FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

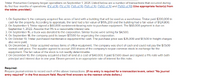

Transcribed Image Text:Tristar Production Company began operatlons on September 1, 2021. Listed below are a number of transactions that occurred during

its first four months of operations. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from

the tables provided.)

1. On September 1, the company acquired five acres of land with a building that will be used as a warehouse. Tristar paid $300,000 in

cash for the property. According to appraisals, the land had a fair value of $195,200 and the building had a fair value of $124,800.

2. On September 1, Tristar signed a $60,000 noninterest-bearing note to purchase equipment. The $60,000 payment is due on

September 1, 2022. Assume that 9% is a reasonable interest rate.

3. On September 15, a truck was donated to the corporation. Slmllar trucks were sellng for $4,500.

4. On September 18, the company paid its lawyer $7,500 for organizing the corporation.

5. On October 10, Tristar purchased maintenance equipment for cash. The purchase price was $35,000 and $1,500 in freight charges

also were paid.

6. On December 2. Tristar acquired various items of office equipment. The company was short of cash and could not pay the $7,500

normal cash price. The supplier agreed to accept 200 shares of the company's no-par common stock in exchange for the

equipment. The fair value of the stock is not readily determinable.

7. On December 10, the company acqulred a tract of land at a cost of $40.000. It pald $7,500 down and signed a 11% note with both

principal and interest due in one year. Eleven percent is an appropriate rate of interest for this note.

Required:

Prepare journal entries to record each of the above transactions. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field. Round final answers to the nearest whole dollars.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Concord Landscaping began construction of a new plant on December 1, 2025. On this date, the company purchased a parcel of land for $125,100 in cash. In addition, it paid $1.800 in surveying costs and $3,600 for a title insurance policy. An old dwelling on the premises was demolished at a cost of $2,700, with $900 being received from the sale of materials. Architectural plans were also formalized on December 1, 2025, when the architect was paid $30,000. The necessary building permits costing $2,700 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2026 as follows. Date of Payment Amount of Payment March 1 May 1 July 1 $216.000 297,000 54,000 The building was completed on July 1, 2026. To finance construction of this plant, Concord borrowed $540,000 from the bank on December 1, 2025. Concord had no other borrowings. The $540,000 was a 10-year loan bearing interest at 8%.…arrow_forwardWiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following balances: Equipment Accumulated Depreciation (beginning of the year) $ 344,000 212,000 During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: Routine maintenance and repairs on the equipment Major overhaul of the equipment that improved efficiency $ 3,550 41,000 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $26,000 estimated residual value. The annual accounting period ends on December 31. Required: - Indicate the effects (accounts, amounts, and + for increase and – for decrease) of the following two items on the accounting equation, using the headings shown below. (Enter any decreases to Assets, Liabilities or Stockholder's Equity with a minus sign.) 1. The adjustment for depreciation made last year at the end of 2020. 2. The two expenditures…arrow_forwardPlease explain how to the methods below and only answer if you completely answer the question. Perdue Company purchased equipment on April 1 for $43,470. The equipment was expected to have a useful life of three years, or 7,020 operating hours, and a residual value of $1,350. The equipment was used for 1,300 hours during Year 1, 2,500 hours in Year 2, 2,100 hours in Year 3, and 1,120 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method.arrow_forward

- Ashvinbhaiarrow_forwardSwifty Company was organized on January 1. During the first year of operations, the followingplant asset expenditures and receipts were recorded in random order.Debit1. Cost of filling and grading the land $ 3,5002. Full payment to building contractor 691,5003. Real estate taxes paid for the current year on land 4,5004. Cost of real estate purchased as a plant site (land $118,000 and building$44,000)162,0005. Excavation costs for new building 31,0006. Architect’s fees on building plans 12,0007. Accrued real estate taxes paid at time of purchase of land 1,0008. Cost of parking lots and driveways 15,0009. Cost of demolishing building to make land suitable for construction ofnew building25,500$946,000Credit10. Proceeds from salvage of demolished building $ 3,500Analyze the transactions using the following table column headings. Enter the amounts in theappropriate columns. (If an amount reducesthe account balance then enter with a negative signpreceding the number, e.g. -15,000 or…arrow_forwardChampion Contractors completed the following transactions Involving equipment. Year 1 January 1 Paid $287,600 cash plus $11,500 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $20,600 salvage value. Loader costs are recorded in the Equipment account. January 3 Paid $4,800 to install air-conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,400. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $5,400 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $820 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. View transaction list Journal entry…arrow_forward

- Oriole Construction Company began operations on January 1, 2025. During the year, Oriole Construction entered into a contract with Winds Corp. to construct a manufacturing facility. At that time, Oriole estimated that it would take 5 years to complete the facility at a total cost of $4.484,000. The total contract price for construction of the facility is $5,972,000. During the year, Oriole incurred $1,082,400 in construction costs related to the construction project. The estimated cost to complete the contract is $4,329,600. Winds Corp. was billed and paid 25% of the contract price. (a) Prepare schedules to compute the amount of gross profit to be recognized for the year ended December 31, 2025, and the amount to be shown as "costs and recognized profit in excess of billings" or "billings in excess of costs and recognized profit" at December 31, 2025, under each of the following methods. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses…arrow_forwardA company began constructing a new warehouse for its operations during the current year. In the year the company incurred interest of $20,000 on a working capital loan, and interest on a construction loan for the warehouse of $80,000. Interest computed on the average accumulated expenditures for the warehouse construction was $40,000. What amount of interest should be expensed for the year?arrow_forwardOn May 4, Year 1, Steger Company purchased a tract of land as a factory site for $1,630,000. An existing building on the property was demolished, and construction was begun on a new factory building in July Year 1 and completed December 15, Year 1. Cost data are shown below. Construction cost of new building Cost of demolishing old building Proceeds from sale of lumber from old building Architect's fees relating to construction of new building Title insurance and attorney's fee for purchase of land Required: Compute the capitalized cost of (1) the land and (2) the new factory building. Land 2. New factory building $7,590,000 139,000 22,900 229,000 83,300arrow_forward

- Valaarrow_forwardWiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following balances: Equipment Accumulated Depreciation (beginning of the year) During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: Routine maintenance and repairs on the equipment $ 3,350 39,000 Major overhaul of the equipment that improved efficiency $ 331,000 229,500 The equipment is being depreciated on a straight-line basis over an estimated life of 20 years with a $25,000 estimated residual value. The annual accounting period ends on December 31. Required: Indicate the effects (accounts, amounts, and + for increase and - for decrease) of the following two items on the accounting equation, using the headings shown below. (Enter any decreases to Assets, Liabilities or Stockholder's Equity with a minus sign.) 1. The adjustment for depreciation made last year at the end of 2020. 2. The two expenditures for…arrow_forwardBuildit Corp. was contracted to construct a building for $2,440,000. The contract provided for progress payments. Buildit's accounting year ends 31 December. Work began under the contract on 1 March 20X3, and was completed on 30 November 20X5. Construction activities are summarized below by year: 20x3 20x4 20X5 Construction coats incurred during the year, $610,000; estimated costs to complete, $1,110,000; progress billings during the year, $520,000; and collections, $430,000. Construction costs incurred during the year, $980,000; estimated costs to complete, $350,000; progress billing during the year, $1,690,000; and collections, $1,430,000. Construction costs incurred during the year, $330,000. Because the contract was completed, the remaining balance was billed and later collected in full per the contract. Required: 1. Prepare Buildit's journal entries to record these events. Assume that percentage of completion is measured by the ratio of costs incurred to date divided by total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education