Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Compute the break even sales for the current year

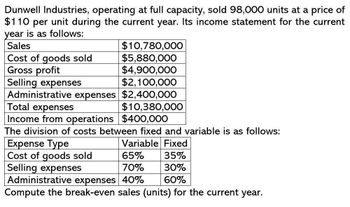

Transcribed Image Text:Dunwell Industries, operating at full capacity, sold 98,000 units at a price of

$110 per unit during the current year. Its income statement for the current

year is as follows:

Sales

$10,780,000

Cost of goods sold

$5,880,000

Gross profit

$4,900,000

Selling expenses

$2,100,000

Total expenses

Administrative expenses $2,400,000

Income from operations $400,000

The division of costs between fixed and variable is as follows:

$10,380,000

Expense Type

Variable Fixed

Cost of goods sold

65%

35%

Selling expenses

70%

30%

Administrative expenses 40%

60%

Compute the break-even sales (units) for the current year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year. Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. What is the sales margin?arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. B. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardDuring the current year, Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forward

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardBrandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.arrow_forwardRogue Industries reported the following items for the current year: Sales = $3,000,000; Cost of Goods Sold = $1,500,000; Depreciation Expense = $170,000; Administrative Expenses = $150,000; Interest Expense = $30,000; Marketing Expenses = $80,000; and Taxes = $300,000. Rogue's gross profit is equal to Select one: a. 1,070,000 b. $1,100,000 c. $1,500,000 d. $770,000arrow_forward

- Whitman Company has just completed its first year of operations. The company's traditional format income statement for the year follows: Whitman Company Income Statement Sales (35,000 units × $25 per unit) Cost of goods sold (35,000 units × $15 per unit) Gross margin Selling and administrative expenses Net operating income Amount $ 875,000 525,000 350,000 278,000 $ 72,000 The company's selling and administrative expenses consist of $208,000 per year in fixed expenses and $2 per unit sold in variable expenses. The $15 unit product cost given above is computed as follows: Direct materials Direct labor Variable overhead Fixed overhead ($100,000 ÷ 50,000 units) Unit product cost (under traditional costing) $ 6 6 1 2 $15 Required: 1. Prepare a contribution format income statement for the year ended December 31. 2. What was the contribution toward fixed expenses and profits for each unit sold? (State this figure in a single dollar amount per snowboard.) 3. What would operating income be if…arrow_forwardEast Mullett Manufacturing earned operating income last year as shown in the following income statement: Sales $531,250 Cost of goods sold 280,000 Gross margin $251,250 Selling and administrative expense 195,300 Operating income $55,950 Less: Income taxes (@ 40%) 22,380 Net income $33,570 At the beginning of the year, the value of operating assets was $390,000. At the end of the year, the value of operating assets was $460,000. Required: For East Mullett Manufacturing, calculate the following: 1. Average operating assets 2. Margin (round to two decimal places) % 3. Turnover (round to two decimal places) 4. Return on investment (round to one decimal place) %arrow_forwardPelican Manufacturing earned operating income last year as shown in the following income statement: Sales $531,250 Cost of goods sold 280,000 Gross margin $251,250 Selling and administrative expense 181,700 Operating income $69,550 Less: Income taxes (@ 40%) 27,820 Net income $41,730 At the beginning of the year, the value of operating assets was $390,000. At the end of the year, the value of operating assets was $460,000. Pelican requires a minimum rate of return of 10%. Required: For Pelican, calculate: 1. Average operating assets 2. Residual incomearrow_forward

- Any help is much aprreciated!arrow_forwardDarby Company, operating at full capacity, sold 83,700 units at a price of $48 per unit during the current year. Its income statement for the current year is as follows: Sales $4,017,600 Cost of goods sold 1,984,000 Gross profit $2,033,600 Expenses: Selling expenses $992,000 Administrative expenses 992,000 Total expenses 1,984,000 Income from operations $49,600 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $336,000 in yearly sales. The expansion will increase fixed costs by $33,600, but will not affect the relationship between sales and variable costs. What is the total variable costs and the total fixed costs…arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $327,600 from total sales of $5,040,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. If required, round your answer to two decimal places. times B. Assume sales margin is 6.5%, what is the total ROI for the company during the current year?. If required, round your answer to one decimal place. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning