??. 1. Solve for the firms’ outputs in a Nash Equilibrium of the Cournot Model. 2. Let Firm A be the first mover, and Firm B be the second mover. Solve for the firms’ outputs in a SPNE of the Stackelberg Model.arrow_forwardTwo firms produce Bliffs. They compete by simultaneously choosing prices in a single period. The demand for Bliffs is given by P(Q) = 100-2Q where Q is market quantity and P is market price. Firm 1 has costs C1(q1) = 20q1 and Firm 2 has costs C2(q2) = 10q2. Which statement is true? In the Nash equilibrium to the game, both firms play dominated strategies None of the other answers are correct O In the Nash equilibrium to the game, both firms play dominant strategies In the Nash equilibrium to the game, both firms slowly lower prices towards marginal costs O In the Nash equilibrium to the game, both firms set price equal to marginal costarrow_forwardConsider the following static game with two firms as the players. Each firm must decide either to upgrade (U) an existing good to a new version; or not upgrade it (N). The decisions are simultaneous. If a firm chooses to upgrade, they have to pay a fixed cost of 7. If they don’t upgrade, there is no fixed cost. The marginal cost is always equal to 3. The demand side of the market is as follows: If neither firm upgrades, each firm sells 2 units at price 4. If both firms upgrade, each firm sells 3 units at price 5. If only one firm upgrades, the one who upgrades sells 5 units at price 5, and the other firm does not sell anything.arrow_forward

- There are two firms in a market and they compete in a Nash-Cournot manner. Firm 1 faces the demand function p1(g1,92) = 200 - 91 - 92, and has a total cost function TC1 = (91)2. Firm 2 faces the demand function p2(91,92) = 160 - 92 - 91, and has a total %3D cost function TC2 = (92)2. Answer each of the following questions. a. Find the Nash-Cournot equilibrim output and price v for firm 1. b. Find the Nash-Cournot equilibrim output v and price v for firm 2.arrow_forward2. Four firms (A, B, C, and D) play a pricing game (i.e. Bertrand). Each firm (i) may choose any price Pi from 0 to ¥, with the goal of maximizing its own profit. Firms A and B have MC = 10, while firms C and D have MC = 20. The firms serve a market with the demand curve Q = 100 – P. All firms produce exactly the same product, so consumers purchase only from the firm with the lowest price. If multiple firms have the same low price, consumers divide their quantities evenly among the low-priced firms. Assume the firms choose price simultaneously. a. There are many equilibria in this simultaneous-move pricing game. Provide one equilibrium combination of prices, and argue that no firm has a unilateral incentive to deviate from these prices. Now assume firm A chooses price first. Firm B observes this choice and then chooses its own price second. Firm C chooses price third, and firm D chooses price last. b. Again, there are many equilibria in this sequential-move pricing game.…arrow_forwardTwo firms produce a homogeneous good and compete in price. Prices can only take integer values. The demand curve is Q = 6 p, where p denotes the lower of the two prices. The lower - priced firm meets all the market demand. If the two firms post the same price p, each one gets half the market demand at that price, i. e., each gets (6p)/2. Production cost is zero.a) Show that the best response to your rival posting a price of 6 is to post the monopoly price of 3. What is the best response against a rival's price of 4? of 5?arrow_forward

- Suppose there are just two firms, 1 and 2, in the oil market and the inverse demand for oil is given by P = 60 – Q. The marginal cost for each firm is €30. What price should Firm 2 charge at the Cournot equilibriumarrow_forwardQUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forwardConsider a Bertrand oligopoly where two firms (Firms 1 and 2) sell goods that are imperfectsubstitutes and compete by choosing prices simultaneously. Their market demands areq!= 1,200 − 3/2p!+ 3/2p", q"= 800 − 2p"+ 1/2p!For simplicity, assume the marginal cost is zero for both firms (MC!= MC"= 0). Find the bestresponse curve of each firm. Which of the following alternatives is correct?(a) Firm 1’s best response curve is p!= 400 + 0.5p"(b) Firm 2’s best response curve is p"= 400 + 0.5p!(c) Firm 1’s best response curve is q!= 45 − 0.5q"(d) Firm 2’s best response curve is q"= 200 + 0.8p! Then, find the optimal price and quantity of each firm.Hint: Start by finding the Nash equilibrium, that is, the combination of mutual best responses.Which of the following alternatives is correct?(a) For firm 1, p!= $1,600/3 and q!= 800/3(b) For firm 1, p!= $800 and q!= 1,600/3(c) For firm 2, p"= $800 3⁄ and q"= 1,600/3(d) For firm 2, p"= $1,600 and q"= 800 key: !=1 "=2arrow_forward

- Consider the following oligopolistic market. In the first stage, Firm 1 chooses quantity q1₁. Firms 2 and 3 observe Firm 1's choice, and then proceed to simultaneously choose 92 and 93, respectively. Market demand is given by p(Q) = 100 – · Q, and Q = 9₁ +92 +93. Firm 1's costs are c₁ (9₁) = 591, firm 2's costs are c₂ (92) = 492 and firm 3's costs are C3 (93) = 493. C2 Starting from the end of the game, you can express Firm 2's best response function in terms of 9₁ and 93, and you can similarly express Firm 3's best response function in terms of 9₁ and 92. Using these, answer the following questions. If rounding is needed, write your answers to 3 decimal places. a) If Firm 1 chooses q₁ = 3, what quantity will Firm 2 choose? b) If Firm 1 chooses 9₁ = 100, what quantity will Firm 2 choose? c) In the subgame perfect Nash equilibrium of this game, firm 1 produces what quantity? d) In the subgame perfect Nash equilibrium of this game, firm 2 and firm 3 each produce what quantity?arrow_forwardTwo firms A and B produce a product jointly. The total value to the two firms from the joint venture is given by V = √iA + √iB where iA and iB are the firms’ respective investment levels. After the investment levels have been chosen, the firms divide V equally. a) Find the Nash equilibrium investment levels, and the payoffs for each firm. b) Suppose that A and B merge. Find the optimal investment levels and the payoffs for the merged firm. Do the firms benefit from the merger? Why?arrow_forwardSuppose that Flashfry and Warmbreeze are the only two firms in a hypothetical market that produce and sell air fryers. The following payoff matrix gives profit scenarios for each company (in millions of dollars), depending on whether it chooses to set a high or low price for fryers. Flashfry Pricing High Low For example, the lower-left cell shows that if Flashfry prices low and Warmbreeze prices high, Flashfry will earn a profit of $15 million, and Warmbreeze will earn a profit of $2 million. Assume this is a simultaneous game and that Flashfry and Warmbreeze are both profit-maximizing firms. Warmbreeze Pricing High Low 9,9 2,15 15, 2 8,8 If Flashfry prices high, Warmbreeze will make more profit if it chooses a chooses a price. If Warmbreeze prices high, Flashfry will make more profit if it chooses a chooses a price. Considering all of the information given, pricing low True O False price, and if Flashfry prices low, Warmbreeze will make more profit if it price, and if Warmbreeze…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education