ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

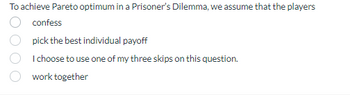

Transcribed Image Text:To achieve Pareto optimum in a Prisoner's Dilemma, we assume that the players

confess

pick the best individual payoff

I choose to use one of my three skips on this question.

work together

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this problem please?arrow_forwardWe can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 1 in the equilibrium?arrow_forwardSuppose we have two ice cream sellers, Blue Cool Ice Cream and Red Mango Ice Cream, deciding where to locate along a 1 kilometer long linear beach. Beachgoers are uniformly spread out everywhere along the beach. They do not like walking, and they view the ice cream from the two sellers as homogenous goods. Because of this, they will always buy from the nearest seller. The sellers cannot choose their price, only the location. A strategy for a player in this game is a distance between 0m and 1000m, which represents where the player will locate. For example, a distance of 0m is a strategy. The payoffs are the percentages of the market that each seller captures (depending on their two strategies). For example, if Blue Cool chooses 0m and Red Mango chooses 1000m, their payoffs are 50% and 50%. If the two sellers locate at exactly the same spot, they share the market and get 50% each. Suppose each player can only choose from 5 locations: 0m, 250m, 500m, 750m, 1000m. Is playing 0m is a…arrow_forward

- Imagine that there are two snowboard manufacturers (FatSki and WideBoard) in the market. Each firm can either produce ten or twenty snowboards per day. The table below (see attached) shows the profit per snowboard for each firm that will result given the joint production decisions of these two firms. Draw the game payoff matrix for this situation. Does either player have a dominant strategy? If so, what is it? What is the Nash equilibrium solution and how many boards should each player produce each day? Since FatSki and WideBoard must play this game repeatedly (i.e. make production decisions every day), what strategy would you advise them to play in order to maximize their payoff over the long term?arrow_forwardWe can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 2 in the equilibrium?arrow_forwardA "Prisoner's Dilemma" is a situation in which both parties: a) have an incentive to cooperate(meaning working with the other criminal by keeping one's mouth shut) even without communication b) have an incentive to not cooperate(meaning working with other criminal by keeping one's mouth shut) even through cooperation would be mutually benefical. c)have no incentives to cooperate or not cooperate because either way they lose.arrow_forward

- Problem 2. Consider the partnership-game we discussed in Lecture 3 (pages 81-87 of the textbook). Now change the setup of the game so that player 1 chooses x = [0, 4], and after observing the choice of x, player 2 chooses y ≤ [0, 4]. The payoffs are the same as before. (a) Find all SPNE (subgame perfect Nash equilibria) in pure strategies. (b) Can you find a Nash equilibrium, with player 1 choosing x = 1, that is not subgame perfect? Explain.arrow_forwardSuppose two players play the prisoners' dilemma game a finite number of times, both players are rational, and the game is played with complete information, is a tit-for-tat strategy optimal in this case? Explain using your own words.arrow_forwardUse the following payoff matrix for a one-shot game to answer the accompanying questions. Player 2 Strategy X Y Player 1 A 30, 30 16, -50 B -50, 16 50, 50 A. Determine the Nash equilibrium outcomes that arise if the players make decisions independently, simultaneously, and without any communication. check all that apply (16, −50) (−50, 16) (30, 30) (50, 50) Which of these outcomes would you consider most likely? multiple choice (16, −50) (50, 50) (−50, 16) (30, 30) B. Suppose player 1 is permitted to “communicate” by uttering one syllable before the players simultaneously and independently make their decisions. What should player 1 utter? multiple choice A or B What outcome do you think would occur as a result? multiple choice (−50, 16) (16, −50) (30, 30) (50, 50) c. Suppose player 2 can choose its strategy before player 1, that player 1 observes player 2’s choice before making her decision, and that this move structure is…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education