FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1.

00

8.

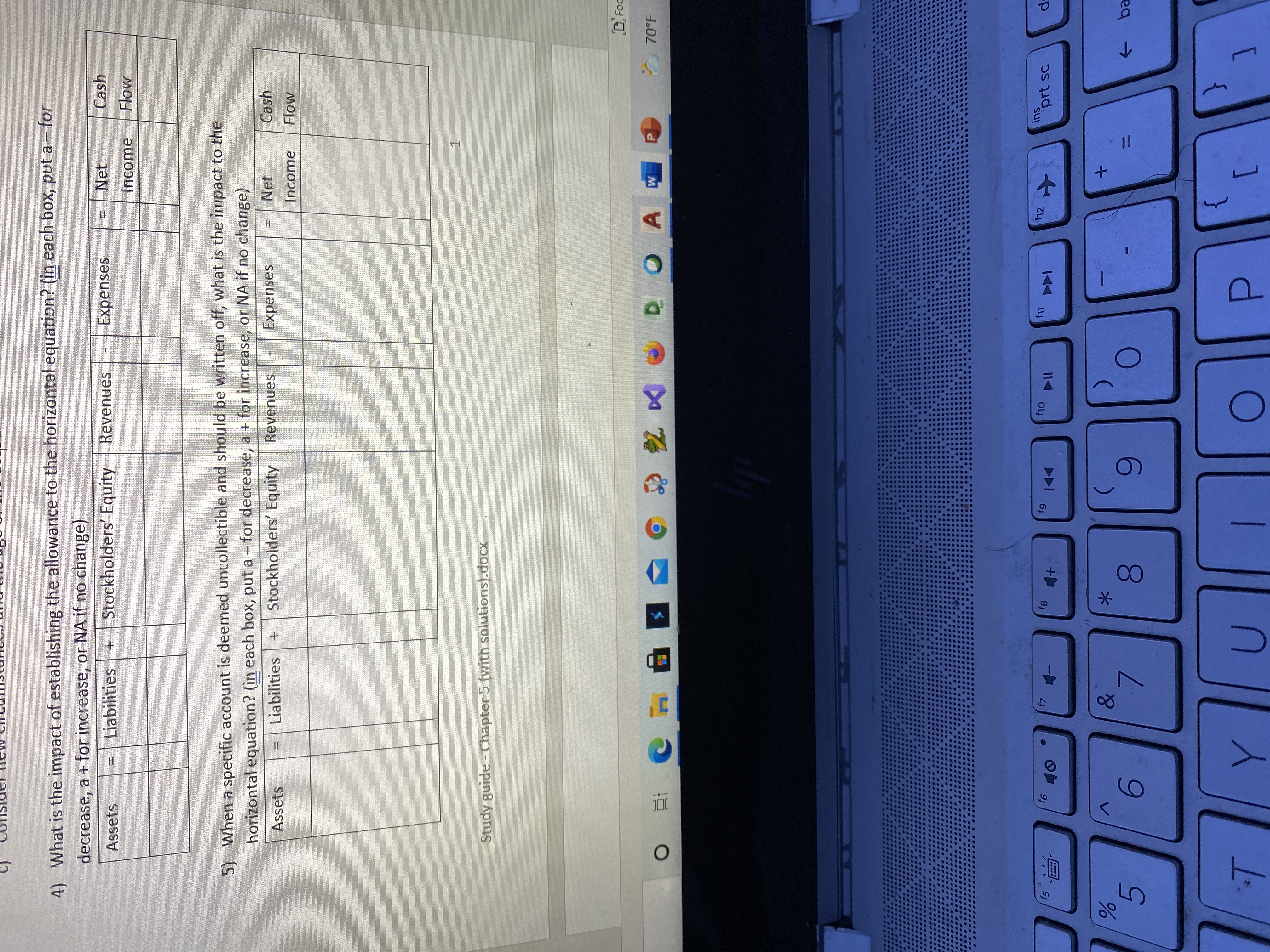

4) What is the impact of establishing the allowance to the horizontal equation? (in each box, put a - for

decrease, a + for increase, or NA if no change)

Liabilities

Stockholders' Equity

Revenues

Expenses

Net

Cash

Assets

Income

Flow

5) When a specific account is deemed uncollectible and should be written off, what is the impact to the

horizontal equation? (in each box, put a - for decrease, a + for increase, or NA if no change)

Stockholders' Equity

Revenues

Expenses

Net

Cash

Assets

Liabilities

Income

Flow

Study guide - Chapter 5 (with solutions).docx

O Foc

70°F

P.

f12

prt sc

f5

->

6.

6.

5.

}

{

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- 4. Which of the following is not an element of a statement of comprehensive income? a. Interest Payable b. Rent Expense c. Interest Expense d.Service Feearrow_forwardOn what information return (T-slip) is the amount withdrawn from an individual's RRSP account reported? Question 16 options: a) T4RSP slip b) T4 slip c) T5 slip d) T4A sliparrow_forwardRequired information [The following information applies to the questions displayed below.] Execusmart Consultants has provided business consulting services for several years. The company has been using the percentage of credit sales method to estimate bad debts but switched at the end of the first quarter this year to the aging of accounts receivable method. The company entered into the following partial list of transactions. a. During January, the company provided services for $270,000 on credit. b. On January 31, the company estimated bad debts using 1 percent of credit sales. c. On February 4, the company collected $135,000 of accounts receivable. d. On February 15, the company wrote off a $500 account receivable. e. During February, the company provided services for $220,000 on credit. f. On February 28, the company estimated bad debts using 1 percent of credit sales. g. On March 1, the company loaned $14,000 to an employee, who signed a 9% note due in 3 months. h. On March 15, the…arrow_forward

- Under the allowance method for uncollectible receivables, the entry to record uncollectible-account expense has what effect on the financial statements?a. Decreases assets and has no effect on net incomeb. Increases expenses and increases stockholders’ equityc. Decreases net income and decreases assetsd. Decreases stockholders’ equity and increases liabilitiesarrow_forwardAn accrual of wages expense would have what effect on the balance sheet? Select one: O O O O A. Decrease liabilities and increase equity B. Increase assets and increase liabilities C. Increase liabilities and decrease equity D. Decrease assets and decrease liabilities E. None of the abovearrow_forward20. For each account indicate the increase or decrease. Five account classifications are shown as column headings in the table below. For each account classification, indicate the manner in which increases and decreases are recorded (i.e., by debits or by credits). Owners' Equity Revenue Expenses Assets Liabilities Increases recorded by: Decreases recorded by:arrow_forward

- 10.Which of the following accounts would be increased with a debit? a. Withdrawals account. b. Legal fees earned c. Rent Payable d. Owner’s capital accountarrow_forward69. Claim against assets are represented by____.I am not satisfy give downvote A. saved earning B. retained earnings C. maintained earnings D.saving account earningarrow_forwardWhat is the impact on the accounting equation when a payment of accountable payable is made? what is the impact on accounting equation when an account receivable is collected? what is the impact on the accounting equation when a sell occurs? what is the impact on the accounting equation when stock is issued, in exchange for assets? which of the following accounts is increased by a debit? which of the following camp do not increase with a debit entry? which of the following pairs increase with credit entries? which of the following pairs of accounts are impacted the same with debits and credits? which of the following count normally have a debit balance? what type of account is prepaid insurance?arrow_forward

- Please tell me if the following are an asset, liability or equity account and if they are real or nominal 1) Accounts payable 2) Service fees revenues 3) Tax expense 4) Cash 5) Interest receivable 6) Accounts receivable 7) Smith, drawings 8) Retained earnings 9) Depreciation expense 10) Interest income (also what is interest income? Example? is a DR or CR balance?)arrow_forwardWhich of the following is a permanent account? A. dividends distributed B. allowance for doubtful accounts C. internet expense d. salesarrow_forwardWhat are the effects of an adjusting entry used to accrue revenue from credit sales? Assets Liabilities Equity A Decrease No effect Decrease B Increase No effect Increase C No effect Decrease Increase D No effect Increase Decreasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education