FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

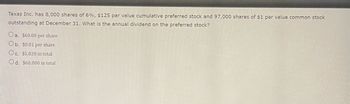

Transcribed Image Text:Texas Inc. has 8,000 shares of 6%, $125 par value cumulative preferred stock and 97,000 shares of $1 par value common stock

outstanding at December 31. What is the annual dividend on the preferred stock?

Oa. $60.00 per share

Ob. $0.01 per share

Oc. $5,820 in total

Od. $60,000 in total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Burton Inc. has two classes of stock, 5% $100 par cumulative Preferred Shares and $3 par Common Shares. The equity section shows: Common stock, $3 par value, 1,000,000 shares authorized and issued.........$595,000 Paid in capital in excess of par value........... How many shares of common are issued? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Answer shares $207,000arrow_forwardSandpiper Company has 10,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: $37,500 6,000 45,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock (dividends per share) 15,000 X 20Y1 20Y2 20Y3 20Y1 20Y2 20Y3 $ 0 X 0 X Common Stock (dividends per share) LA LA 0 X 0 0 Xarrow_forwardDividend Per Share Swilley Furniture Company has 50,000 shares of cumulative preferred 2% stock, $75 par, and 100,000 shares of $10 par common stock. The following amounts were distributed as dividends: Year 1 $45,000 Year 2 123,000 Year 3 130,000 Determine the dividend per share for preferred and common stock for each year. If an amount box does not require an entry, leave it blank. Round all answers to two decimal places. Year 1 Year 2 Year 3 Preferred stock (Dividend per share) Common stock (Dividend per share) %24 %24 %24arrow_forward

- Dividends Per Share Sandpiper Company has 15,000 shares of cumulative preferred 3% stock, $100 par and 50,000 shares of $15 par common stock. The following amounts were distributed as dividends: $90,000 18,000 135,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock (dividends per share) 20Y1 20Y2 20Y3 20Y1 20Y2 20Y3 $ Common Stock (dividends per share) 0arrow_forwardDividend Per Share Castillo Nutrition Company has 14,000 shares of cumulative preferred 1% stock, $130 par, and 70,000 shares of $5 par common stock. The following amounts were distributed as dividends: Year 1 $35,000 Year 2 6,300 Year 3 80,500 Determine the dividend per share for preferred and common stock for each year. If an amount box does not require an entry, leave it blank. Round all answers to two decimal places. Year 1 Year 2 Year 3 Preferred stock (Dividend per share) Common stock (Dividend per share)arrow_forwardSandpiper Company has 30,000 shares of cumulative preferred 2% stock, $150 par and 50,000 shares of $15 par common stock. The following amounts were distributed as dividends: Year 1 $225,000 Year 2 45,000 Year 3 270,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Year 1 Year 2 Year 3 Preferred stock (Dividends per share) $ $ $ Common stock (Dividends per share)arrow_forward

- Sanchez Company has 38,000 shares of 5% preferred stock of $100 par and 112,000 shares of $50 par common stock issued and outstanding. The following amounts were distributed as dividends: Year 1 $538,000 Year 2 $440,000 Year 3 $510,000 Determine the dividends per share for preferred and common stock for each year. Round the dividends per share to the nearest cent. Year 1 Year 2 Year 3 Amount distributed $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Preferred dividend $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Common dividend $fill in the blank 7 $fill in the blank 8 $fill in the blank 9 Dividends per share: Preferred stock $fill in the blank 10 $fill in the blank 11 $fill in the blank 12 Common stock $fill in the blank 13 $fill in the blank 14 $fill in the blank 15arrow_forwardPrestige Investments had the following preferred stock outstanding at the end of a recent year: $25 par, 10% 6,000 shares $42 par, 8%, cumulative 11,000 shares $50 par, 12%, cumulative, convertible 2,000 shares $80 par, 11%, nonparticipating 15,000 shares Required: 1. Determine the amount of annual dividends on each issue of preferred stock and the total annual dividend on all four issue Issue 1 ($25 par, 10%) of preferred stock Issue 2 ($42 par, 8%, cumulative) of preferred stock Issue 3 ($50 par, 12%, cumulative, convertible) of preferred stock Issue 4 ($80 par, 11%, nonparticipating) of preferred stock Total annual dividend 2. Calculate what the amount of dividends in arrears would be if the dividends were omitted for 1 year.arrow_forwardSandpiper Company has 20,000 shares of cumulative preferred 1% stock of $100 par and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends: Year 1 $10,000 Year 2 $45,000 Year 3 $80,000 Determine the dividends per share for preferred and common stock for each year.arrow_forward

- sarrow_forwardSabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock of and 100,000 shares of $50 par common stock.The following amounts were distributed as dividends: Year one 10,000 Year 2 45,000 Your 3 90,00 Determine the dividends per share for preferred and common stock for the second year.arrow_forwardDividends Per Share Sandpiper Company has 25,000 shares of cumulative preferred 2% stock, $50 par and 50,000 shares of $20 par common stock. The following amounts were distributed as dividends: 20Y1 20Y2 20Y3 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. 20Y1 20Y2 20Y3 $62,500 20,000 75,000 Preferred Stock (dividends per share) $ $ Common Stock (dividends per share)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education