Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer 1 and 2 please!!! here is the data you needf:

| Month | Monthly Product Demand |

| 2021-01-01 | 100.32 |

| 2021-02-01 | 102.57 |

| 2021-03-01 | 103.32 |

| 2021-04-01 | 104.45 |

| 2021-05-01 | 108.78 |

| 2021-06-01 | 110.10 |

| 2021-07-01 | 112.99 |

| 2021-08-01 | 113.27 |

| 2021-09-01 | 108.22 |

| 2021-10-01 | 107.20 |

| 2021-11-01 | 114.90 |

| 2021-12-01 | 117.88 |

| 2022-01-01 | 104.92 |

| 2022-02-01 | 112.06 |

| 2022-03-01 | 112.56 |

| 2022-04-01 | 109.18 |

| 2022-05-01 | 111.41 |

| 2022-06-01 | 112.62 |

| 2022-07-01 | 122.41 |

| 2022-08-01 | 124.90 |

| 2022-09-01 | 111.65 |

| 2022-10-01 | 115.37 |

| 2022-11-01 | 120.23 |

| 2022-12-01 | 120.64 |

| 2023-01-01 | 106.34 |

| 2023-02-01 | 115.43 |

| 2023-03-01 | 119.18 |

| 2023-04-01 | 110.58 |

| 2023-05-01 | 112.89 |

| 2023-06-01 | 117.91 |

| 2023-07-01 | 123.61 |

| 2023-08-01 | 128.75 |

| 2023-09-01 | 117.18 |

| 2023-10-01 | 124.42 |

| 2023-11-01 | 128.22 |

| 2023-12-01 | 121.14 |

| 2024-01-01 | 108.70 |

| 2024-02-01 | 120.23 |

| 2024-03-01 | 130.26 |

| 2024-04-01 | 115.35 |

| 2024-05-01 | 116.74 |

| 2024-06-01 | 128.81 |

| 2024-07-01 | 130.88 |

| 2024-08-01 | 132.19 |

| 2024-09-01 | 129.45 |

| 2024-10-01 | 129.72 |

| 2024-11-01 | 137.30 |

| 2024-12-01 | 131.99 |

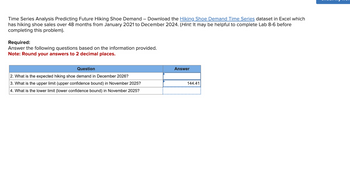

Transcribed Image Text:Time Series Analysis Predicting Future Hiking Shoe Demand - Download the Hiking Shoe Demand Time Series dataset in Excel which

has hiking shoe sales over 48 months from January 2021 to December 2024. (Hint: It may be helpful to complete Lab 8-6 before

completing this problem).

Required:

Answer the following questions based on the information provided.

Note: Round your answers to 2 decimal places.

Question

2. What is the expected hiking shoe demand in December 2026?

3. What is the upper limit (upper confidence bound) in November 2025?

4. What is the lower limit (lower confidence bound) in November 2025?

Answer

144.41

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please see below. Need this asap please and thank you.arrow_forwardin 1. Calculate the Annual rate of return. Solving for Rates - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri, BIU - A- Alignment Number Conditional Format as Cll Formatting Table Styles 国 Paste Cipboard H. 1. D. E. C. 3. What annual rate of return is earned on a $5,000 investment when it grows to $10,750 in six years? (Do not round intermediate calculations and round your final answer to 2 decimal places. Present value Future value Number of periods 0000 2410,750 Complete the following analysis. Do not hard code values in your calculations. 28 of 40 ere to search %23arrow_forwardCalculate the ROE and retention rate (1 - payout ratio) for the company Oracle for the years 2019-2023. Then calculate then calulcte the sustainable growth (ROE * Retention Rate) for each year and find the average g. You can use online data to figure it out. I keep getting 140% and I'm wondering if it's wrong or if I'm using not using the right data. Please calculate the actual Oracle Data from online. I know how to do it I just want to know what data to get and where to get it since I keep geeting an impossible number. ** Can you just give me the payout ratios for Oracle from year 2019 to year 2023. I can do the rest.***arrow_forward

- You expect to have $179,681 in 19 months. You plan to make savings contributions of $X per month for 19 months. The expected return is 0.81 percent per month and the first regular savings contribution will be made in 1 month. What is X? Input instructions: Round your answer to the nearest dollar. $ 8675 x C raw Q Search > DO98969DANAAI Carrow_forwardFor the Hawkins Company, the monthly percentages of all shipments received on time over the past 12 months are 80, 82, 84, 83, 83, 84, 85, 84, 82, 83, 84, and 83. Construct a time series plot. What type of pattern exists in the data? Compare a three-month moving average forecast with an exponential smoothing forecast for α = 0.2. Which provides the better forecasts using MSE as the measure of model accuracy? What is the forecast for next month?arrow_forwardPlease answer this simple questionarrow_forward

- 1. Calculate the Annual rate of return. Solving for Rates - Excel FILE INSERT PAGE LAYOUT FORMULAS DATA REVEW VIEW Calibri 国 Paste BIU - -A-Alignment Number Conditional Format as Cell Cells Formatting Table Styles Clipboard Font. Styles A1 E. What annual rate of return is earned on a $5,000 investment when it grows to $10,750 in six years? (Do not round intermediate calculations and round your final answer to 2 decimal places Present value 5,000 Future value Number of periods Complete the following analysis. Do not hard code values in vour calculations. Annual rate of return s of 10 Next > here to search TPLarrow_forwardThe quarterly sales data (number of copies sold) for a college textbook over the past three years are as follows: a. Construct a time series plot. What type of pattern exists in the data? b. Use a regression model with dummy variables as follows to develop an equation to account for seasonal effects in the data: Qtr1 = l if quarter l, 0 otherwise; Qtr2 = l if quarter 2, 0 otherwise; Qtr3 = 1 if quarter 3, 0 otherwise. c. Based on the model you developed in part (b), compute the quarterly forecasts for next year. d. Let t = 1 to refer to the observation in quarter 1 of year 1; t = 2 to refer to the observation in quarter 2 of year 1; ; and t = 12 to refer to the observation in quarter 4 of year 3. Using the dummy variables defined in part (b) and t, develop an equation to account for seasonal effects and any linear trend in the time series. e. Based upon the seasonal effects in the data and linear trend, compute the quarterly forecasts for next year. f. Is the model you developed in part (b) or the model you developed in part (d) more effective? Justify your answer.arrow_forwardWrite down a financial goal that you will accomplish in the next 24 months. How much money do you need for the financial goal? What date will you need the financial goal by? How money will you need to save each month for the financial goal?arrow_forward

- Suppose you want to have $300,000 for retirement in 20 years. Your account earns 10% interest. How much would you need to deposit in the account each month? Submit Question ath.com/course/showcalendar.php?cid=179278 Q Searcharrow_forwardPlease provide answer on A and B in TEXT. Not snip or handwriting. Please, make sure it is correct and not from chat GPT. Thank you. I'll rate you like.arrow_forwardCurrent Attempt in Progress Find the future value of an investment of $2,800 made today for the following rates and periods: (Do not round intermediate calculations. Round final answer to 2 decimal places, e.g. 2,515.25.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) a. 6.25 percent compounded semiannually for 12 years. Future value $ b. 7.63 percent compounded quarterly for 6 years. Future value $ c. 9.0 percent compounded monthly for 10 years. Future value $ d. 10.95 percent compounded daily for 3 years. Future value $ lliarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning