FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

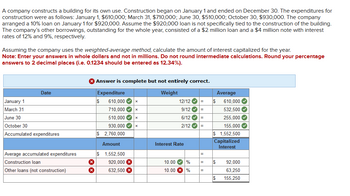

Transcribed Image Text:A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for

construction were as follows: January 1, $610,000; March 31, $710,000; June 30, $510,000; October 30, $930,000. The company

arranged a 10% loan on January 1 for $920,000. Assume the $920,000 loan is not specifically tied to the construction of the building.

The company's other borrowings, outstanding for the whole year, consisted of a $2 million loan and a $4 million note with interest

rates of 12% and 9%, respectively.

Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year.

Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage

answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%).

* Answer is complete but not entirely correct.

Date

January 1

March 31

June 30

October 30

Accumulated expenditures

Average accumulated expenditures

Construction loan

Other loans (not construction)

$

Expenditure

610,000

710,000

Weight

Average

12/12

$

610,000

x

9/12

=

532,500

510,000

x

6/12 =

255,000

930,000

2/12

|=

155,000

$ 2,760,000

$ 1,552,500

Capitalized

Amount

Interest Rate

Interest

$ 1,552,500

|=

920,000 ×

10.00

%

=

$

92,000

632,500 x

10.00

%

=

63,250

$

155,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dhapaarrow_forwardA company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $700,000; March 31, $800,000; June 30, $600,000; October 30, $1,200,000. The company arranged a 8% loan on January 1 for $1,100,000. Assume the $1,100,000 loan is not specifically tied to the construction of the building. The company's other borrowings, outstanding for the whole year, consisted of a $7 million loan and a $9 million note with interest rates of 10% and 6%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%). Date January 1 March 31 June 30 October 30 Expenditure Weight Average Accumulated expenditures S 0 S 0 Amount Interest Rate…arrow_forwardSagararrow_forward

- A construction company entered into a fixed-price contract to build an office building for $18 million. Construction costs incurred during the first year were $6 million, and estimated costs to complete at the end of the year were $9 million. The company recognizes revenue over time according to percentage of completion. During the first year the company billed its customer $6 million, of which $3 million was collected before year-end. What would appear in the year-end balance sheet related to this contract? Note: Enter your answers in whole dollars and not in millions (i.e., $4 million should be entered as $4,000,000). Balance Sheet (Partial) Assets:arrow_forwardA company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $590,000; March 31, $690,000; June 30, $490,000; October 30, $870,000. The company arranged a 8% loan on January 1 for $880,000. Assume the $880,000 loan is not specifically tied to the construction of the building. The company's other borrowings, outstanding for the whole year, consisted of a $4 million loan and a $6 million note with interest rates of 12% and 7%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%). Date January 1 Expenditure Weight Average $ 590,000 x 12/12 = $ 590,000 March 31 690,000 x 9/12 = 517,500 June 30 490,000 x 6/12 = 245,000…arrow_forwardBonita Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $3,960,000 on March 1, $2,640,000 on June 1, and $6,600,000 on December 31. Bonita Company borrowed $2,200,000 on March 1 on a 5-year, 10% note to help finance construction of the building. In addition, the company had outstanding all year a 12%, 5-year, $4,400,000 note payable and an 11%, 4-year, $7,700,000 note payable. Compute avoidable interest for Bonita Company. Use the weighted-average interest rate for interest capitalization purposes. (Round "Weighted-average interest rate" to 4 decimal places, e.g. 0.2152 and final answer to O decimal places, eg. 5,275.) Avoidable interest %24arrow_forward

- Munabhaiarrow_forwardDominion construction is awarded a contract to build a commercial building. The contract price is $1,500,000 and during the first month of the job, the following transactions occurred: Cash expenditures to date $300,000 Total expenditures to date $350,000 Estimated expenditure to complete $1,100,000 Total estimated expenditures $1,450,000 Billing to date $280,000 Cash collected to date $250,000 What is "Revenue to Date" in Cash Method? 350000 280000 250000 300000arrow_forwardMSK Construction Company contracted to construct a factory building for $525,000. Construction started during 20X1 and was completed in 20X2. Information relating to the contract follows: 20X1 20X2 Costs incurred during the year $ 290,000 $ 150,000 Estimated additional cost to complete 145,000 — Billings during the year 260,000 265,000 Cash collections during the year 240,000 285,000 Required: Record the preceding transactions in MSK’s books assuming it recognizes revenue over time and uses costs incurred to measure the extent to which its performance obligation has been satisfied. Record the preceding transactions in MSK’s books assuming it recognizes revenue at a point in time when control of the completed factory is transferred to the customer at the end of the project. Question: Prepare the entry to record revenue, expense, and completion of the project.arrow_forward

- A company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $590,000; March 31, $690,000, June 30, $490,000; October 30, $870,000. The company arranged a 8% loan on January 1 for $880,000. Assume the $880,000 loan is not specifically tied to the construction of the building. The company's other borrowings, outstanding for the whole year, consisted of a $4 million loan and a $6 million note with interest rates of 12% and 7%, respectively. Assuming the company uses the weighted-average method, calculate the amount of interest capitalized for the year. A company constructs a building for its own use. Construction began on January 1 and ended on December The expenditures for construction were as follows: January 1, $590,000; March 31, $690,000; June 30, $490,000; October 30, $870,0 00. The company arranged a 8% loan on January 1 for $880,000. Assume the $880,000 loan is not…arrow_forwardOn March 1, Gatt Co began construction of a small building. The following expenditures were incurred for construction: March 1: $75,000 April 1: $74,000 May 1: $180,000 June 1: $270,000 July 1: $100,000 The building was completed and occupied on July 1. To help pay for the construction, $50,000 was borrowed on March 1 on a 12%, three year note payable. The only other debt outstanding during the year was a $500,000, 10% note issued two years ago. 1. Calculate the weighted-average accumulated expenditures Use commas, but do not use $ signs or cents. Question 11 Calcualte the actual interest cost incurred during the year. 4 ptsarrow_forwardPlease walk me through problem.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education