FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

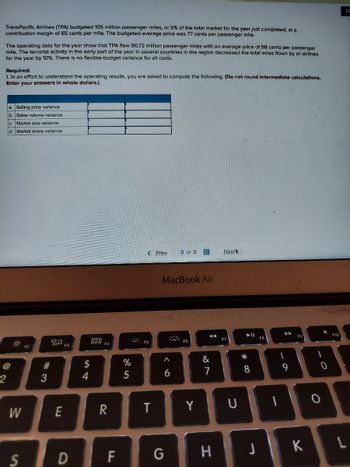

Transcribed Image Text:TransPacific Airlines (TPA) budgeted 105 million passenger miles, or 5% of the total market for the year just completed, at a

contribution margin of 65 cents per mile. The budgeted average price was 77 cents per passenger mile.

The operating data for the year show that TPA flew 90.72 million passenger miles with an average price of 58 cents per passenger

mile. The terrorist activity in the early part of the year in several countries in the region decreased the total miles flown by all airlines

for the year by 10%. There is no flexible-budget variance for all costs.

Required:

1. In an effort to understand the operating results, you are asked to compute the following. (Do not round Intermediate calculations.

Enter your answers in whole dollars.)

a. Selling price variance

b. Sales volume variance

c. Market size variance

d. Market share variance

W

S

F2

43

20

#

E

F3

D

54

000

000 F4

R

70

F

%

5

< Prev

T

MacBook Air

^

6

3 of 3

G

F6

Y

&

H

Next

U

► 11

*

8

-

A

K

1

0

0

F10

CH

L

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Speedjet Aircraft Corporation has a central materials laboratory. The laboratory has only two users, the Large Plane Department and the Small Plane Department. The following data apply to the coming budget year: Budgeted costs of operating the materials laboratory for 100,000 to 200,000 technician hours per year: Fixed costs per year $8,200,000 Variable costs Budgeted long-run usage in hours per year: Large Plane Department Small Plane Department $74 per technician hour 90,000 technician hours 110,000 technician hoursarrow_forwardMunabhaiarrow_forwardWilson Blossom is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows. Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: (a1) Direct materials $55.00 Direct labor 19.00 Manufacturing overhead 16.00 Selling and administrative 14.00 Total unit cost $104.00 The company's budget includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses. (a2) Your answer is partially correct. Your answer is correct. Calculate variable overhead per unit and variable selling and…arrow_forward

- Electro Company manufactures transmissions for electric cars. Management reports ending finished goods inventory for the first quarter at 124,800 units. The following unit sales are budgeted during the rest of the year: second quarter, 312,000 units; third quarter, 328,000 units; and fourth quarter, 371,000 units. Company policy calls for the ending finished goods inventory of a quarter to equal 40% of the next quarter's budgeted unit sales. Prepare a production budget for both the second and third quarters that shows the number of transmissions to manufacture. ELECTRO COMPANY Production Budget Next period budgeted sales units Desired ending inventory units Total required units Units to produce Second Quarter Third Quarterarrow_forwardElectro Company manufactures transmissions for electric cars. Management reports ending finished goods inventory for the first quarter at 72,600 units. The following unit sales are budgeted during the rest of the year: second quarter, 242,000 units; third quarter, 206,000 units; and fourth quarter, 431,000 units. Company policy calls for the ending finished goods inventory of a quarter to equal 30% of the next quarter's budgeted unit sales. Prepare a production budget for both the second and third quarters that shows the number of transmissions to manufacture. ELECTRO COMPANYProduction Budget Second Quarter / Third Quarter Next period budgeted sales units / Desired ending inventory units / Total required units…arrow_forwardThe management of Furrow Corporation is considering dropping product L07E. Data from the company’s budget for the upcoming year appear below: Sales $ 980,000 Variable expenses $ 383,000 Fixed manufacturing expenses $ 365,000 Fixed selling and administrative expenses $ 245,000 In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $223,000 of the fixed manufacturing expenses and $184,000 of the fixed selling and administrative expenses are avoidable if product L07E is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be: Multiple Choice $(13,000) $13,000 $(190,000) $190,000arrow_forward

- Variance During the winter months, the New York City department of Social Services purchases blankets for use at shelters throughout the city. In previous years, the department had purchased blankets for 15 different shelters at a price of $7.50 per blanket, expecting that each shelter would use 14 new blankets. The department budgeted a similar amount this year; however, at the end of the year they discovered that they had spent more on blankets than anticipated. They had actually spent $1,989, purchased 234 blankets, and provided blankets to 18 shelters. Fill in the following blanks: [Note: Be sure to indicate unfavorable variances with a negative sign, e.g. -54.67. Do not use parentheses. Round your numbers to TWO decimal places, e.g. 54.12.] A) The volume variance is $ _________________ B) The quantity variance is $ _________________ C) The price variance is $ ____________________ D) Of the three variances you calculated, which one contributed the most to the total variance? 1.…arrow_forwardDogarrow_forwardCybernet Systems is a start-up company that makes connectors for high-speed Internet connections. The company has budgeted variable costs of $130 for each connector and fixed costs of $5,500 per month. Cybernet’s static budget predicted production and sales of 100 connectors in August, but the company’s actually produced and sold only 70 connectors at a total cost of $20,000. Cybernet's total flexible budget cost for 70 connectors per month isarrow_forward

- NUBD Co. budgeted sales of 400,000 calculators at P40 for 2021. Variable manufacturing costs were budgeted at P16 per unit, and fixed manufacturing costs at P10 per unit. A special order offering to buy 40,000 calculators for P23 each was received by NUBD Co. in October 2021. NUBD Co. has sufficient plant capacity to manufacture the additional quantity; however, the production would have to be done on an overtime basis at an estimated additional cost of P3 per calculator. Acceptance of the special order will not affect NUBD’s normal sales and no selling expenses would be incurred. What would be the effect on operating profit (loss) if the special order were accepted?arrow_forwardLadle Corporation uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 81,000 units next year, the unit product cost of a particular product is $45.30. The company's selling and administrative expenses for this product are budgeted to be $1,898,000 in total for the year. The company has invested $262,000 in this product and expects a return on investment of 14%. The markup on absorption cost for this product would be: a. 14% b. 52.7% c. 51.7% d. 65.7%arrow_forwardMultiple Choice Gallonte Inc. began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 20% are collected in the month of sale; 70% are collected in the First month after sale; and 10% are collected in the second month after sale. If sales for April, May, and June were $80,000, $140,000, and $130,000, respectively, what were the firm's budgeted collections for the quarter? $201,000. $220,000. $232,000. $292,000. Help None of the answers is correct. Save & EXIL SUBarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education