FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

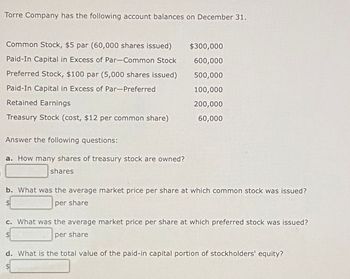

Transcribed Image Text:Torre Company has the following account balances on December 31.

Common Stock, $5 par (60,000 shares issued)

Paid-In Capital in Excess of Par-Common Stock

Preferred Stock, $100 par (5,000 shares issued)

Paid-In Capital in Excess of Par-Preferred

Retained Earnings

Treasury Stock (cost, $12 per common share)

Answer the following questions:

a. How many shares of treasury stock are owned?

shares

$300,000

600,000

500,000

100,000

200,000

60,000

b. What was the average market price per share at which common stock was issued?

$

per share

c. What was the average market price per share at which preferred stock was issued?

$

per share

d. What is the total value of the paid-in capital portion of stockholders' equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- A corporation purchases 9,515 shares of its own $10 par common stock for $18 per share, recording it at cost. What will be the effect on total stockholders' equity? a.decrease by $171,270 b.increase by $171,270 c.decrease by $76,120 d.increase by $76,120arrow_forwardThe balance sheet caption for common stock is the following: Common stock, $2 par value, 2,070,000 shares authorized, 1,310, 000 shares issued, 1,050,000 shares outstanding $? Required: a. Calculate the dollar amount that will be presented opposite this caption. b. Calculate the total amount of a cash dividend of $0.27 per share. c. What accounts for the difference between issued shares and outstanding shares? a. Amount b. Cash dividend c. Difference between issued shares and outstanding sharesarrow_forwardThe stockholders' equity section of Ayayai Corp.'s balance sheet consists of common stock ($7 par) $840,000 and retained earnings $400,000. A 10% stock dividend (12,000 shares) is declared when the market price per share is $15. (a) Show the before-and-after effects of the dividend on the components of stockholders' equity. Before Dividend After Dividend $4 $ $4 (b) Show the before-and-after effects of the dividend on the shares outstanding. Before Dividend After Dividend Outstanding shares >arrow_forward

- Please help me with show all calculation thankuarrow_forwardPresented below is information related to a company at the beginning of the year: Common Stock, $10 par $6,700 Retained Earnings 4,700 During the year, 10 shares were reacquired at $11 per share. How much is the total stockholders' equity after the treasury stock transaction, assuming the company accounts for treasury stock under the cost method?arrow_forwardThe stockholders' equity section of Swifty Corporation consists of common stock ($10 par) $2,200,000 and retained earnings $523,000. A 10% stock dividend (22,000 shares) is declared when the market price per share is $15. Show the before-and-after effects of the dividend on the following. (a) (b) (c) The components of stockholders' equity. Shares outstanding. Par value per share. Stockholders' equity Outstanding shares Par value per share Before Dividend $ After Dividendarrow_forward

- The balance sheet caption for common stock is the following: Common stock, $5 par value, 2,920,000 shares authorized, 1,560,000 shares issued, 1,070,000 shares outstanding Calculate the dollar amount that will be presented opposite this caption. $?arrow_forwardThe stockholders' equity section of Rakusin Corp. reflected the following in the capital stock subsection (all stock was issued on the same date): Common stock, par $10 $60,000 Additional paid-in-capital 15,000 What was the per-share selling price of the stock? $ _________arrow_forwardThe following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $174,000 $157,000 $140,000 Notes payable (8% interest) 60,000 60,000 60,000 Common stock 24,000 24,000 24,000 Preferred 6% stock, $100 par 12,000 12,000 12,000 (no change during year) Retained earnings 63,550 47,100 36,000 The 20Y7 net income was $17,170, and the 20Y6 net income was $11,820. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders’ equity for the years 20Y6 and 20Y7. When required, round to one decimal place. 20Y7 20Y6 Return on total assets fill in the blank 1 % fill in the blank 2 % Return on stockholders’ equity fill in the blank 3 % fill…arrow_forward

- Company E reports the following stockholders' equity: Common Stock, 100,000 authorized, 30,000 issued, $3 par ? Paid-In Common Stock 93,000 Less: Treasury Stock, 5000 shares (15,000) Retained Earnings 40,000 Assume that Company E pays a $1 per share dividend to its common shareholders. What would be the ending balance in Retained Earnings after the dividend was paid?arrow_forwardTexas Inc. has 8,000 shares of 6%, $125 par value cumulative preferred stock and 97,000 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? Oa. $60.00 per share Ob. $0.01 per share Oc. $5,820 in total Od. $60,000 in totalarrow_forwardBrewer, Inc. had the following data related to its common shares: Shares outstanding at 1/130,000 2 for 1 stock split at 3/31 Stock issuance at 6/30 1,000 What is the weighted average number of shares Brewer, Inc. should use to calculate its basic earnings per share for the year? 62,000 shares 61,000 shares 60,500 shares 31,000 sharesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education