FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

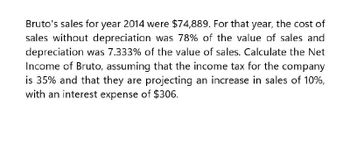

Transcribed Image Text:Bruto's sales for year 2014 were $74,889. For that year, the cost of

sales without depreciation was 78% of the value of sales and

depreciation was 7.333% of the value of sales. Calculate the Net

Income of Bruto, assuming that the income tax for the company

is 35% and that they are projecting an increase in sales of 10%,

with an interest expense of $306.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Fusion Energy Co’s earnings before interest and taxes (EBIT) was $275 million. Assuming Fusion Energy’s tax rate is 25%, what is their net operating profit after taxes (NOPAT) for 2015 expressed in millions of dollarsarrow_forwardMBI Incorporated had sales of $35 million for fiscal 2022. The company's gross profit ratio for that year was 26%. Required: a. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. b. Assume that a new product is developed and that it will cost $469 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. c. From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price. Complete this question by entering your answers in the tabs below. Required A Required B Required C From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price.arrow_forwardC Company has the following data for the year ending 12/31/2020 (dollars are in thousands): Net income = $600; EBIT = $1,184; Total assets = $3,000; Short-term investments = $200; Total capital employed = $2,193; and tax rate = 30%. The company’s WACC is 11.07%. What was its Economic Value Added (EVA) for the year 2020? Round your answer to the nearest dollar. Group of answer choices: $583 $586 $577 $572 $580arrow_forward

- Global Corp. expects sales to grow by 7% next year. Using the percent of sales method and the data provided in the given tables LOADING... , forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 26%.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Income Statement Net Sales 185.3Costs Except Depreciation -175.4EBITDA 9.9Depreciation and Amortization -1.2EBIT 8.7Interest Income (expense) -7.7Pretax Income 1Taxes (26%) -0.3Net Income 0.7 Balance Sheet Assets Cash 23.4Accounts…arrow_forwardMedium Manufacturers, Inc. (MMI) has the following items on its Income Statement for last year: Sales of $459,500, Cost of Goods Sold of $325,789, Cash Operating Expenses of $45,795, Depreciation Expense of $33,595, Interest Expense of $8,796, and a Marginal Tax Rate of 25%. Medium Manufacturers, Inc. (MMI) has the following items on its Balance Sheet for last year: Cash of $16,495, Accounts Receivable of $49,786, Inventory of $54,997, Short Term Investments of $85,039, Gross Fixed Assets of $429,750, Accumulated Depreciation of $95,847, Accounts Payable of $39,875, Accrued Expenses of $5,496, Short Term Notes Payable of $17,950, Long Term Debt of $105,345, Common Stock of $75,678 with a $1 Par Value, Additional Paid in Capital of $95,876, and Retained Earnings of $200,000. MMI paid Cash Dividends last year of $10,243. 9) What was MMI’s Beginning of Year Retained Earnings Balance last year to the nearest cent?arrow_forwardFor the past year, Momsen, Ltd., had sales of $44,042, interest expense of $2,918, cost of goods sold of $14,559, selling and administrative expense of $10,626, and depreciation of $4,675. If the tax rate was 35 percent, what was the company's net income?arrow_forward

- For the past year, shame ltd., had sales of $45,002, interest expense of $4,306, cost of goods sold of $18,349, selling and administrative expense of $12,146, and depreciation of $6,995. If the tax rate was 33 percent, what was the company's net income?arrow_forwardForaker Inc. has sales of $52,900, costs of $35,443, depreciation expense of $3,480, and interest expense of $2,105. If the tax rate is 21%, the operating cash flow (OCF) is:arrow_forwardStackhouse Industries had the following operating results for 2020: sales = $54,510; cost of goods sold = $37,430; depreciation expense = $5,830; interest expense = $1,325; dividends paid = $2,820. At the beginning of the year, net fixed assets were $33,200, current assets were $8,300, and current liabilities were $5,553. At the end of the year, net fixed assets were $42,820, current assets were $9,395, and current liabilities were $5,870. The tax rate was 24 percent. a. What was net income for 2020? (Do not round intermediate calculations.) b. What was the operating cash flow for 2020? (Do not round intermediate calculations.) c. What was the cash flow from assets for 2020? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) d-1. If no new debt was issued during the year, what was the cash flow to creditors? (Do not round intermediate calculations.) d-2. If no new debt was issued during the year, what was the cash flow to…arrow_forward

- Crane reported the following information for its fiscal year end: On net sales of $ 53.000 billion, the company earned net income after taxes of $ 7.155 billion. It had a cost of goods sold of $ 21.465 billion and EBIT of $ 9.275 billion. What are the company’s gross profit margin, operating profit margin, and net profit margin? (Round answers to 1 decimal place, e.g.12.5%.) Gross profit margin % Operating profit margin % Net profit margin %arrow_forwardNeed detailed help with the proforma income statementarrow_forwardLocal Co. has sales of $10.3 million and cost of sales of $6.1 million. Its selling, general and administrative expenses are $460000 and its research and development is $1.1 million. It has annual depreciation charges of $1.1 million and a tax rate of 25% . a. What is Local's gross margin? b. What is Local's operating margin? c. What is Local's net profit margin? d. If Local Co. had an increase in selling expenses of $270000, how would that affect each of its margins?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education