FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can you answer dividend per share (b.)

The

| Stockholders’ Equity | ||||||

| Paid-in capital | ||||||

| 170,000 shares authorized, 47,000 shares issued and outstanding | $ | 705,000 | ||||

| Common stock, $12 stated value, 220,000 shares authorized, 47,000 shares issued and ?? shares outstanding | 564,000 | |||||

| Paid-in capital in excess of par—Preferred | 37,000 | |||||

| Paid-in capital in excess of stated value—Common | 141,000 | |||||

| Total paid-in capital | $ | 1,447,000 | ||||

| 320,000 | ||||||

| (33,000 | ) | |||||

| Total stockholders’ equity | $ | 1,734,000 | ||||

Note: The market value per share of the common stock is $26, and the market value per share of the preferred stock is $19.

Required

-

What is the dividend per share on the preferred stock?

Transcribed Image Text:Req A to D

Req F

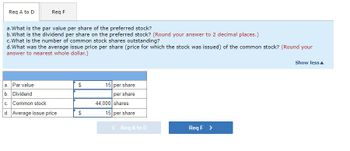

a. What is the par value per share of the preferred stock?

b. What is the dividend per share on the preferred stock? (Round your answer to 2 decimal places.)

c. What is the number of common stock shares outstanding?

d. What was the average issue price per share (price for which the stock was issued) of the common stock? (Round your

answer to nearest whole dollar.)

a. Par value

b. Dividend

c. Common stock

d. Average issue price

$

$

15 per share

per share

44,000 shares

15 per share

<

Req A to D

Req F >

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The stockholders’ equity section of Creighton Company’s balance sheet is shown as follows: CREIGHTON COMPANY As of December 31, Year 3 Stockholders’ equity Preferred stock, $10 stated value, 7% cumulative,300 shares authorized, 50 issued and outstanding $ 500 Common stock, $10 par value, 250 shares authorized,100 issued and outstanding 1,000 Common stock, class B, $20 par value, 400 sharesauthorized, 150 issued and outstanding 3,000 Common stock, no par, 150 shares authorized,100 issued and outstanding 2,200 Paid-in capital in excess of stated value—preferred 600 Paid-in capital in excess of par value—common 1,200 Paid-in capital in excess of par value—class B common 750 Retained earnings 7,000 Total stockholders’ equity $ 16,250 Requireda. Assuming the preferred stock was originally issued for cash, determine the amount of cash collected when the stock was issued.b. Based on the class B common stock alone,…arrow_forwardBeacon Corporation issued a 8 percent stock dividend on 35,000 shares of its $7 par common stock. At the time of the dividend, the market value of the stock was $30 per share. Required a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. Complete this question by entering your answers in the tabs below. Required A Required B Show the effects of the stock dividend on the financial statements using a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.)…arrow_forwardA company with 118,808 authorized shares of $5 par common stock issued 31,951 shares at $16 per share. Subsequently, the company declared a 2% stock dividend on a date when the market price was $33 a share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend? Oa. $17,893 Ob. $21,088 Oc. $3,195 Od. $78,413arrow_forward

- The stockholders' equity section of Ayayai Corp.'s balance sheet consists of common stock ($7 par) $840,000 and retained earnings $400,000. A 10% stock dividend (12,000 shares) is declared when the market price per share is $15. (a) Show the before-and-after effects of the dividend on the components of stockholders' equity. Before Dividend After Dividend $4 $ $4 (b) Show the before-and-after effects of the dividend on the shares outstanding. Before Dividend After Dividend Outstanding shares >arrow_forwardThe stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock's per share market value on April 2 is $20 (prior to the dividend). Common stock-$5 par value, 375,000 shares authorized, 200,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Prepare the stockholders' equity section immediately after the stock dividend is distributed. Total paid-in capital JUN COMPANY Stockholders' Equity April 2 (after stock dividend) Total stockholders' equity $ $ 1,000,000 600,000 833,000 $ 2,433,000 0arrow_forwardThe stockholders' equity section of the balance sheet for Mann Equipment Co. at December 31, Year 2, is as follows. Stockholders' Equity Paid-in capital Preferred stock, ? par value, 6% cumulative, 110,000 shares authorized, 41,000 shares issued and outstanding Common stock, $20 stated value, 160,000 shares authorized, 41,000 shares issued and ?? shares outstanding Paid-in capital in excess of par-Preferred Paid-in capital in excess of stated value-Common Total paid-in capital Retained earnings Treasury stock, 3,000 shares Total stockholders' equity Note: The market value per share of the common stock is $42, and the market value per share of the preferred stock is $13. Required a. What is the par value per share of the preferred stock? b. What is the dividend per share on the preferred stock? c. What is the number of common stock shares outstanding? d. What was the average issue price per share (price for which the stock was issued) of the common stock? f. If Mann Equipment Company…arrow_forward

- Presented below is information related to a company at the beginning of the year: Common Stock, $10 par $6,700 Retained Earnings 4,700 During the year, 10 shares were reacquired at $11 per share. How much is the total stockholders' equity after the treasury stock transaction, assuming the company accounts for treasury stock under the cost method?arrow_forwardPlease help mearrow_forwardFollowing is the stockholders' equity section from ABC Company's balance sheet as of Dec 31, Yr 1: STOCKHOLDERS' EQUITY Common stock: $0.45 par value, authorized 600,000 shares; 175,000 shares issued: $78,750 Additional paid-in capital: 532,000 Retained earnings: 79,500 Treasury stock: (180,000) Total stockholder's equity: $510,250 a) At the time the common stock was sold, what was the cost of each common stock sold? b) Compute the average price at which ABC Company issued its common stock shares: c) Compute the number of common stock shares outstanding as of Dec 31, Yr 1.arrow_forward

- Reporting Stockholders' Equity Using the following accounts and balances, prepare the “Stockholders’ Equity” section of the balance sheet. 30,000 shares of common stock authorized, and 1,000 shares have been reacquired. Common Stock, $60 par $1,080,000 Paid-In Capital from Sale of Treasury Stock 43,000 Paid-In Capital in Excess of Par—Common Stock 378,000 Retained Earnings 594,000 Treasury Stock 22,000 Balance Sheet Stockholders' Equity Paid-in capital: $ Paid-in capital, common stock $ Total paid-in capital $ Total $ Total stockholders' equity $arrow_forwardGordon Corporation reported the following equity section on its current balance sheet. The common stock is currently selling for OMR 11.50 per share. Common stock, OMR 5 par, 100,000 shares authorized, 40,000 shares issued OMR 200,000 Paid in capital in excess of par—common 120,000 Retained earnings 290,000 Total stockholders' equity OMR 610,000 If the company declared and issued 10% stock dividend? What will the number of issued shares Select one: a. 20,000 shares b. 44,000 shares c. 40,000 shares d. 4,000 sharesarrow_forwardThe year end balance sheet of CP, In., include the following stockholders’ equity section (with certain details omitted). Stockholders’ equity: Capital stock: 7% cumulative preferred stock, $100 par value……………. $15,000,000 Common stock, $5 par value, 5,000,000 shares Authorized, 4,000,000 shares issued and outstanding…… 20,000,000 Additional paid in capital: Common stock……………………………………………………………… 44,000,000 Retained earnings………………………………………………………… 64,450,000 Total stockholders’ equity…………………………………………… $143,450,000 From this information, I must compute the answers to the following question. 1. What is the amount of legal capital and the amount of total paid-in capital? 2. What is the book value per share of common stock, assuming no dividends in arrears? 3. Is it possible to determine the fair market value per share of common stock from the stock-holders' equity section? Explainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education