ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

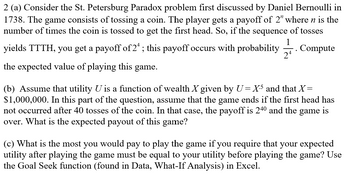

Transcribed Image Text:### Problem 2: Analysis of the St. Petersburg Paradox

**(a) St. Petersburg Paradox Overview**

The St. Petersburg Paradox, first discussed by Daniel Bernoulli in 1738, involves a theoretical game where a coin is tossed repeatedly. The player earns a payoff of \(2^n\), where \(n\) is the number of tosses required to get the first head. For example, if the sequence of tosses is TTTT followed by H, the payoff is \(2^4\). This outcome occurs with a probability of \(\frac{1}{2^4}\). Calculate the expected value of playing this game.

**(b) Expected Payout with Utility Function**

Assume the utility \(U\) is a function of wealth \(X\) given by \(U = X^5\) and \(X = \$1,000,000\). Assume further that the game concludes if a head does not appear after 40 tosses. The payoff then is \(2^{40}\). Determine the expected payout of this modified game.

**(c) Maximum Payment for Utility Equivalence**

Determine the maximum amount one would be willing to pay to play the game, given that the expected utility after playing must be equal to the pre-game utility. Utilize Excel’s Goal Seek function (located in Data, What-If Analysis) to find this value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

(b) Assume that utility U is a function of wealth X given by U = X.5 and that X = $1,000,000. In this part of the question, assume that the game ends if the first head has not occurred after 40 tosses of the coin. In that case, the payoff is 240 and the game is over. What is the expected payout of this game?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

(b) Assume that utility U is a function of wealth X given by U = X.5 and that X = $1,000,000. In this part of the question, assume that the game ends if the first head has not occurred after 40 tosses of the coin. In that case, the payoff is 240 and the game is over. What is the expected payout of this game?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- When a famous painting becomes available for sale, it is often known which museum or collector will be the likely winner. Yet, the auctioneer actively woos representatives of other museums that have no chance of winning to attend anyway. Suppose a piece of art has recently become available for sale and will be auctioned off to the highest bidder, with the winner paying an amount equal to the second highest bid. Assume that most collectors know that Yakov places a value of $35,000 on the art piece and that he values this art piece more than any other collector. Suppose that if no one else shows up, Yakov simply bids $35,0002=$17,500 $35,000 2 = $17,500 and wins the piece of art. The expected price paid by Yakov, with no other bidders present, is. Suppose the owner of the artwork manages to recruit another bidder, Bob, to the auction. Bob is known to value the art piece at $28,000. The expected price paid by Yakov, given the presence of the second bidder Bob, is.arrow_forward3) Consider the following two gambles: Option A: you win $50 with probability 0.75 and lose $100 with probability 0.25. Option B: You win $100 with probability 0.25 and lose $50 with probability 0.75. Which option is preferred according to expected utility if i) You use an exponential utility function with R=5 ii) You use an exponential utility function with R=10 iii) You use an exponential utility function with R=100 iv) You use an exponential utility function with R=1000 v) You use an exponential utility function with R=10,000arrow_forwardA buyer wants to purchase a house from a seller. Let v be the quality of this house. The quality v is known to the seller but unobservable to the buyer. The buyer thinks the chance that v=$1k is 20%, v=$10k is 40%, and v=$50k is 40%. The seller’s valuation of the house is v and the buyer’s valuation of the house is 2v a) Suppose both the buyer and the seller see the value of v . Also suppose the transaction price equals the value of v (i.e. if =10k, then the buyer pays 10k for the house). Calculate the buyer’s expected profit before seeing the value of b) Suppose only the seller sees v. Also suppose the buyer is allowed to make any offer to the seller and the seller accepts it if the offered price is above or equals to v. What is the buyer’s profit maximizing offer? What is the buyer’s maximum profit? c) Base on your answers from (a) and (b), what is the value of information (i.e. the benefits of seeing the value of ) to the buyer?arrow_forward

- 4. Kate has von Neumann-Morgenstern utility function U(x1,x2) = m7. She currently has $2025. a. Would she be willing to undertake a gamble that involves a gain $2875 with probability + and a loss of $1125 with probability ? Show your work and explain your answer. b. Would she be willing to undertake a gamble that involves a gain $2599 with probability and a loss of $800 with probability ? Show your work and explain your answer.arrow_forwardVeerarrow_forwardLucy and Henry each have $1652. Each knows that with 0.1 probability, they will lose 85% of their wealth. They both have the option of buying a units of insurance, with each unit costing $0.1. Each unit of insurance pays out $1 in the event the loss occurs. The cost of the insurance policy is paid regardless of whether the loss is incurred. Lucy's utility is given by u²(x) = x, Henry's utility is given by u¹(x) = √√x. Answer the following: (If rounding is needed, only round at the end and write your answer to three decimal places.) a) Without insurance, what is the expected value of the loss? b) c) d). e) ( For Henry, facing the "lottery " above without any insurance is as bad as losing how many dollars for sure? Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a. Now suppose insurance costs $0.2. Find Lucy's utility maximising choice of a. If more than 1 exist, enter the largest a. What is Henry's utility maximising choice of a with the new price of…arrow_forward

- Exercise 1.8. Consider the following "third-price" auction. There are n≥ 3 bidders. A single object is auctioned and Player / values the object $v,, with V, > 0. The bids are simultaneous and secret. The utility of Player / is: 0 if she does not win and (v-p) if she wins and pays $p. Every non-negative number is an admissible bid. Let b, denote the bid of Player i. The winner is the highest bidder. In case of ties the bidder with the lowest index among those who submitted the highest bid wins (e.g. if the highest bid is $120 and it is submitted by players 6, 12 and 15, then the winner is Player 6). The losers don't get anything and don't pay anything. The winner gets the object and pays the third highest bid, which is defined as follows. Let be the winner and fix a Player j such that b₁ = max({b,,...,b,}\ {b}) [if GAME THEORY - Giacomo Bonanno 39 max({b,...,b}\{b;}) contains more than one element, then we pick one of them]. Then the third price is defined as max({b₁,...,b}\{b,,b;}).…arrow_forwardPROBLEM (3) (Regret Aversion, Gale's Roulette Wheels) Consider the regret utility u(x, y) = {1 if x>y, 0 if x=y, and -1 if xarrow_forwardConsider the lottery that assigns a probability T of obtaining a level of consumption CH and a probability 1-T an individual facing such a lottery with utility function u(c) that has the properties that more is better (that is, a strictly positive marginal utility of consumption at all levels of c) and diminishing marginal utility of consumption, u"(c) CL. Consider du(c) for the first derivative of the utility function with respect to dc du(c) du' (c) consumption and u"(c) (which is also the derivative of the first derivative of the utility function). to be the second derivative of the utility function dc dc2 1. Provide a definition for the certainty equivalent level of consumption for the simple lottery described above.arrow_forwardAn individual is off ered a choice of either $50 or a lottery which may result in $0 or $100, each with equal probability 1/2. If the individual has a utility function u(w) = w, which one would they choose? If the individual has a utility function u(w) =sqr(w)?arrow_forwardAt a company, 20 employees are making contributions for a retirement gift. Each of the 20 employees is choosing how many dollars to contribute from the interval [0,20]. The manager of these 20 employees announces that she will contribute dd dollars for every dollar that an employee contributes. The payoff to employee ii who makes contribution of xixi dollars is bi(1+d)xi−xi, where bi>0.bi(1+d)xi−xi, where bi>0. Assume that d=4d=4, bi=0.25bi=0.25 for i=1,2,…,10i=1,2,…,10, andbi=0.5bi=0.5 for i=11,12,…,20i=11,12,…,20 What is the best contribution level of any employee ii for i=1,2,…,10i=1,2,…,10. At a company, 20 employees are making contributions for a retirement gift. Each of the 20 employees is choosing how many dollars to contribute from the interval [0,20]. The manager of these 20 employees announces that she will contribute dd dollars for every dollar that an employee contributes. The payoff to employee ii who makes contribution of xixi dollars is bi(1+d)xi−xi,…arrow_forwardanswer this properly, remember (0.35x50)+(0.65x10)=£24 herearrow_forwardarrow_back_iosarrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education