FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

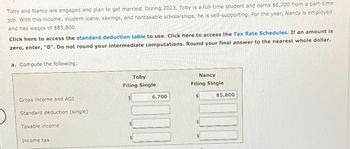

Transcribed Image Text:Toby and Nancy are engaged and plan to get married. During 2023, Toby is a full-time student and earns $6,700 from a part-time

job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Nancy is employed

and has wages of $85,800.

Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is

zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar.

a. Compute the following:

Gross income and AGI

Standard deduction (single)

Taxable income

Income tax

Toby

Filing Single

$

$

6,700

Nancy

Filing Single

$

$

$

85,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- I need help with b, c, and d.arrow_forwardJacob Turner hired Jen Hatcher as a housekeeper starting on January 2 at $831 monthly. Jacob does not withhold any federal taxes. Assume that Jen is not a housekeeper for anyone else. Assume that Jacob paid $2,493 in wages for the fourth quarter of 2020. Required: How much in social security tax should Jacob pay? (Round your final answer to 2 decimal places.) How much Medicare tax should Jacob pay? (Round your final answer to 2 decimal places.) How much FUTA tax should Jacob pay?arrow_forwardRequired information [The following information applies to the questions displayed below.] In 2021, Elaine paid $2,800 of tuition and $600 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? (Leave no answer blank. Enter zero if applicable.) b. Elaine's AGI is $168,000. American opportunity tax creditarrow_forward

- Bennett is a single individual and received a salary of $28,000 before he retired in October of this year. After he retired, he received Social Security benefits of $4,000 during the year. Read the requirements. Requirement a. What amount, if any, of the Social Security benefits are taxable for the year? Begin by computing the provisional income. Only select items that are applicable to Bennett.(Leave unused cells blank, do not select a label or enter a zero.) Adjusted gross income (excluding Social Security benefits) $28,000 Plus: 50% of Social Security benefits 2,000 Provisional income $30,000 The taxable portion of the Social Security benefits is . Requirements a. What amount, if any, of the Social Security benefits are taxable for the year? b. Would the answer be different if Bennett also had $1,500 of tax-exempt interest? c. What if he had had $6,400of…arrow_forwardConsider the following scenarios: i (Click the icon to view the scenarios.) Requirement For each scenario, indicate the amount that must be included in the taxpayer's gross income. a. Larry was given a $1,500 tuition scholarship to attend Eastern Law School. In addition, Eastern paid Larry $4,000 per year to work part-time in the campus bookstore. (Assume the tuition scholarship is less than the cost of tuition at Eastern Law School. Enter a "0" for any amounts that should not be included in the taxpayer's gross income.) The amount of tuition scholarship that Larry must include in his gross income is The amount of wages from the campus bookstore that Larry must include in his gross income is $ $ C 0 4,000 b. Marty received a $10,000 football scholarship for attending Northern University. The scholarship covered tuition, room and board, laundry, and books. Four thousand of the scholarship was designated for room and board and laundry. It was understood that Marty would participate in…arrow_forwardYou are getting ready to prepare a 2022 tax return for your clients Moose and Suzie Okie and are doing some initial calculations. Moose and Suzie have two children, Arva (age 12) and Ralph (age 9). They have provided you with the following information regarding 2022 relevant activities: Moose received a Form W-2 for $60,000 which showed his federal income tax withheld amount was $7,000. Suzie has a residential rental property (cost basis $270,000) which was rented for the whole year for $2,000 per month. Property taxes on the residential rental property: $3,700 and property insurance: $1,785. Suzie spent $500 fixing the sprinklings system and $5,000 for a new roof after a hailstorm. Moose got lucky and won $4,000 gambling on a trip to Las Vegas. Suzie sold her old car for $4,000. She had originally paid $8,000 for it. She also sold a parcel of land for $7,500 on March 7, 2022. She purchased it on January 5th of 2000 for $5,000. What is the total reportable income?arrow_forward

- Identify the statement that is TRUE regarding the Earned Income Credit for Tax Year 2022. Childless taxpayers have no maximum age limit (previously it was 65). Taxpayers must not have investment income that exceeds $10,300. Taxpayers will be allowed to calculate their Earned Income Credit for 2022 using their 2019 earned income if 2022 earned in is less than it was in 2019. The maximum childless Earned Income Credit is $1,502. Mark for follow uparrow_forwardYanni, who is single, provides you with the following information for 2021: Salary State income taxes Mortgage interest expense on principal residence Charitable contributions. 2,564 Interest income 1,923 Click here to access the exemption table. If required, round your answers to the nearest dollar. Compute the following: a. Yanni's taxable income: b. Yanni's AMT base: $128,200 12,820 11,538 c. Yanni's tentative minimum tax: X Incorrectarrow_forwardGodoarrow_forward

- Sharon Jones is single. During 2022, she had gross income of $159,800, deductions for AGI of $5,500, itemized deductions of $14,000 and tax credits of $2,000. Sharon had $22,000 withheld by their employer for federal income tax. She has a tax (due/refund) rounded to the nearest whole dollar of $.arrow_forwardGadubhiarrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education