Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

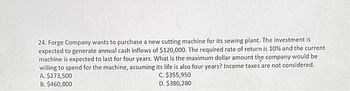

Transcribed Image Text:24. Forge Company wants to purchase a new cutting machine for its sewing plant. The investment is

expected to generate annual cash inflows of $120,000. The required rate of return is 10% and the current

machine is expected to last for four years. What is the maximum dollar amount the company would be

willing to spend for the machine, assuming its life is also four years? Income taxes are not considered.

A. $273,500

C. $355,950

D. $380,280

B. $460,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 18arrow_forwardWhat will be the annual cash outflows for Mimi Inc. if it leased a milling machine for $8, 200 per year for 5 years. Assume that the new machine cost $ 42,000 and will depreciate on a straight line basis over the 5 years and that Mimi has a tax rate of 32 percent. Question 15Select one: a. - $5,576 b. $42,000 C. -$8,264 d. $33,800 e. - $2,688arrow_forward6. A drill press costs $30,000 and is expected to have a 10 year life. The drill press will be depreciated on a straight-line basis over 10 years to a zero estimated salvage value. This machine is expected to reduce the firm's cash operating costs by $4,500 per year. If the firm is in the 40 percent marginal tax bracket, determine the annual net cash flows generated by the drill press.arrow_forward

- Nonearrow_forwardFULL QUESTION: Kinky Copies may buy a high-volume copier. The machine costs $100,000 and this cost can be fully depreciated immediately. Kinky anticipates that the machine actually can be sold in 5 years for $30,000. The machine will save $20,000 a year in labor costs but will require an increase in working capital, mainly paper supplies, of $10,000. The firm’s marginal tax rate is 21%, and the discount rate is 8%. (Assume the net working capital will be recovered at the end of Year 5.) What is the NPV of this project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardA company must purchase a new machine to increase production. The machine will cost $50,000 to purchase. The following are the remaining cash flows of the machine and its probabilities. The machine is supposed to be used for 6 years and the MARR is 10%. Annual Cost Annual Revenue Calculate the Present Worth. Probability .2 .6 .2 .6 .4 Outcome $3,000 $4,500 $5,500 $35,000 $40,000arrow_forward

- NPV. Grady Precision Measurement Tools has forecasted the following sales and costs for a new GPS system: annual sales of 45,000 units at $16 a unit, production costs at 37% of sales price, annual fixed costs for production at $200,000. The company tax rate is 38%. What is the annual operating cash flow of the new GPS system? Should Grady Precision Measurement Tools add the GPS system to its set of products? The initial investment is $1,320,000 for manufacturing equipment, which will be depreciated over six years (straight line) and will be sold at the end of five years for $380,000. The cost of capital is 12%. What is the annual operating cash flow of the new GPS system? $ (Round to the nearest dollar.)arrow_forwardA 150.arrow_forward1arrow_forward

- 11. I need help with finance home work question A company is considering a 7-year project. At the beginning of the project, a cash outflow in the amount of $340,000 would be required. The company expects the project would generate cash inflows in the amount of $70,000 at the end of each of the project's 7 years. Assume the company requires a return of 8%. What NPV does the company expect for this project?arrow_forward6b) Kalvino Inc. has a new five-year project that produces high-end raincoats. The initial investment equals $85,000. The estimated selling price equals $102 per unit and variable costs equal $80 per unit. Fixed costs equal $29,000. Investors do require a 15% return. Calculate the cash break-even quantity? Interpret your answer. Calculate the accounting break-even quantity? Interpret your answer. Calculate the financial break-even quantity? Interpret your answer. What is the degree of operating leverage for this project? Assuming that sales are estimated at $249,900.arrow_forwardWHAT IS ECONOMIC LIFE OF ASSET?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education