Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

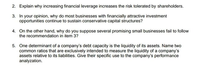

Transcribed Image Text:2. Explain why increasing financial leverage increases the risk tolerated by shareholders.

3. In your opinion, why do most businesses with financially attractive investment

opportunities continue to sustain conservative capital structures?

4. On the other hand, why do you suppose several promising small businesses fail to follow

the recommendation in item 3?

5. One determinant of a company's debt capacity is the liquidity of its assets. Name two

common ratios that are exclusively intended to measure the liquidity of a company's

assets relative to its liabilities. Give their specific use to the company's performance

analyzation.

Transcribed Image Text:True or False: Write T if the statement is true and accurate, otherwise indicate F if you think the

statement is false. Further justify your answer on each of the questions.

8

1. The free cash flow valuation model is based on the same principle as the P/E valuation

approach; that is, the value of a share of stock is the present value of future cash flows.

2. Preferred stock is a special form of stock having a fixed periodic dividend that must be

paid prior to payment of any interest to outstanding bonds.

3. A common stockholder has no guarantee of receiving any cash inflows but receives

what is left after all other claims on the firm's income and assets have been satisfied.

4. Investors purchase a stock when they believe that it is undervalued and sell when they

feel that it is overvalued.

5. In common stock valuation, any action taken by the financial manager that increases risk

will also increase the required return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If common stock is issued for an amount greater than par value, the excess goes to what account? a. Legal Capital b. Retained Earnings C. Cash d. Paid-in-Capital in Exess of Par Value A Moving to the next question prevents changes to this answer. & % #3 8.arrow_forwardSelling shares of stock for more than you originally paid is called modern portfolio theory. leverage. current income. capital gain.arrow_forwardAll stocks pay dividends, and therefore one can count on them having a dividend yield. OA. True OB. Falsearrow_forward

- D6) Finance How would you use cash flow discount method and comparable method (aka relative value method) to estimate the intrinsic value of these two stocks? Discuss the pros and cons of the two methods. Use Macy and Nordstorm company as an example.arrow_forward"The dividend discount model is used to find the price of a stock based on the expected dividends received by the shareholder and the discount rate. Therefore, all else constant, the price of a share of stock will increase if the discount rate decreases." A) True B) Falsearrow_forward1. Choose the best definition for a Stock? A. Being a creditor to a company B. Robin Hood C. Ownership shares of a company D. Voting shares in a company E. Ownership shares of a public company 2. When investing in stocks, there are two ways in which you can have a positive return. What are the components of this return called? A. Dividends and Capital Loss B. Robin Hood C. Coupon and Capital Gains D. Coupon and Capital Loss E. Dividends and Capital Gainsarrow_forward

- i need the answer quicklyarrow_forwardAccording to the basic Dividend Discount model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. Is the above statement True or False? Please Explain.arrow_forward1. How does the binomial model account of volatility in the stock?arrow_forward

- . The cash flow of a long stock and long put strategy is equal to the cash flow from a long call strategy. True or False can i also get some explantation please?arrow_forwardA share of stock is worth the present value of all the cash flows an investor in said share of stock expects to receive. Group of answer choices True Falsearrow_forward(please correct answer and question information)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education