Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

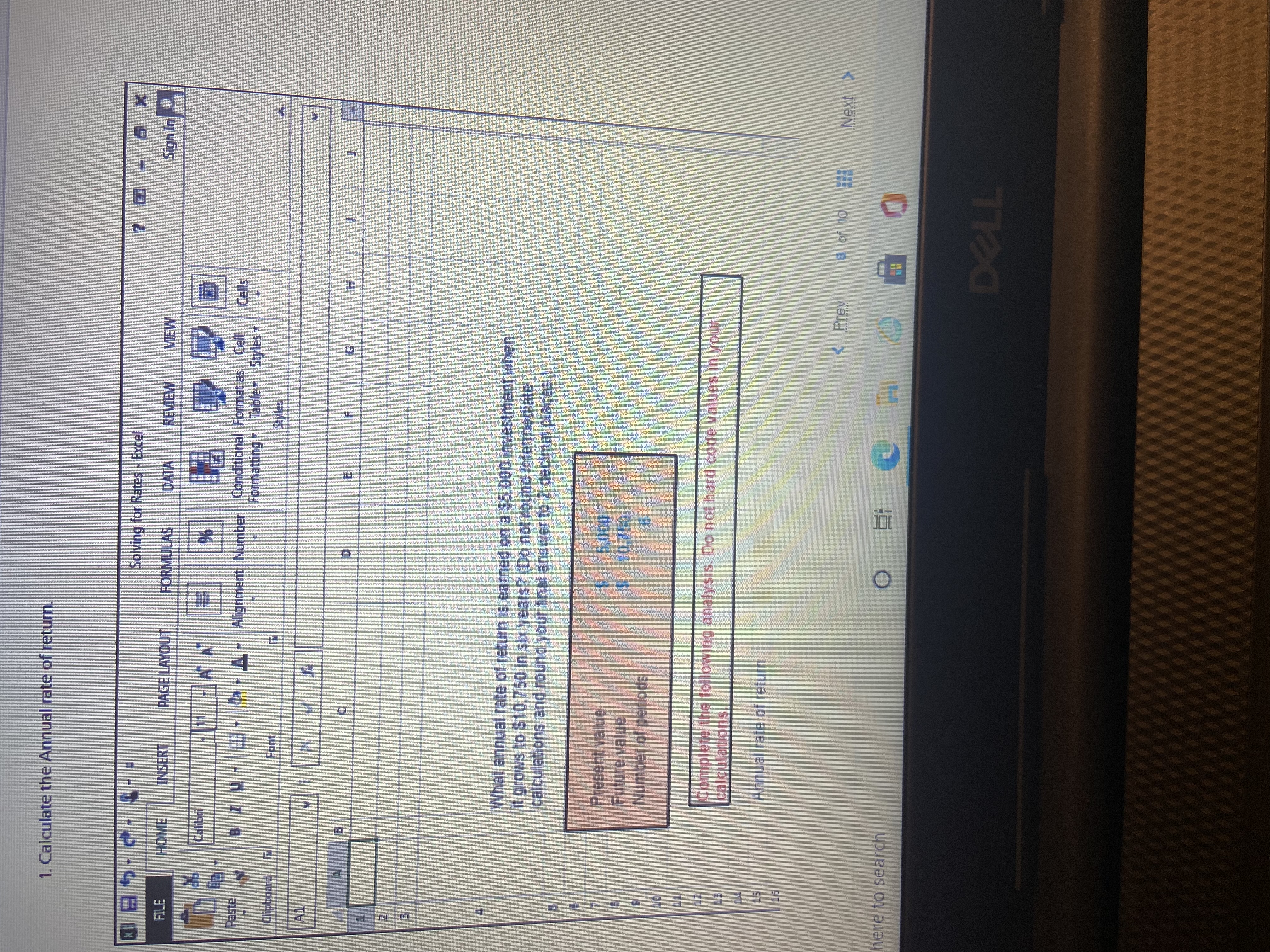

Transcribed Image Text:1. Calculate the Annual rate of return.

Solving for Rates - Excel

FILE

INSERT

PAGE LAYOUT

FORMULAS

DATA

REVEW

VIEW

Calibri

国

Paste

BIU - -A-Alignment Number Conditional Format as Cell Cells

Formatting Table Styles

Clipboard

Font.

Styles

A1

E.

What annual rate of return is earned on a $5,000 investment when

it grows to $10,750 in six years? (Do not round intermediate

calculations and round your final answer to 2 decimal places

Present value

5,000

Future value

Number of periods

Complete the following analysis. Do not hard code values in vour

calculations.

Annual rate of return

s of 10

Next >

here to search

TPL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardplease solve this practice problemarrow_forwardme roll ck d tch PgUp Pause Break Westc Question 7) Annuities & Loans-worth 15% of the grade The following formulas will be helpful for the problems below, or you may use TVM Solver in your calculator: For annuities: A = nt PMT ((1- ((1 + 7) ¹² − 1) r n For loans: PMT= P(7) [1 − (1 + 7)"] -nt the st month Mr. Garcia would like to use an annuity with an APR of 11% compounded monthly to reach his retirement goal of $225,000 in 20 years. How much would he need to deposit monthly into this account to reach this goal? Suppose that you decide to borrow $30,000 for a new car. To finance the purchase, you will make regular monthly payments for five years. The loan has a 9% interest rate. What will your monthly payment be? Westchester Community College 5% of the gra the problems with an How m =&= no toom 000 for a years. Th >arrow_forward

- Please don't give image format and no chatgpt answerarrow_forwardHi, can someone help me with these excel problems?arrow_forwardpractice. need to double check work. use table to find 1. Loan Amount 2. monthly payment on a 30 year loan (use pmt) 3. total interest paid over the life of 30 year loanarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education