Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

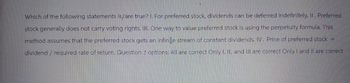

Transcribed Image Text:Which of the following statements is/are true? I. For preferred stock, dividends can be deferred indefinitely. II. Preferred

stock generally does not carry voting rights. III. One way to value preferred stock is using the perpetuity formula. This

method assumes that the preferred stock gets an infinite stream of constant dividends. IV. Price of preferred stock =

dividend / required rate of return. Question 2 options: All are correct Only I, II, and Ill are correct Only I and II are correct

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question 1 Share value, stock value and equity value are synonymous terms. options: True Falsearrow_forwardThe purpose of a lockup provision is to: Question 22 options: keep individual investors from buying and selling stock. prevent downward pressure on the stock's price. increase the number of outstanding shares. allocate a larger proportion of stock to institutional investors.arrow_forwardYou hold a portfolio of an asset-or-nothing call and a cash-or-nothing put option written on a stock that does not pay dividends. The strike price of the options is the same. The payout of the cash-or- nothing option if it is exercised equals the strike price. Your portfolio is equivalent to O A plain-vanilla call option. O None of the other answers are correct. O A covered call position, i.e., a long stock + short plain vanilla call. O A plain-vanilla put option. O A protective put position, i.e., a long stock + long put option.arrow_forward

- Give typing answer with explanation and conclusion Preferred equity is stock with dividend __ over __ stock, normally with a __ dividend rate, and sometimes __ voting rights. Word bank: common without priority with insignificance variable fixed regulararrow_forward[S1] If an individual stock's beta is higher than 1, that stock is riskier than the market. [S2] In determining the estimated cost of equity, the CAPM explicitly recognizes a firm’s risk but it does not rely on any dividend assumptions or growth of dividends.a. both are trueb. both are falsec. S1 is trued. S2 is truearrow_forwardA stock price is currently $23. A butterfly spread (ie. options are bought with strike prices of K₁ and K3, and two options with the middle strike price K₂ are sold) is created from call options with strike prices of $20, $25, and $30. Which of the following is TRUE? Select one alternative: O It is incorrect to assume that there is always a gain when the stock price is greater than $30 or less than $20. O The loss when the stock price is greater than $30 is the same as the loss when the stock price is less than $20. The gain when the stock price is greater than $30 is greater than the gain when the stock price is less than $20. O The gain when the stock price is greater than $30 is less than the gain when the stock price is less than $20.arrow_forward

- When we compute the diluted earnings per share, under the treasury stock method for stock options, if the exercise price of the options exceeds the average market price, then: (Enter 1, 2, 3, or 4 that represents the correct answer.) we present both diluted earnings per share and basic earnings per share. we present only diluted earnings per share, but not basic earnings per share. the number of shares assumed issued will be greater than the number of shares assumed reacquired. the number of shares assumed issued will be smaller than the number of shares assumed reacquired.arrow_forwardWhich of the following is true? None of the others A call on a stock plus a stock the same as a put A long call is the same as a short put A short call is the same as a long putarrow_forwardA stock currently trades at $100. Consider a put and a call option written on this stock with strike price $105. Which of the following statements is most accurate? A.The call option is in-the-money and the put option is out-of-the-money B.The call option is out-of-the-money and the put option is in-the-money C.Both options are in-the-money D.Cannot determine without further informationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education