Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting

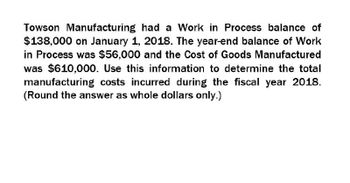

Transcribed Image Text:Towson Manufacturing had a Work in Process balance of

$138,000 on January 1, 2018. The year-end balance of Work

in Process was $56,000 and the Cost of Goods Manufactured

was $610,000. Use this information to determine the total

manufacturing costs incurred during the fiscal year 2018.

(Round the answer as whole dollars only.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardBaltimore Manufacturing had a Work in Process balance of $64,000 on January 1, 2018. The year-end balance of Work in Process was $51,000 and the Cost of Goods Manufactured was $500,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2018.arrow_forwardGive me answerarrow_forward

- Need answerarrow_forwardProvide correct answerarrow_forwardKansas Plating Company reported a cost of goods manufactured of P260,000, with the firm's year-end balance sheet revealing work in process and finished goods of P35,000 and P67,000, respectively. If supplemental information disclosed raw materials used in production of P40,000, direct labor of P70,000, and manufacturing overhead of P120,000, 1) how much was the total production cost incurred during the period? 2) how much was the company's beginning work in process? Case B For the year just ended, Cole Corporation's manufacturing costs (raw materials used, direct labor, and manufacturing overhead) totaled P1,500,000. Beginning and ending work-in-process inventories were P60,000 and P90,000, respectively. Cole's balance sheet also revealed respective beginning and ending finished-goods inventories of P250,000 and P180,000. On the basis of this information, 3) how much would the company report as cost of goods manufactured (CGM)?, and 4) cost of goods sold (CGS)? Case C For each of…arrow_forward

- The following data summarizes in part the results of operations for 2021 of Diamond Company. Of the total cost of goods manufactured for 2021, 38% was for materials used, 30% for direct labor, and 32% for manufacturing overhead. During 2021, the company paid 90% of the materials purchased, leaving P293,000 of unpaid invoices for materials at year end.The company commenced 2021 operations with materials inventory of P421,000. All materials were purchased FOB company’s plant. The company disbursed P2,101,500 for direct labor during 2021. As of December 31, 2021, the accrued liability for direct labor amounted to P144,000, which was twice as much as last year’s accrual. The inventory of finished goods on December 31, 2021, was 10% of the cost of the units finished during the year, and goods in process on that date were one-half the finished goods inventory. This year’s finished goods inventory was 150% of last year. There are no in process last year. The manufacturing overhead, except for…arrow_forwardThe following data summarizes in part the results of operations for 2021 of Place Company. Of the total cost of goods manufactured for 2021, 38% was for materials used, 30% for direct labor, and 32% for manufacturing overhead. During 2021, the company paid 90% of the materials purchased, leaving P293,000 of unpaid invoices for materials at year end. The company commenced 2021 operations with materials inventory of P421,000. All materials were purchased FOB company's plant. The company disbursed P2,101,500 for direct labor during 2021. As of December 31, 2021, the accrued liability for direct labor amounted to P144,000, which was twice as much as last year's accrual. The inventory of finished goods on December 31, 2021, was 10% of the cost of the units finished during the year, and goods in process on that date were one-half the finished goods inventory. This year's finished goods inventory was 150% of last year. There are no in process last year. The manufacturing overhead, except for…arrow_forwardThe Genesis Corporation has the following account balances (in millions): Prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended December 31, 2013.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning