FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

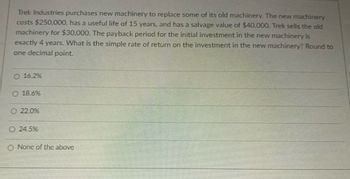

Transcribed Image Text:Trek Industries purchases new machinery to replace some of its old machinery. The new machinery

costs $250,000, has a useful life of 15 years, and has a salvage value of $40,000. Trek sells the old

machinery for $30,000. The payback period for the initial investment in the new machinery is

exactly 4 years. What is the simple rate of return on the investment in the new machinery? Round to

one decimal point.

O 16.2%

O 18.6%

22.0%

Ⓒ 24.5%

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- K Company has purchased a new machine costing $27,000 and the machine is expected to reduce the operating expenses by $7,000 every year. The useful life of machine is 5 years and the machine is expected to have a zero-scrap! value at the end of its useful life. The company's required rate of return is 12%. Calculate the Net Present Value (NPV) of the machine. (Round intermediate calculations to 3 decimal places and final answer to the nearest dollar.)arrow_forwardGodoarrow_forwardNonearrow_forward

- With the estimates shown below, Sarah needs to determine the trade-in (replacement) value of machine X that will render its AW equal to that of machine Y at an interest rate of 8% per year. Determine the replacement value. Machine X Machine Y 90,000 Market Value, S -40,000 for year 1,increasing by 2000 per year thereafter. 24,000 Annual Cost, $ per Year -59,500 Salvage Value Life, Years 19,500 The replacement value is $arrow_forwardMjarrow_forwardVaughn Excavating Inc. is purchasing a bulldozer. The equipment has a price of $97,600. The manufacturer has offered a payment plan that would allow Vaughn to make 10 equal annual payments of $15.883.95, with the first payment due one year after the purchase. x Your answer is incorrect. How much total interest will Vaughn pay on this payment plan? (Round factor values to 5 decimal places, eg 1.25124 and final answer to 0 decimal places, eg. 458.5811 Total interest 501877 Your answer is partially correct. Vaughncould borrow $97,600 from its bank to finance the purchase at an annual rate of 9% Click here to view factor tables Should Vaughn borrow from the bank or use the manufacturer's payment plan to pay for the equipment? (Round factor values to decimal places, s 1.25124 and final answer to O decimal places, eg 7%) 15.00 % Manufacturer's rate from the Daarrow_forward

- Help question 17arrow_forwardBelmont Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income after tax of $290,000. The equipment will have an initial cost of $1,000,000 and have an 8 year life. If there is no salvage value of the equipment, what is the accounting rate of return? Multiple Choice 21.5% 29.0% 58.0% 24.0%arrow_forwardEsc You consider purchasing a new piece of equipment (7yr MACRS property) for your manufacturing process for $120,000. The equipment has a 6-year useful life and no salvage value. The equipment is expected to generate an additional $40,000 of net income before taxes and depreciation each year by using this upgraded system. The combined federal and state income tax rate= 35%. Annual inflation = 4%. a. Fill in the following table assuming MACRS depreciation rates Year 46°F Rain showers 0 1 F1 2 O 2 3 4 5 Pretax income 6 MACRS Taxable Depreciation income F2 - F3 + F4 Ⓡ b. If your MARR = 12%, should you purchase this system based on your real after-tax income? Why or why not? F5 8 C B Tax owed F6 Q Search G After tax income F7 Ca 7 F8 O Inflation adjustment factor O F9 ala LG F10 Real after tax income 0 A I THE F11 - 0 1 asod F12 + Prt Sc ScrLk Post-it sod Ins Post-it Del Backspace Post-it PgUp Home asod> Post-it Mumi 1-10 PgOn End Pause Break 11-15 11-15 Carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education