Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

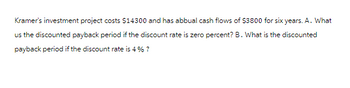

Transcribed Image Text:Kramer's investment project costs $14300 and has abbual cash flows of $3800 for six years. A. What

us the discounted payback period if the discount rate is zero percent? B. What is the discounted

payback period if the discount rate is 4 % ?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A project that provides annual cash flows of $16,900 for eight years costs $75,000 today. What is the NPV for the project if the required return is 7 percent? What is the NPV for the project if the required return is 19 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardA project that provides annual cash flows of $16,900 for eight years costs $75,000 today. What is the NPV for the project if the required return is 7 percent? What is the NPV for the project if the required return is 19 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardAn investment project costs $12,600 and has annual cash flows of $3,100 for six years Required: (a) What is the discounted payback period if the discount rate is zero percent? (Click to select) (b) What is the discounted payback period if the discount rate is 3 percent? (Click to select) (c) What is the discounted payback period if the discount rate is 20 percent? (Click to select) eBook & Resources eBook: 9.3. The Discounted Paybackarrow_forward

- A project that provides annual cash flows of $11322 for eight years costs $80145 today. At what discount rate would you be indifferent between accepting the project and rejecting it? (Enter your answer as a percentage, omit the "%" sign in your response, and round your answer to 2 decimal places. For example, 0.12345 or 12.345% should be entered as 12.35.)arrow_forwardWhat is the no arbitrage price of a risk-free investment that promises to pay $1,000 in one year? The risk-free interest rate is 3.5%. If you can purchase the investment for $950, do you have an arbitrage opportunity?arrow_forwardam. 144.arrow_forward

- Project K costs $30,000, its expected cash inflows are $8,000 per year for 8 years, and its WACC is 10%. What is the project's discounted payback? Round your answer to two decimal places. Project K costs $45,000, its expected cash inflows are $11,000 per year for 6 years, and its WACC is 11%. What is the project's payback? Round your answer to two decimal places.arrow_forwardProject A costs $5,300 and will generate annual after-tax net cash inflows of $1,900 for five years. What is the NPV using 5% as the discount rate? Round your present value factor to three decimal places and final answer to the nearest dollar. (Click here to see present value and future value tables) 2,928 xarrow_forwardAn investment project costs $15,600 and has annual cash flows of $3,900 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period b. What is the discounted payback period if the discount rate is 6 percent? Discounted payback periodarrow_forward

- 2. Match each of the following terms with the appropriate definition. The time expected to recover the cash initially invested in a project. A minimum acceptable rate of return on a potential investment. 1. Discounting A return on investment which results in a zero net present value. 2. Net Present Value A comparison of the cost of 3. Capital Budgeting an investment to its projected cash flows at a single point in time. 4. Accounting Rate of Return 5. Net Cash Flow A capital budgeting method focused on the rate of return on a project's average investment. 6. Internal Rate of Return 7. Payback Period The process of restating future cash flows in terms 8. Hurdle Rate of present time value. Cash inflows minus cash outflows for the period. A process of analyzing alternative long-term investments. >arrow_forwardAn investment project costs $13,200 and has annual cash flows of $3,600 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period 3.67 b. What is the discounted payback period if the discount rate is 5 percent? Discounted payback period 4.15arrow_forwardSuppose you considering investing $33 to earn $5.9 every year for 9 years. If the annual interest rate is 4.8%, what is the payback of this project? Suppose you considering investing $22 to earn $4.0 every year for 7 years. If the annual interest rate is 3.4%, what is the payback of this project?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education