FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

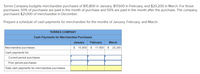

Transcribed Image Text:Torres Company budgets merchandise purchases of $15,800 in January, $17,600 in February, and $20,200 in March. For those

purchases, 50% of purchases are paid in the month of purchase and 50% are paid in the month after the purchase. The company

purchased $21,000 of merchandise in December.

Prepare a schedule of cash payments for merchandise for the months of January, February, and March.

TORRES COMPANY

Cash Payments for Merchandise Purchases

January

February

March

Merchandise purchases

$ 15,800

$ 17,600

$ 20,200

Cash payments for:

Current period purchases

Prior period purchases

Total cash payments for merchandise purchases

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- July 1 Purchased merchandise from Carter Company for $11,200 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Martin Company for $3,500 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $2,100. July 3 Paid $1,165 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $4,100 for $6,900 cash. July 9 Purchased merchandise from Walker Company for $4,800 under credit terms of 2/15, n/60, FOB destination, invoice dated July sukrale cab the th 9. July 11 Returned $1,000 of merchandise purchased on July 9 from Walker Company and debited its account payable for that amount. July 12 Received the balance due from Martin Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Carter Company within the discount period. July 19 Sold merchandise that cost $4,500 to Ryan Company for $6,400 under credit terms of 2/15, n/60, FOB…arrow_forwardDon't upload imagearrow_forwardSales and purchase-related transactions for seller and buyer using perpetual inventory system The following selected transactions were completed during April between Swan Company and Bird Company: Date Transaction Apr. 2. Swan Company sold merchandise on account to Bird Company, $63,900, terms FOB shipping point, n/15. Swan paid freight of $1,550, which was added to the invoice. The cost of the goods sold was $34,840. 8. Swan Company sold merchandise on account to Bird Company, $44,100, terms FOB destination, n/15. The cost of the goods sold was $28,720. 8. Swan Company paid freight of $1,040 for delivery of merchandise sold to Bird Company on April 8. 17. Bird Company paid Swan Company for purchase of April 2. 23. Bird Company paid Swan Company for purchase of April 8. 24. Swan Company sold merchandise on account to Bird Company, $66,550, terms FOB shipping point, n/eom. The cost of the goods sold was $40,840. 25. Swan Company paid Bird Company a cash refund of $2,350 for damaged…arrow_forward

- Journal Entries for Merchandise Transactions on Seller's and Buyer's Books- Perpetual System The following transactions occurred between the Decker Company and Mann Stores, Inc., during March: Mar. 8 Decker sold $20,200 worth of merchandise ($15,800 cost) to Mann Stores with terms of 2/10, n/30. 10 Mann Stores paid freight charges on the shipment from Decker Company, $270. 12 Mann Stores returned $1,300 of the merchandise ($870 cost) shipped on March 8. 17 Decker received full payment for the net amount due from the March 8 sale. 20 Mann Stores returned goods that had been billed originally at $700 ($400 cost). Decker issued a check for $686. Required Prepare the necessary journal entries for (a) the books of Decker Company and (b) the books of Mann Stores, Inc. Assume that both companies use the perpetual inventory system. Sellers journal entries Buyer's journal entries DECKER COMPANY GENERAL JOURNAL Date Description Debit Credit Mar. 8…arrow_forwardCash Discount Calculations On June 1, Forest Company sold merchandise with a list price of $25,000. For each of the sales terms below, determine the proper amount of cash received:arrow_forwardRecording Sales Transactions Jeet Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April: a. On April 1, Jeet purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,100, and the cost of the merchandise sold was $2,225. b. On April 1, Jeet paid freight charges of $250 cash to have the goods delivered to its warehouse. c. On April 8, Jeet returned $800 of the merchandise. The cost of the merchandise returned was $500. d. On April 10, Jeet paid Reece the balance due. Required: Prepare the journal entries to record these transactions on the books of Reece Company. For a compound transaction, if those boxes in which no entry is required, leave the box blank. April 1 (Recorded sale on account) April 1 (Recorded cost of merchandise sold) April 8 (Record return of merchandise) April 8arrow_forward

- What is the balance of accounts payable at May 31st?arrow_forwardInstructions The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. Apr. Jun. Jul. Aug. Dec. 1 Purchased merchandise on account from Kirkwood Co., $390,000, terms n/30. 31 Issued a 30-day, 10% note for $390,000 to Kirkwood Co., on account. 30 Paid Kirkwood Co. the amount owed on the note of March 31. 1 Borrowed $156,000 from Triple Creek Bank, issuing a 45-day, 8% note. 1 Purchased tools by issuing a $216,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. 1 Purchased equipment from Greenwood Co. for $500,000, paying $150,000 cash and issuing a series of ten 8% notes for $35,000 each, coming due at 30-day intervals. Settled a product liability lawsuit with a customer for $310,000, payable in January. Accrued the loss in a litigation claims payable account. Paid the amount due…arrow_forwardRecording Sales and Shipping Terms Milano Company shipped the following merchandise during the last week of December 2022. All sales were on credit. Sales Price Shipping Terms Date Goods Shipped Date Goods Received $5,460 FOB shipping point December 27 January 3 $3,800 FOB destination December 29 January 5 $4,250 FOB destination December 29 December 31 Required: 1. Compute the total amount of sales revenue recognized by Milano from these transactions. 2. If Milano included all of the above shipments as revenue, what would be the effect on the financial statements? Enter all amounts as positive numbers.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education