ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

not use ai please

Transcribed Image Text:ts

6

rt 2 of 2

!

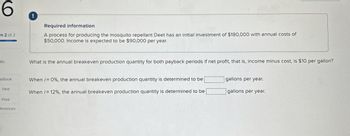

Required information

A process for producing the mosquito repellant Deet has an initial investment of $180,000 with annual costs of

$50,000. Income is expected to be $90,000 per year.

What is the annual breakeven production quantity for both payback periods if net profit, that is, income minus cost, is $10 per gallon?

eBook

When i=0%, the annual breakeven production quantity is determined to be

gallons per year.

Hint

When /= 12%, the annual breakeven production quantity is determined to be

gallons per year.

Print

ferences

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Required information A process for producing the mosquito repellant Deet has an initial investment of $175,000 with annual costs of $45,000. Income is expected to be $90,000 per year. What is the annual breakeven production quantity for both payback periods if net profit, that is, income minus cost, is $10 per gallon? (Consider the rounded values of years calculated in part a. Also, round your answer to the nearest integer.) When /= 0%, the annual breakeven production quantity is determined to be When i=12%, the annual breakeven production quantity is determined to be gallons per year. gallons per year.arrow_forwardChambers Company has just gathered estimates forconducting a break-even analysis for a new product.Variable costs are $7 a unit. The additional plant willcost $48,000. The new product will be charged $18,000a year for its share of general overhead. Advertisingexpenditures will be $80,000, and $55,000 will be spenton distribution. If the product sells for $12, what is thebreak even point in units? What is the break even pointin dollar sales volume?arrow_forwardRequired information A process for producing the mosquito repellant Deet has an initial investment of $170,000 with annual costs of $44,000. Income is expected to be $90,000 per year. What is the annual breakeven production quantity for both payback periods if net profit, that is, income minus cost, is $10 per gallon? (Consider the rounded values of years calculated in part a. Also, round your answer to the nearest integer.) When i= 0%, the annual breakeven production quantity is determined to be gallons per year. When i= 12%, the annual breakeven production quantity is determined to be gallons per year.arrow_forward

- The projected profit of a hi-tech recording disks retailer is Birr 200,000 for the current year based on sale volume of 200,000 units. The company has been selling the disks for $16 each; variable costs consist of the Birr 10 purchase price and Birr 2 handling cost. The retailer’s annual costs are Birr 600,000. Required: a. Calculate the breakeven point for the current year in units. b. What will be the company’s profit for the current year if there is a 10% increase in projected unit sales volume? c. Management is planning for the coming year when it expects that the unit purchase price of the disks will increase by 30%. What volume of dollar sales must the retailer achieve in the coming year to maintain the current year’s profit if the selling price remains constant at Birr 16arrow_forwardQ1. Calculate EOQ and plot a graph with the following information. Annual Usage= 1600 units Holding Cost $8 unit/yr Ordering Cost = $100 unit/yr > Price of per Unit= $50 Number of Units 1600 800 400 200 100 80 50 Number of Order 1 2 4 8 16 20 32arrow_forward2.7 A machine cost $315000 to purchase . Fuel , oil, grease and minor maintenance are estimated to cost $53.50 per operating hours. A set of tires cost $16000 to replace and their estimated life is 3100 user hours. A $ 17000 major repair will probably be required after 6200 hr of use. The machine is expected to lat for 9300 hr. after which it will be sold at a price (salvage value ) equal to 13% of the original prurchae price . A final the owner of the machine charger per hours of use, if it is expected that the machine will operated 3100 per year ? the compnay's cost -of -capital rate is 7.25%.arrow_forward

- An electronics firm is planning to manufacture a new handheld gaming device for the preteen market. The data have been estimated for the product. Assuming a negligible market (salvage) value for the equipment at the end of five years, determine the breakeven annual sales volume for this product.arrow_forwardOnly typed solutionarrow_forwardTrue/False AVC can fall even when MC is risingarrow_forward

- The wow great expert Hand written solution is not allowedarrow_forwardPls answer it manually and show a complete solutionarrow_forwardShow complete solutiion. Do not use excel. Manual Method. Steel drums manufacturer incurs a yearly operating cost of P 200,000. Each drum manufactured cost P 160 and sells for P 300. A machine use for the production has a first cost of P 20,000 and a salvage value of P 2,000 after producing 1,000 units. What is the break even number of units per year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education