FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:Rockers expects total sales of $700,000 for January and $351,000 for

February. November sales totaled $392,000 and December sales were

$425,000.

Now assume that Rockers's sales are collected as follows:

60% in the month of the sale

The following schedule of cash receipts for January and February was

prepared based upon the collection history given:

(Click the icon to view the collection history.)

30% in the month after the sale

5% two months after the sale

5% never collected

(Click the icon to view the schedule of cash receipts.)

Prepare a revised schedule of cash receipts for January and February.

(If an input field is not used in the table leave the input field empty; do not enter a zero.)

More Info

Cash Receipts from Customers

January

February

Total sales

700,000

351,000

50% in the month of the sale

January

February

40% in the month after the sale

Cash Receipts from Customers:

6% two months after the sale

Nov.-Credit sales, collection of Nov. sales in Jan.

19600|

4% never collected

Dec.-Credit sales, collection of Dec. sales in Jan.

127500

Dec.-Credit sales, collection of Dec. sales in Feb.

21250

Print

Done

Jan

Credit sales, collection of Jan. sales in Jan.

420000

Jan.-Credit sales, collection of Jan. sales in Feb.

210000

Feb.-Credit sales, collection of Feb. sales in Feb.

210600

567100

441850

Total cash receipts from customers

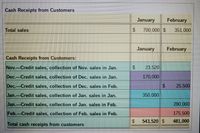

Transcribed Image Text:Cash Receipts from Customers

January

February

Total sales

$ 700,000 $

351,000

January

February

Cash Receipts from Customers:

Nov.-Credit sales, collection of Nov. sales in Jan.

$.

23,520

Dec.-Credit sales, collection of Dec. sales in Jan.

170,000

Dec.-Credit sales, collection of Dec. sales in Feb.

$4

25,500

Jan.-Credit sales, collection of Jan. sales in Jan.

350,000

Jan.-Credit sales, collection of Jan. sales in Feb.

280,000

Feb.-Credit sales, collection of Feb. sales in Feb.

175,500

543,520 $

481,000

Total cash receipts from customers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jasper Company has 56% of its sales on credit and 44% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $523,000 for April, $533,000 for May, and $558,000 for June. Total sales for March are $305,700. Prepare a schedule of cash receipts from sales for April, May, and June. Sales Cash receipts from: Cash sales JASPER COMPANY Schedule of Cash Receipts from Sales April May Collections of prior period sales Total cash receipts S S $ $ $ $ Junearrow_forward5 At Lyman Company, past experience reveals that 10% of sales are for cash and the remaining 90% are on credit. Lyman Company expects to collect 30% of its credit sales in the month of sale, 50% in the month following sale, and 18% in the second month following sale. Which ONE of the following is part of the cash collections expected to be made in January? O Cash sales from the preceding December O Cash collections of credit sales from the preceding December O Cash collections of credit sales from the preceding September O Cash sales from the preceding Novemberarrow_forwardPage Company makes 30% of its sales for cash and 70% on account. 60% of the credit sales are collected in the month of sale, 25% in the month following sale, and 12% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current year: Month Total sales Total cash receipts in Month 4 will be: Multiple Choice $27,230. $47,900. 1 2 3 $ 60,000 $ 70,000 $50,000 $30,000 £36 230arrow_forward

- Pardee Company makes 30% of its sales for cash and 70% on account. 60% of the account sales are collected in the month of sale, 25% in the month following sale, and 12% in the second month following sale. The remainder is uncollectible. The following information has been gathered for the current year: Month 1 2 3 4 Total sales $78,000 $80,000 $68,000 $48,000 Total cash receipts in Month 4 will be: A. 38,780 B.68,000 C.53,180 D.50,600arrow_forwardThe table contains the Sales estimates for the next year. The Purchases are 55% of Sales. Purchases are paid in the following month. The administrative expenses of $11,550 are paid each month Tax expenses of $16,458 are paid in March, June, September, and December each year. Rent expenses of $47,735 are paid in June and December. What is the cash outflow for March? Month Sales $ Month Sales $ Jan 87,400 July 21,931 Feb 89,751 Aug 78,038 Mar 78,038 Sep 87,400 Apr 21,931 Oct 78,038 May 87,400 Nov 89,751 June 89,751 Dec 21,931arrow_forwardValley's managers have made the following additional assumptions and estimates: Estimated sales for July and August are $345,000 and $315,000 respectively Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July Each month's ending inventory must equal 20% of the cost of the next month's sales. The Cost of Goods Sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred The company does not plan to buy or…arrow_forward

- 4 Jasper Company has 70% of its sales on credit and 30% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $525,000 for April, $535,000 for May, and $560,000 for June. Total sales for March are $500,000. Prepare a schedule of cash receipts from sales for April, May, and June, ts Book erences Sales Cash receipts from: Total cash receipts JASPER COMPANY Schedule of Cash Receipts from Sales April 525,000 May 535,000 June 560,000arrow_forwardFernando Company developed the following data for the month of August:1. August 1 cash balance P123,000.2. Cash sales in August P800,000.3. Credit sales for August are P300,000; for July P400,000; and for June P400,000. 70% of credit sales are collected in the month of sale, 15% in thefollowing month, and 10% in the second month following the sale. 4. Purchases for July were P500,000 and for August are P400,000. One-fourth of purchases are paid in the month of purchase and the remaining three-quarters in the following month. 5. August salaries are P314,000, utilities are P32,200, and depreciation on the building and equipment is P100,000. Required:1. Anticipated cash receipts from accounts receivable in August.arrow_forwardCash Collections for Belcher Motors found that 35% of its sales were cash and the remaining 65% are credit sales. Of the credit sales, the company collected 55% in the month of sale, 40% collected the month after the sale, and 5% collected the second month after the sale. May Sales were $100 000, April Sales were $115,000, and June Sales were 136,000. How much will be collected in the 3rd quarter if July sales are $180,000, August sales are 167,000, and September sales are $152,000, and include a total column for the 3rd quarter total.arrow_forward

- K- Mer Company expects its November sales to be 25% higher than its October sales of $150.000 Al sales are on credit and are collected as follows: 35% in the month of the sale and 60% in the following month. Purchases were $130,000 in October and are expected to be $150.000 in November Purchases are paid 35% in the month of purchase and 65% in the following month. The cash balance on November 1 is $13.900 The cash balance on November 30 will be G A $32.525 OB $4,725 OC $160,525 OD. $18.625arrow_forwardBark & Purr Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May $260,000 June 290,000 July 390,000 All sales are on account. 53 percent of sales are expected to be collected in the month of the sale, 37% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for May, June, and July. May June July May sales on account: Collected in May $fill in the blank 1 Collected in June $fill in the blank 2 Collected in July $fill in the blank 3 June sales on account: Collected in June fill in the blank 4 Collected in July fill in the blank 5 July sales on account: Collected in July fill in the blank 6 Total cash collected $fill in the blank 7 $fill in the blank 8 $fill in the blank 9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education