Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

Engineering Econ HW2 Q3

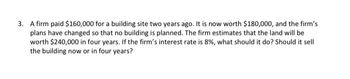

Transcribed Image Text:3. A firm paid $160,000 for a building site two years ago. It is now worth $180,000, and the firm's

plans have changed so that no building is planned. The firm estimates that the land will be

worth $240,000 in four years. If the firm's interest rate is 8%, what should it do? Should it sell

the building now or in four years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is a capital gain?arrow_forwardWhat does a share of stock represent?arrow_forwardEnergy entrepreneur T. Boone Pickens has proposed converting the trucking fleet in the United States to liquefied natural gas (LNG) and using wind power to replace the missing LNG in electric power production. What infrastructure issues do you see that must be resolved before the Pickens plan could be adopted?arrow_forward

- What is deflation?arrow_forwardImagine that a local water company issued 10,000 ten-year bond at an interest rate of 6. You are thinking about buying this bond one year before the end of the ten years, but interest rates are now 9. Given the change in interest rates, would you expect to pay more or less than 10,000 for the bond? Calculate what you would actually be willing to pay for this bond.arrow_forwardWhat is the total amount of interest from a 5,000 loan after three years with a simple interest rate of 6?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning