FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

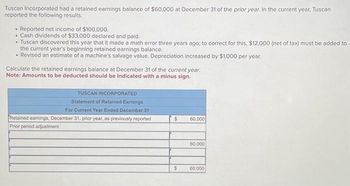

Transcribed Image Text:Tuscan Incorporated had a retained earnings balance of $60,000 at December 31 of the prior year. In the current year, Tuscan

reported the following results.

• Reported net income of $100,000.

• Cash dividends of $33,000 declared and paid.

• Tuscan discovered this year that it made a math error three years ago; to correct for this, $12,000 (net of tax) must be added to

the current year's beginning retained earnings balance.

• Revised an estimate of a machine's salvage value. Depreciation increased by $1,000 per year.

Calculate the retained earnings balance at December 31 of the current year.

Note: Amounts to be deducted should be indicated with a minus sign.

TUSCAN INCORPORATED

Statement of Retained Earnings

For Current Year Ended December 31

Retained earnings, December 31, prior year, as previously reported

Prior period adjustment

$ 60,000

$

60,000

60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Darren ltd. has a December 31 year end. For the current year, the company reported net income before tax for accounting purposes, determined under generally accepted accounting principles, of $682,000. Darren has an investment in Lake Inc. that is accounted for using the equity method. Current-period equity income is $65,000, and dividends received on this investment in the year were $43,500. In the current year, Darren also received dividends from taxable Canadian corporations of $3,700 on portfolio investments and foreign dividends of $4,600. Darren's capital cost allowance claim for the year is equal to amortization expense reported in the income statement. For the current year, what amount will Darren report as net income for tax purposes and taxable income?arrow_forwardBTS Corporation reports the following information: • Correction of overstatement of depreciation expense in prior years, net of tax- P215,000 • Dividends declared- P160,000 • Net income- P500,000 • Retained earnings, 1/1/21, as reported- P1,000,000 BTS should report retained earnings, December 31, 2021 at?arrow_forwardDuring the current year, Dale Corporation sold a segment of its business at a gain of $315,000.Until it was sold, the segment had a current period operating loss of $112,500. The company had$1,275,000 from continuing operations for the current year.Prepare the lower part of the income statement, beginning with the $1,275,000 income fromcontinuing operations. Follow tax allocation procedures, assuming that all changes in incomeare subject to a 20% income tax rate. Disregard earnings per share disclosures. (Round all calculations to nearest dollar amount.)arrow_forward

- This year, Sooner Company reports a deficit in current E&P of ($304,000). Its accumulated E&P at the beginning of the year was $220,000. Sooner distributed $440,000 to its sole shareholder, Boomer Wells, on June 30 of this year. Boomer's tax basis in his Sooner stock before the distribution is $86,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) c. What is Sooner's balance in accumulated E&P on the first day of next year? Balance in accumulated E&P at the beginning of next yeararrow_forwardAssume a company starts operations on 1/1/2013 with an equity investment of $776,750. The companies next 7 years of financial performance are listed below. Assume that the company has no permanent or temporary differences for the first three fiscal years. During fiscal 2016 the company experiences a net operating loss. The marginal corporate tax rates for each year are located on the Income Statement. Calculate taxable income (IRS), taxes payable (IRS)and tax expenses (USGAAP). How should the company accounts for the Net Operating Loss. Provide all Journal Entries & T-Accounts. Create a complete set of financial statements (I/S, SRE, B/S, SCF) for the firm for years 2013 through 2019. INCOME STATEMENT 1/1/13 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 Cash Sales - $776,750 $776,750 $776,750 $119,500 $836,500 $717,000 $746,875 Credit Sales - - - - - - - - Instalment Sales - - - - - -…arrow_forwardThis year, Soner Company reports a deficit in current E&P of ($304,000). Its accumulated E&P at the beginning of the year was $220,000. Sooner distributed $440,000 to its sole shareholder, Boomer Wells, on June 30 of this year. Boomer's tax basis in his Sooner stock before the distribution is $86,000. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) b. What is Boomer's tax basis in his Sooner stock after the distribution? Tax basisarrow_forward

- Jayhawk Company reports current E&P of $310,000 and accumulated E&P of negative $282,500. Jayhawk distributed $505,000 to its sole shareholder, Christine Rock, on the last day of the year. Christine s tax basis in her Jayhawk stock is $128,750. What is Jayhawk s balance in accumulated E&P on the first day of next year?arrow_forwardKatt Co. began operations two years ago (Year 1) and recognized $37,000 in business income and $1,000 in taxable capital gains that year. Last year (Year 2) the company incurred a business loss of $25,000, a taxable capital gain of $2,000, and an allowable capital loss of $5,000. During the current year (Year 3) business income was $50,000, taxable capital gains were $4,000, and the company received $10,000 in dividends from a taxable Canadian corporation. Katt Co. utilizes any unused losses in the earliest years possible, Which of the following taxable incomes are correct after all carry-over adjustments have been made? Select one or more: a. Year 1: $13,000; Year 2: $0; Year 3: $61,000 b. Year 1: $12,000; Year 2: $0; Year 3: $52,000 O c. Year 1: $38,000; Year 2: ($28,000); Year 3: $64,000arrow_forwardAt the end of its first year of operations on December 31, 2022, the Metro Company reported pretax financial income of $100,000. An investigation of that income revealed the following items:· Bad debts expense of $12,000 was recognized (reported on 2022 income statement). The accounts will be written off (tax deductible) in 2023.· Interest received on municipal bonds: $7,500.· Warranty expenses of $16,000 were accrued for financial reporting purposes, but were not expected to result in a cash payment until 2023.· Depreciation on the tax return exceeded depreciation for financial reporting purposes by $32,000.Assume that any deferred tax assets are considered more likely than not to be realized. The enacted income tax rate for all years is 25%.Required:1) Compute taxable income. Show your calculation. If not, no credit.2) Prepare the entry to record income tax expense and any related assets and liabilities for Metro on December 31, 2022.arrow_forward

- The following items were taken from the adjusted trial balance of the Dylex Corporation for the year ended December 31, 2020. Assume an average 25% income tax on all ens. The accounting period ends December 31, and all amounts given are pre-tax. Dylex Corporation had 11,000 common shares outstanding in 2020 and follows IFRS Cost of goods sold Depreciation expense, building Gain on exchange Gain on sale of assets from discontinued operations Insurance expense Interest expense Interest income Loss on sale of trading investment 140,000 23,000 a) Prepare a multi-step income statement in good form. Please make sure your final anewarts) are accurate to 2 decimal places Dylex Corporation For the Year Ended December 31, 200 125,000 100,000 54,000 52,000 X 58,000 135,000 Operating loss of discontinued operation to disposal date 100,000 Salaries expense 160.000 Sales ** 900,000 REQUIRED DISCLOSURES b) Calculate basic eamings per share (EPS) from continuing operations. Please make sure your final…arrow_forwardSol Limited. reported earnings of $510,000 in 20X8. The company has $91,000 of depreciation expense this year, and claimed CCA of $142,000. The tax rate was 25%. At the end of 20X7, there was a $122.000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $71,000 caused by capital assets with a net book value of $1,310,000 and UCC of $1,010,000. The tax rate had been 20% in 20X7 Required: What is the amount of income tax expense in 20X8? Tax expense Prepare the income tax entry or entries. View transaction list No 1 Date 20X8 View journal entry worksheet Income tax expense Income tax payable Deferred income tax asset General Journal Debit Credit 114,750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education