FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

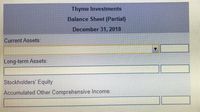

Requirement 2. Prepare a partial balance sheet for Thyme's Vince investment as of December 31, 2018.

Use the partial balance sheet below to show how to report the investment on Thyme's balance sheet at December 31, 2018. (Use a minus sign or parentheses to enter a loss. If a box is not used in the balance sheet, leave the box empty; do not sect a label or enter a zero.)

Transcribed Image Text:### Educational Transcription: Thyme Investments Balance Sheet (Partial)

**Thyme Investments**

**Balance Sheet (Partial)**

**December 31, 2018**

- **Current Assets:**

(Dropdown menu available for selection)

- **Long-term Assets:**

(Input field for details)

- **Stockholders' Equity:**

(Input field for details)

- **Accumulated Other Comprehensive Income:**

(Input field for details)

This partial balance sheet represents a snapshot of Thyme Investments' financial position as of December 31, 2018. It includes sections for current assets, long-term assets, stockholders' equity, and accumulated other comprehensive income. These segments are vital for assessing the company's financial health and guiding investment decisions.

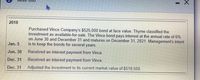

Transcribed Image Text:### 2018 Investment Details

**Transaction Overview:**

- **Purchase of Bonds:**

- Purchased Vince Company's bond with a face value of $525,000.

- Classified as an available-for-sale investment.

- The bond has an annual interest rate of 6%, payable on June 30 and December 31.

- Maturity Date: December 31, 2021.

- Management intends to retain the bonds for several years.

**Timeline of Events:**

- **January 5:**

- The initial purchase of the bond.

- **June 30:**

- Received an interest payment from Vince Company.

- **December 31:**

- Received a second interest payment from Vince Company.

- Adjusted the investment to its current market value of $518,500, indicating a change in the bond's market value.

This data shows the bond's financial activities and how its valuation and returns are managed throughout the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format ?arrow_forwardest Requirements Raider Investments completed the following investment transactions during 2018: 1. Journalize Raider's investment transactions. Explanations are not required. 2. Classify and prepare a partial balance sheet for Raider's Voltexar investment as of December 31, 2018. 3. Prepare a partial income statement for Raider Investments for year ended December 31, 2018. A (Click the icon to view the transactions.) Read the requirements. Requirement 1. Journalize Raider's investment transactions. Explanations are not required. (Record required" on the first line of the Accounts column and leave the remaining cells blank.) Jan. 14: Purchased 600 shares of Voltexar stock, paying $53 per share. The investment represents intends to hold the investment for the indefinite future. Print Done Date Accounts Debit Jan. 14 Purchased 600 shares of Voltexar stock, paying $53 per share. The investment represents 2% ownership in Voltexar's voting stock. Raider does not have significant influence…arrow_forwardFill in the dollar changes caused in the Investment account and Dividend Revenue or Investment Revenue account by each of the following transactions, assuming Ayayai Company uses (a) the fair value method and (b) the equity method for accounting for its investments in Sunland Company. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any answer field blank. Enter 0 for amounts.) (a) Fair Value Method (b) Equity Method Transaction Investment Account Dividend Revenue Investment Account Investment Revenue 1. At the beginning of Year 1, Ayayai bought 30% of Sunland's common stock at its book value. Total book value of all Sunland's common stock was $760,000 on this date. 2. (a) During Year 1, Sunland reported $52,000 of net income. (b) During Year 1, Sunland paid $28,500 of dividends. 3. (a) During Year 2, Sunland reported…arrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardConcord Today Publishers completed the following investment transactions during 2024 and 2025: i (Click the icon to view the transactions.) Requirements 1. Journalize Concord Today's investment transactions. Explanations are not required. 2. On December 31, 2024, how would the Peaceful stock be classified and at what value would it be reported on the balance sheet? Requirement 1. Journalize Concord's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Dec. 6, 2024: Purchased 1,100 shares of Peaceful stock at a price of $21.00 per share, intending to sell the investment next month. Concord did not have significant influence over Peaceful. Date Credit 2024 Dec. 6 Accounts C Debit More info Dec. 6, 2024 Dec. 23, 2024 Dec. 31, 2024 Jan. 27, 2025 Purchased 1,100 shares of Peaceful…arrow_forward

- Hartford Today Publishers completed the following investment transactions during 2024 and 2025: i (Click the icon to view the transactions.) Requirements 1. Journalize Hartford Today's investment transactions. Explanations are not required. 2. On December 31, 2024, how would the Golden stock be classified and at what value would it be reported on the balance sheet? Requirement 1. Journalize Hartford's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Dec. 6, 2024: Purchased 950 shares of Golden stock at a price of $35.00 per share, intending to sell the investment next month. Hartford did not have significant influence over Golden. Date Debit Credit 2024 Dec. 6 Accounts More info Dec. 6, 2024 -C Dec. 23, 2024 Dec. 31, 2024 Jan. 27, 2025 Purchased 950 shares of Golden stock…arrow_forwardHello, how do I solve this problem? I attached the bottom part of the question and what it's asking for since it wouldn't fit in the screenshot. Assuming that total assets were $3,112,000 at the beginning of the current fiscal year, determine the following. When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets % e. Return on stockholders’ equity % f. Return on common stockholders' equity %arrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education