Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

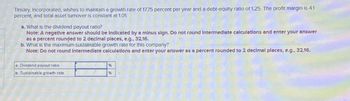

Transcribed Image Text:Tinsley, Incorporated, wishes to maintain a growth rate of 17.75 percent per year and a debt-equity ratio of 1.25. The profit margin is 4.1

percent, and total asset turnover is constant at 1.01.

a. What is the dividend payout ratio?

Note: A negative answer should be Indicated by a minus sign. Do not round Intermediate calculations and enter your answer

as a percent rounded to 2 decimal places, e.g., 32.16.

b. What is the maximum sustainable growth rate for this company?

Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Dividend payout ratio

b. Sustainable growth rate

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Premier Corporation has an ROE of 14.9 percent and a payout ratio of 48 percent. What is its sustainable growth rate? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Sustainable growth rate 7.75 %arrow_forwardThis is 1 question that has 2 sub-parts. Please answer both questions. NB!!! Round off both answers to 2 decimal places.arrow_forwardYou've collected the following information about Hendrix Guitars, Incorporated: Profit margin Total asset turnover Total debt ratio Payout ratio 4.42% 3.30 .27 278 What is the sustainable growth rate for the company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Sustainable growth rate %arrow_forward

- What is the equations you use for the questions below to solve in excel?arrow_forwardAssume the following ratios are constant: Profit margin Total asset turnover 2.5 5.2% Equity multiplier 1.3 Payout ratio 22% What is the sustainable growth rate? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., Answer is complete but not entirely correct. Sustainable growth rate 1.09 %arrow_forwardIf we know that a firm has a net profit margin of 4.3%, total asset turnover of 0.77, and a financial leverage multiplier of 1.37, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? The firm's ROE is %. (Round to two decimal places.) What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? (Select from the drop-down menus.) Observe the modified DuPont formula (see) and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Dupont system is that ROE is broken into three distinct components. Starting at the right we see how has increased assets over the owners' original equity. Next, moving to the left, we see how efficiently the firm used its sales. to…arrow_forward

- Now that you know how to calculate the ratios, you have have been teaching your assistant about them. He has calculated the following ratios for Joe's Pool Room, Inc., but cannot answer the question, "What is Joe's Pool Room, Inc's. Debt to Equity Ratio? This is a level 3 question. Total Asset Turnover (TATO): ||1.4x| Return on Assets (ROA): 0.05 Return of Equity (ROE): 0.13 Current Ratio 1.5arrow_forwardBased on the above information, calculate the sustainable growth rate for Kayla's Heavy Equipment.arrow_forwardHenderson's Hardware has an ROA of 15%, a 4.5% profit margin, and an ROE of 25%. What is its total assets turnover? Do not round intermediate calculations. Round your answer to two decimal places. What is its equity multiplier? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- A firm has an asset turnover ratio of 5.0. Its plowback ratio is 50%, and it is all-equity-financed. If the profit margin of the firm is 3%, what is the maximum payout ratio that will allow it to grow at 5% without resorting to external financing? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Maximum payout ratio %arrow_forwardget all answerarrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education